Delivered wood fiber prices in the Lake States are at their lowest point since Forest2Market began collecting transactional pricing data from the region over eight years ago.

As we reported last year in the wake of the devastating economic impacts caused by the COVID-19 pandemic, wood fiber consumption dropped off significantly in every wood basket across North America. But as the economy picked up steam in 3Q and 4Q2020, some regions experienced structural changes in fiber demand that continue to impact their respective wood supply chains.

What drives inventory management in the Lake States?

Unlike the US South and the Pacific Northwest (PNW), which must contend with unusually wet weather on occasion, the seasonality of timber harvesting is a significant driver of price in the Lake States region. While seasonal access to all species groups is important, hardwood production is the key driver in the Lake States. Meticulous hardwood inventory management is therefore key to understanding market pricing for all regional fiber.

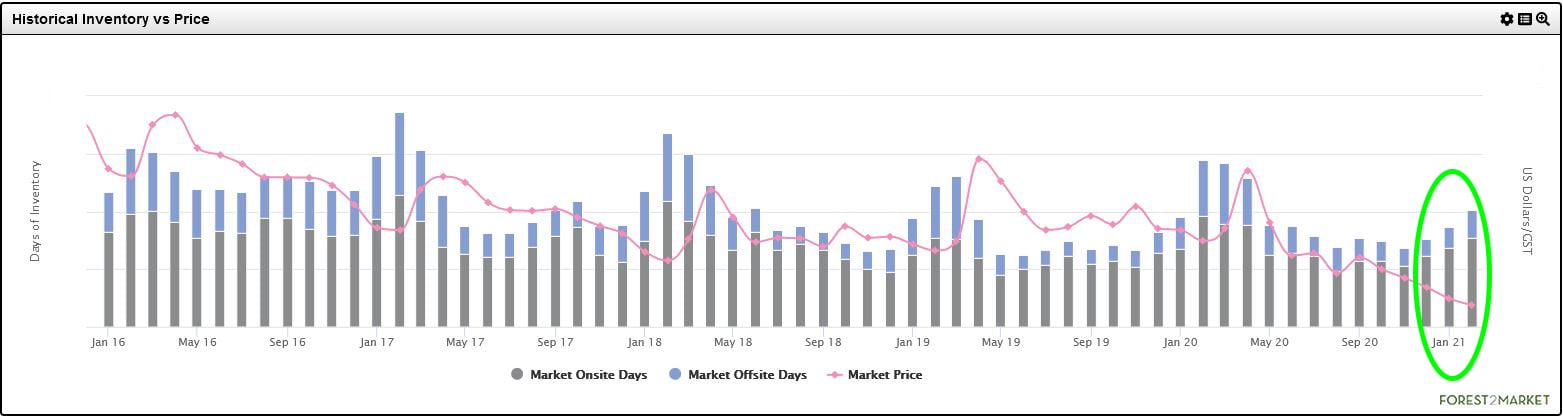

Deliveries typically peak from January through March and, depending on when the cold weather hits, can sometimes include December of the prior year. As a result, regional mills fill their log inventories during 1Q to include as much as 80 days’ worth of system-wide inventory designed to last through the spring season. It is equally important for the system to maintain a minimum of 30 days’ worth of hardwood inventory during the rest of the year so that winter surge capacity is not stressed beyond its capabilities.

There is little flexibility in these numbers, as spring “break up” is traditionally the low point for wood deliveries because the rainy climate from March - May results in difficult forest and road conditions. Procurement managers throughout the Lake States have learned that it’s far better to carry excess inventory during break-up than it is to risk running out of wood or paying exorbitant spot prices in an effort to play catch-up.

What’s driving prices lower?

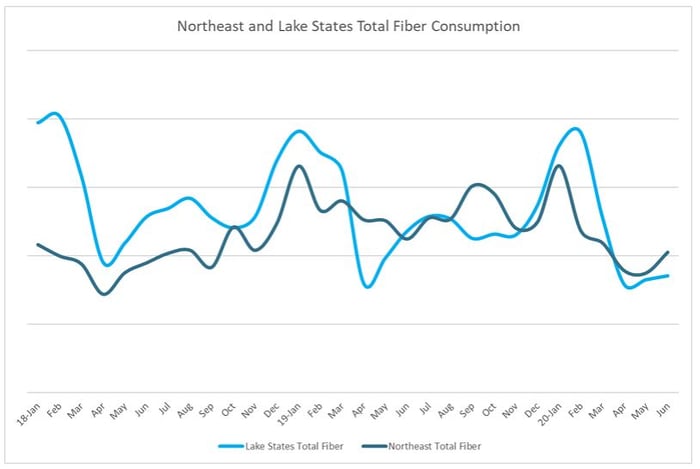

Based on this variability in the weather, 2Q deliveries typically average +/-50% of winter deliveries in a normal year. So, unlike the data for other regions, last year’s effects of COVID-19 didn’t really impact deliveries in the Lake States until May and June. Historically, deliveries bottom in early summer and begin rising again throughout the 3Q before peaking in 4Q/1Q. But unlike the May/June 2020 consumption data for the Northeast, notice how there was no sharp reversal in the data from the Lake States as there was in previous years.

The Lake States has a concentration of printing and writing paper mills, and the pandemic has accelerated the decline of this industry sector. Verso mills in Wisconsin Rapids, WI and Duluth, MN were both shuttered, and many other mills in the area curtailed production in the wake of the 2020 lockdowns. This resulted in the permanent removal of over 1.5 million tons of (what had been) stable hardwood demand from the region, and fiber prices have plunged in response.

Recent inventory data also confirms that regional mills are maintaining lower inventories than in years past – suggesting that there is now more flexibility throughout wood supply systems based on the structural decrease in demand. Lake States hardwood inventory levels for January and February 2021 are now 30% below the 5-year average for the same two-month period. At the same time, regional hardwood prices are also at their lowest point in many years.

Outlook

Despite seasonal inventory targets that have been used by procurement managers in the Lake States for years, a new regional demand dynamic is taking shape within the market. With spring break-up developing in earnest, we will have to wait until Forest2Market’s March data is finalized to see exactly how 1Q will go down in the books. However, even if there is an uptick in March inventory, it’s unlikely it will affect the downward trending price of regional wood fiber.

The last time mills were holding such low levels of inventory in the winter months was in 1Q2014, when the Lake States experienced a huge increase in delivered price that raised fiber costs to some of the highest in the world. It then took over two years for prices to once again moderate.

Did the large mills in Wisconsin Rapids and Duluth that shuttered in 2020 force procurement managers to keep more inventory in the past? Once the mills closed, did the immediate decrease in competition for fiber result in a more flexible wood supply system and lower prices throughout the region? If so, will this result in a structural market change in the Lake States and if low prices are the “new normal,” what will be the impacts to the regional landowner base? Or, will prices reverse course and surge like they did in 2014, setting up the Lake States for another multi-year period of high prices?