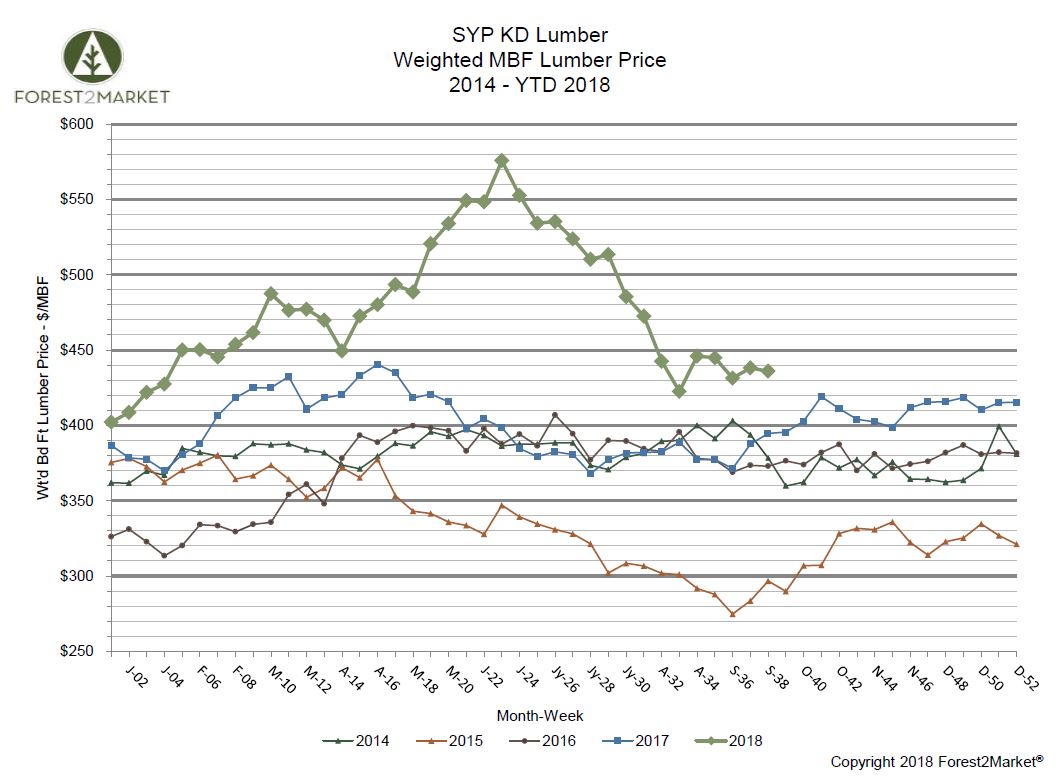

Southern yellow pine (SYP) lumber prices appear to have leveled out over the course of the last few weeks. Forest2Market’s composite southern yellow pine lumber price for week 38 was $436/MBF, a 0.5 percent decrease from the previous week’s price of $438/MBF, but a 10 percent increase from the same week in 2017.

Price volatility has largely decreased since late August; prices have been range-bound between $446/MBF and $432/MBF. After reaching a record high price of $576/MBF in late June, SYP prices declined rapidly before bottoming at $423 in mid-August.

SYP orders and shipments both jumped in week 38—likely in response to a major hurricane that made landfall in the Carolinas, as well as improved housing starts data.

- Moody's Analytics preliminary estimate is that Hurricane Florence caused $40 billion in damage and $4 billion in lost economic output, which would make it one of the top 10 costliest US hurricanes. The most expensive storm, Hurricane Katrina in 2005, cost $192.2 billion in today's dollars, and 2017’s Hurricane Harvey cost $133.5 billion.

As of this writing, five river gauges in eastern North Carolina are still at major flood stage and five others are at moderate flood stage, according to the National Weather Service. Sections of Interstates 95 and 40 are expected to remain underwater through the end of September, and a number of state roads are still impassible and/or severely damaged. The flood waters have caused substantial damage to farm and timberlands throughout the state—the full scope of which is yet to be determined.

- August’s housing starts data was significantly improved (+9.4 percent) after a lackluster July (+0.9 percent). Single-family starts accounted for 876,000 units, which is 1.9 percent above the revised July figure of 860,000, and starts for the multi-family housing segment surged 29.3 percent to a rate of 406,000 units in August. Privately-owned housing completions were up 2.5 percent to a rate of 1,183,000 units in August, and performance in the South was strong: +6.5 percent for total starts; +3.0 percent for single-family starts.

A closer look at some of the prices we have seen since the beginning of the year:

- 1Q2018 Average Price: $449/MBF

- 2Q2018 Average Price: $523/MBF

- YTD Average Price: $477/MBF

- Average Price Since June’s Record High: $479/MBF