Despite December's drop in housing starts, economists and industry watchers are warning that the performance is not indicative of what is really going on within the larger US housing market. Starts fell hardest in the Northeast and US South, where temperatures were significantly below normal and both regions continue to be battered by extensive cold fronts and extreme conditions. And despite December’s number, an estimated 1.2 million units were started in 2017, which is 2.4 percent above the 2016 number of 1.17 million units.

Housing Starts, Permits & Completions

After modest gains in November, US housing starts dropped 8.2 percent to a seasonally adjusted annual rate (SAAR) of 1,192,000 units in December. Single-family starts were at a rate of 836,000 units, which is 11.8 percent below the revised November figure of 948,000. Starts for the volatile multi-family housing segment increased 1.4 percent to a rate of 356,000 units.

Privately-owned housing authorizations inched down 0.1 percent to a rate of 1.3 million units in December. However, single-family authorizations rose to 881,000, which is 1.8 percent above the revised November figure.

Privately-owned housing completions decreased to a SAAR of 1.19 million in December, down 8.2 percent from November’s revised estimate of 1.29 million and 6 percent below December 2016’s rate. Regional performance in November was mixed, as confirmed by the US Census Bureau report. Seasonally-adjusted total housing starts by region included:

- Northeast: -4.3 percent (-39.6 percent last month)

- South: -14.2 percent (+11.1 percent last month)

- Midwest: -2.2 percent (-12.9 percent last month)

- West: -0.9 percent (+19.0 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -24.2 percent (0.0 percent last month)

- South: -16.6 percent (+8.4 percent last month)

- Midwest: -2.2 percent (-11.1 percent last month)

- West: 0.0 percent (+11.4 percent last month)

Mortgage Rates & Market Outlook

The 30-year fixed mortgage rate increased from 3.92 to 3.95 percent in December, and finished out the year at an average of 3.99. Homebuilder sentiment in December jumped to the highest level in 20 years following the passage of the Republican tax plan, though it has since ticked down slightly. The lack of existing homes available for sale also gives builders a confident, long view of potential demand, and they are now starting to build more speculative homes—homes without a current buyer—because demand is so strong. This was common practice during the pre-2007 housing boom, but builders haven’t been willing to overextend themselves on speculative construction over the last decade.

2017 Performance

Final housing starts for 2017 maintained the slow, steady pace they have demonstrated in recent years, rising to their highest level since 2007. However, 2017’s 1.2 million pace was still lower than the 50-year average and is lower than needed to meet current demand.

"The pace of housing starts averaged just 1.2 million for the year, far short of the historical average of 1.5 million starts," Redfin chief economist Nela Richardson noted. "Given the three-year drought in inventory and surging homebuyer demand, a pace of 2 to 3 million starts would be reasonable and appropriate. The market is in dire need of starter homes and homes near transit in major job centers."

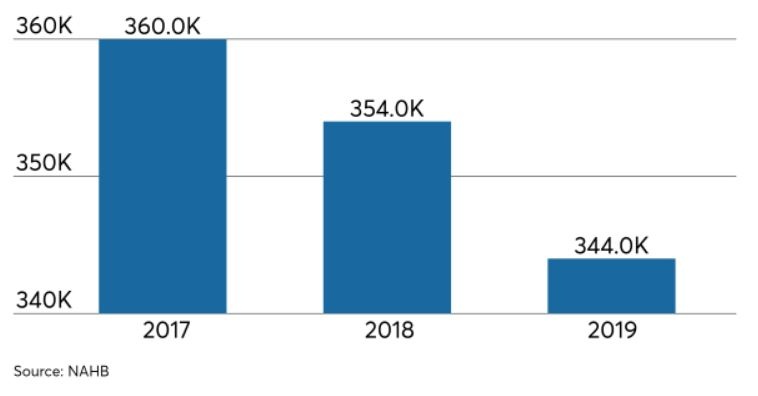

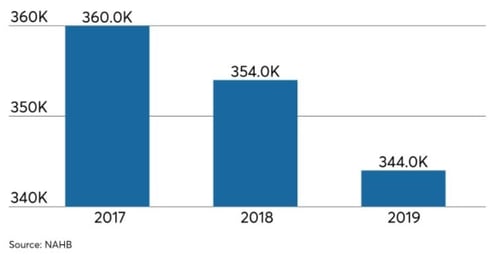

Low housing inventory has been bolstering multi-family occupancy and new building activity over the last several years. However, as builders continue to increase speculative construction to meet strong demand for single-family homes, the multi-family segment will be impacted. Production should run at a level where supply meets demand, but multi-family starts have already dropped 2 percent from 2017's estimate and they are forecast to decline another 3 percent next year.

"From 1995 through 2005, multifamily starts averaged 335,000. Construction activity during the past four years has been running above this trend, and we are seeing the market stabilizing near more normal production levels," said National Association of Home Builders (NAHB) Senior Economist Michael Neal.

Multi-Family Housing Production Outlook

The weakening multi-family segment will likely be positive for the housing market as a whole, given that rents have skyrocketed over the last decade and many of the major markets are now oversupplied.

Per a report by real estate website RentCafe, the average apartment rent increased by roughly 2.5 percent in 2017 to $1,359. Based on this number, rent prices across the US are around 24 percent higher than they were a decade ago and, on average, American renters paid $400 more in 2017 than they did in 2016. With unsustainable YoY price increases, a new single-family housing boom would provide the needed inventory to convert many of these renters into owners—potentially at a much more affordable price.

Ralph McLaughlin, Trulia's chief economist noted "While we applaud new multifamily construction in helping moderate rents over the past few years, we see the slowdown as a healthy retreat that will continue this year."

Outlook for 2018

As we begin a new year, there certainly seems to be an overwhelming sense of optimism permeating both national and global markets. The DJIA recently crested 26,000 points and newly-released earnings reports are generally strong, but we cannot fully fathom the impact that the new pro-growth tax law will have in 2018. The law will lower tax rates for most individuals in all income groups, which will put more money into the pockets of hard-working families and, ultimately, back into the economy.

More importantly (for the future), corporate America is “all in” on the tax changes; jobless claims just decreased to their lowest level since February 1973, and companies are bringing money back into the country and pumping it into their operations and workforces.

- Apple Inc. is giving a bonus of $2,500 to most employees worldwide. The company will also inject $350 billion into the US economy over the next five years to fund a new campus, data centers and 20,000 new jobs, as well as pay a $38 billion repatriation tax, bringing roughly $252 billion in cash back to the US.

- Walmart recently announced that it would increase its base pay rate to $11/hour, and the company will spend $400 million in fiscal 2018 to fund one-time bonuses.

- AT&T will pay more than 200,000 US employees $1,000 each and increase its capital spending budget by $1 billion.

- Wells Fargo is boosting its minimum wage to $15/hour and is targeting $400 million in donations to community and nonprofit organizations in 2018.

- Fifth Third Bancorp will pay more than 13,500 employees a bonus and raise the minimum wage of its workforce to $15/hour.

As Pete Stewart recently noted, while poll results show that half of America doesn’t approve of the Trump Administration itself, their spending behavior, however, indicates that they have confidence in the Administration’s handling of the economy. As evidenced above, corporate America also has confidence in the current economic climate and the direction in which our country is heading, and the sentiment is rippling throughout the mid-cap and small business segments as well.

For all of the trepidation and uncertainty the US housing market has weathered since 2007, the segment is poised for modest but tangible growth in 2018. As such, we expect housing starts to total 1.26 million units in 2018 (+4.0 percent relative to 2017).