As any professional forester will attest, we quickly learn the truth of an old business adage while working in the field: “The only constant is change.” When working in an industry that is not only impacted by macroeconomic factors (oil prices, GDP, housing starts, etc.), we are also forced to adapt to whatever circumstances Mother Nature throws our way. As we have seen throughout 2019, the weather can wreak havoc on short-term performance in localized markets.

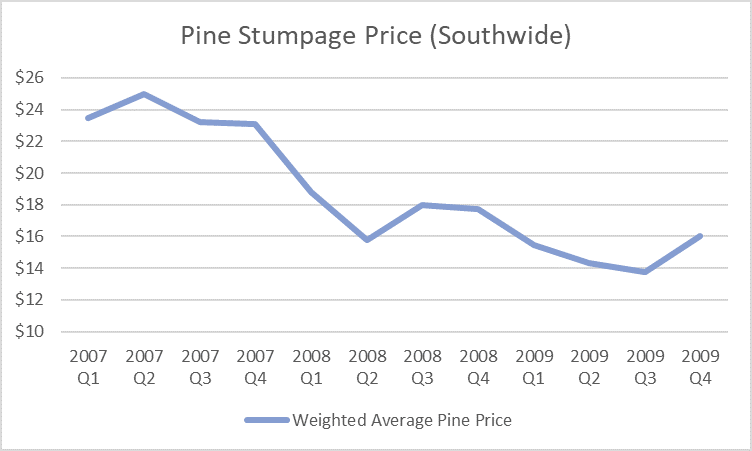

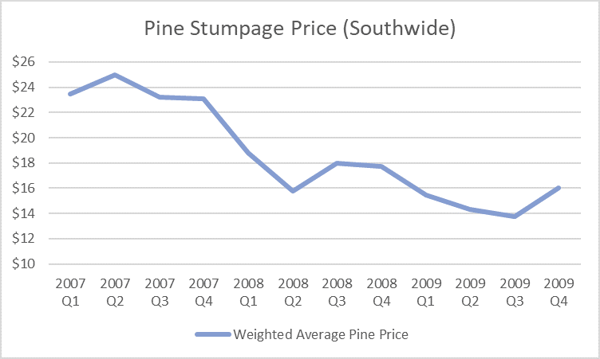

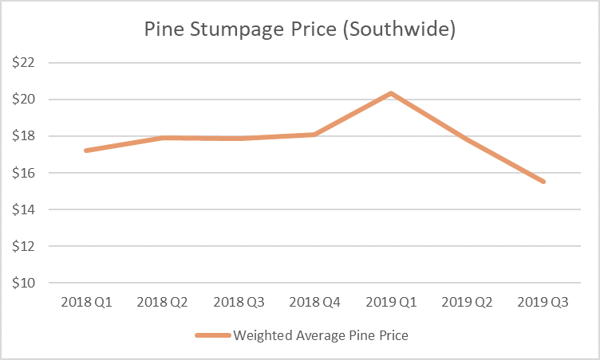

While I’m certainly not comparing the current pine stumpage market in the US South to the market directly in the wake of the 2008 Great Recession, there are some noteworthy similarities. Despite these resemblances, however, the market’s performance has been affected by very different drivers.

- The weighted average pine stumpage price demonstrated a 35% decrease from 2007 to 2009, with a weighted average annual price in 2009 of $15.42/ton.

- The weighted average pine stumpage price demonstrated a 24% decrease from 1Q2018 to 3Q2019 with an ending average of $15.53/ton. This marks the first time the price has dropped below $16/ton since 2011.

Historical vs. Current Market: Why is it Suppressed?

From the onset of the Great Recession in 2007 and its immediate aftermath, the market for southern timber shrank due to lack of demand. Consider the compounding consequences of the housing market crash during that time period and their effects on housing starts, for example. Starts in January of 2006 were 2.3 million units, which represented a high point of the decade. However, three years later in January 2009, starts totaled just 490,000 units—a decrease of 79%. The tremendous reduction in demand for lumber and other building products sent shockwaves through the entire forest supply chain, resulting in the current oversupply of timber on the stump throughout southern forests.

Now, flash forward 10 years. Based on weather challenges experienced during the last 12 months, timber tracts that were previously purchased became unworkable; the markets reacted accordingly and sent stumpage prices soaring in 1Q2019. Harvesting crews put these tracts on the back burner and moved to workable tracts to maintain production. However, when the wet weather subsided, these crews simply circled back to work the previously-purchased tracts in the “bottoms” that had dried out.

As a result, timber purchasers still have a surplus of wood on their books, which means they aren’t actively buying stumpage and are essentially working to get rid of what they already have. Sellers of timber are now dealing with two challenging dynamics: 1) repercussions of the oversupply that date back to the 2007-2010 time period; 2) slack demand in the current market, which is keeping downward pressure on prices.

What Does This Mean for Timber Markets in the Near Term?

While current stumpage prices are once again suppressed, a global recession is not the culprit… thankfully. This time, extreme weather patterns (both wet and dry) across US South have combined with a tense trade situation, which that has spooked many markets. Housing starts are flat, and demand for lumber and other building products is equally flat. (The forest segment is not alone, however, as it seems like a number of industries are in a holding pattern at the moment.)

This combination of factors over the last year has resulted in significantly fewer new stumpage sales on a Southwide basis. There are pockets where stumpage prices have surged due to demand, but they are the exception and not the rule. However, as previously purchased timber inventories become depleted, something will have to give. We are now entering inventory-building season in a prime buyer’s markets, which should prompt some new stumpage sales in the coming months.

Many southern timberland owners currently find themselves in a similar situation they experienced 12 years ago: they have lots of timber for sale, but no buyers. While the drivers of these two situations outlined above are very different, both have ultimately led to a flooded market with sluggish demand. Timberland owners need to know what’s happening in their local markets to maximize their returns, and buyers need to stay ahead the competition and secure stumpage sales at competitive prices. While we can’t control the weather or the broader economy, timber buyers and sellers can make better decisions by accessing the historical price data, trends and timber sales details available in Stumpage 360.