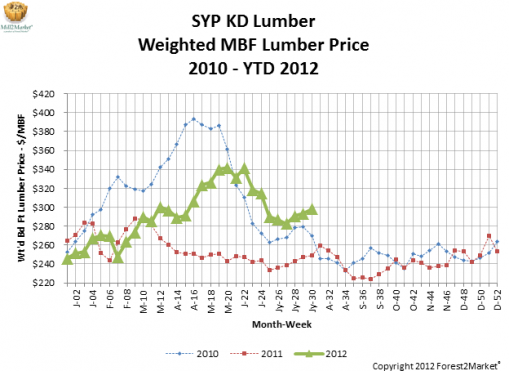

The figure below summarizes pricing data gathered for Forest2Market’s weekly lumber market report, Mill2Market. For this market report, Forest2Market aggregates sales order data submitted directly by report subscribers. This figure charts weekly sales order prices from January 2010 through year to date 2012 and compares sales order data, FOB Mill on a volume weighted $/MBF basis. The prices in the figure are composite prices; they include dimension lumber, timbers and boards.

Forest2Market’s composite lumber price increased 4 percent throughout July. After composite price declined in the first week of the month (Week 27) to a low of $283/MBF, it began to climb, with an $8/MBF increase in Week 28, a $2/MBF increase in Week 29 and a $5/MBF increase in Week 30. Price stood at $298/MBF at the end the month.

Sales order volume per mill fluctuated throughout July, ending the month 1 percent below the end of June. Sales order volume experienced increases in Week 28 and Week 30 and declines in Week 27 and Week 29. Unlike sales volume in the month of June, orders did not show a direct relationship to weekly pricing.

A historical look at July shows that, similar to 2011 and 2010, pricing rebounded slightly after the precipitous decline in June. It appears as though demand and pricing have levelled off a bit, as neither demand nor pricing have steeply fluctuated this month. It is interesting to see that July 2012 pricing is higher than both of the previous two years, a reflection of the improving housing market.

Mill2Market provides an analysis of the southern yellow pine market in two ways:

- A weekly market report that provides a real-time description of how the market is operating in the current week. This report uses sales order information in order to capture the current market.

- A quarterly market report that provides a comparison of an individual subscriber’s performance against the market. This report reflects invoice data in order to accurately capture final price.

For more information, visit the Mill2Market page of our website, or call Bob Bratton at 980-233-4034.