1 min read

Southern Yellow Pine Lumber Prices Surge to 12-Year High in April

John Greene

:

April 28, 2017

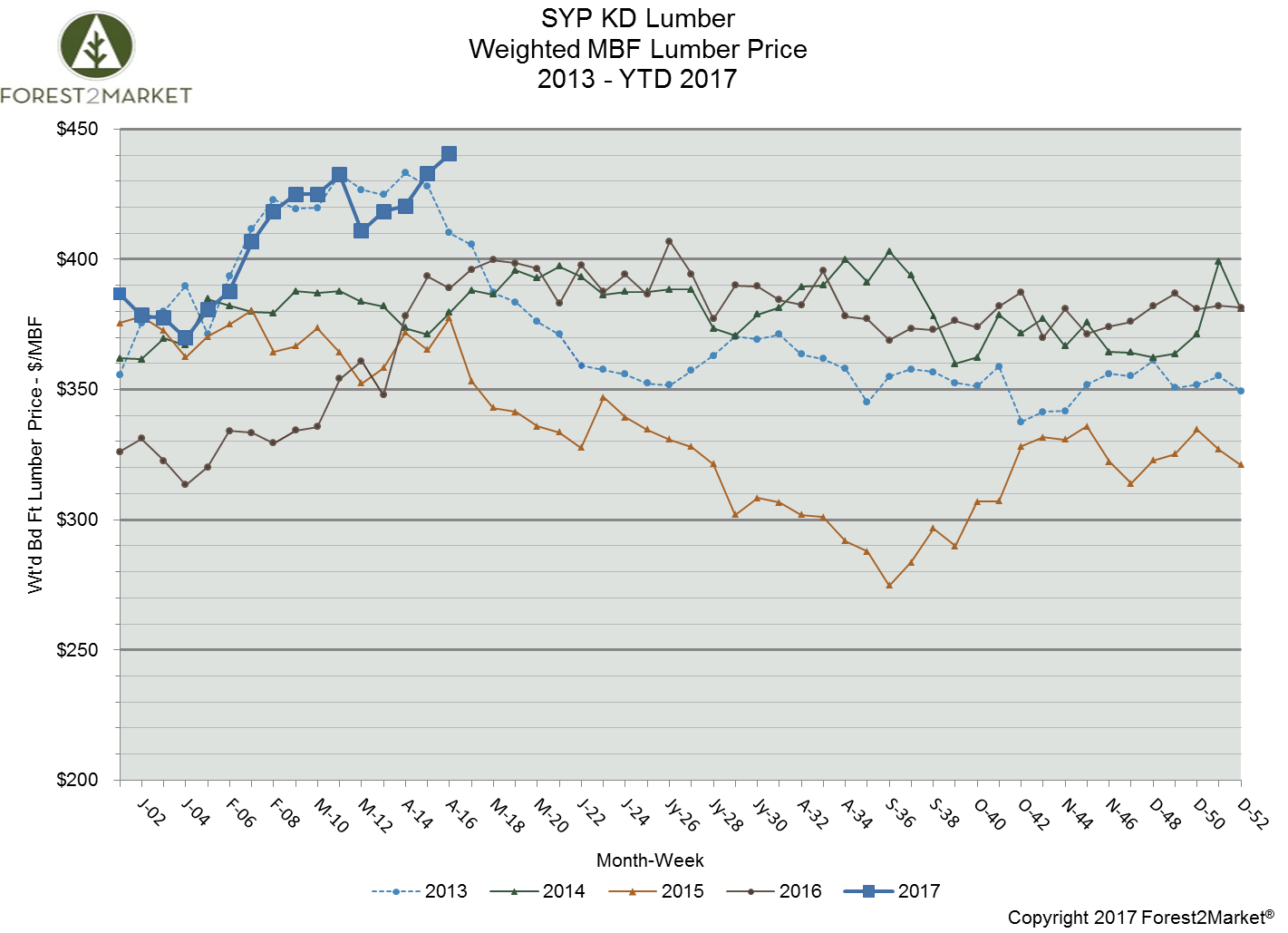

The composite southern yellow pine lumber price soared in late April to its highest level since Forest2Market implemented its weekly index in 2009. While a number of market and trade-related factors have combined to buoy the price through 1Q2017, a milder-than-normal winter also likely helped to drive prices higher.

Lumber prices have risen recently to a 12-year high—a level not seen since March of 2005, soon after homeownership peaked in the US. A number of economists feel the price is being supported by a series of trade-related dynamics that are coinciding: A recently-announced decision on countervailing duties to be levied on softwood imports from Canada since the sunsetting of the Softwood Lumber Agreement (a separate decision on antidumping duties is also due by late May); President Trump’s repeated calls to renegotiate NAFTA; and growing demand for new homes, as well as a spike in remodeling, in the wake of the housing crisis.

A recent NAHB article noted that “Hiking [lumber] prices has recently been challenging for producers as trading volume slowed. One explanation is that the pricing increase drove many buyers to shift purchases forward to hedge against future price increases.” If lumber price increases are mostly due to “pre-buying” rather than increased consumer-driven demand, prices could subside later this year.

Week 15’s price was at $440/mbf, which is up from week 14’s $433/mbf mark. Week 15’s price is 14 percent above its January 2017 starting point of $387/mbf, and 13 percent above its 2016 week 15 price of $389/mbf.

A closer look at monthly prices since the beginning of the year: