Western wood chip prices are declining rapidly in response to an oversupply of fiber. In many areas, timber sellers are having trouble moving pulpwood logs as whole log chippers have a glut of log inventory and chip sales are sluggish.

During much of 2010, chip prices rose dramatically as demand from increased pulp and paper production aggravated chip supply anxiety in the western region. Traditionally, sawmill residuals have been the lowest cost source of western wood chips. Declining sawmill production settled to very low levels in 2009, forcing western pulp mills to rely on costly whole log chips for as much as 50 percent of their furnish. For a deeper look at the numbers, see Daniel Stuber's containerboard activity report.

Prices for western wood chips retreated sharply in the second quarter of 2012. Softening global pulp and paper demand, a major mill closure, seasonal mill downtime and dwindling Japanese chip imports have backed up the pipeline, leading to large price cuts for residual and whole log wood chips across the West.

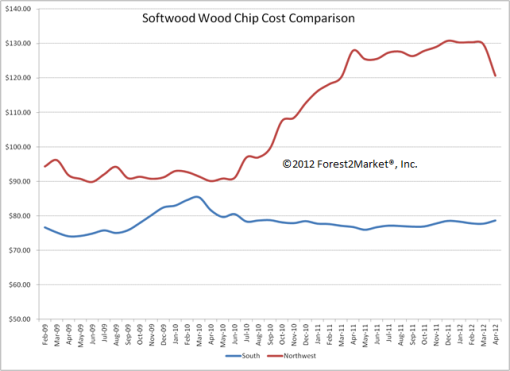

The big story is the current disparity in wood chip prices between the US South and the Pacific Northwest (see Figure). In April 2012, the total delivered fiber cost for Pacific Northwest wood chips was nearly 50 percent higher than delivered fiber cost in the US South, when compared on a bone dry ton basis. Prices in the two regions came as close as 10 percent in early 2010, when a lengthy period of wet weather in the South tightened chip accessibility while Northwest mills had abundant supply. This relative parity was short-lived though, as Northwest prices rose sharply during late 2010 and prices in the South moderated with improved conditions.

The wood supply chain between the two regions is drastically different. Southern mills have a distinct advantage over western mills. Three-quarters of southern chip supply comes from easily accessible plantation pine forests. Tree-length pulpwood is delivered to very efficient mill site wood yards, giving mills in the US South a more predictable and lower cost alternative for wood chip procurement.

A major price correction is imminent for western region wood chip buyers and sellers. Regional lumber production for 2012 year-to-date is up nearly 10% from the previous year, adding more residual chips to already congested inventories. At the same time, markets for pulp and paper products are weakening across the board. All signs point toward falling Northwest wood chip prices throughout 2012 and beyond, as pulp and paper producers seek to restore the unhealthy imbalance in regional pricing.

Comments

Western wood chip prices are declining rapidly in

06-05-2012

[...] wood chip prices are declining rapidly in response to an oversupply of fiber By GORDON CULBERTSON - FOREST2MARKET · Image by Howard F. Schwartz, Colorado State University, [...]

Gordon Culbertson

Gordon Culbertson