2 min read

Trends and Projections for Forest Product Exports from the Pacific Northwest

Hannah Jefferies : April 29, 2016

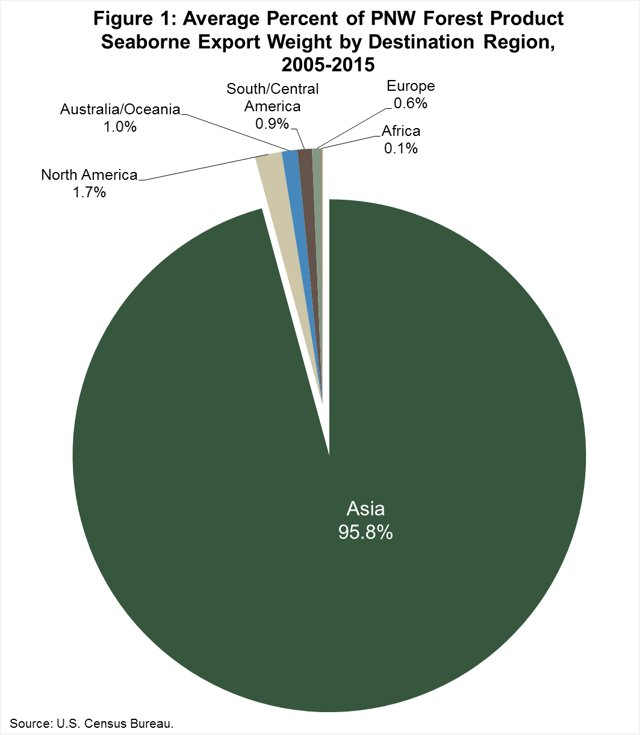

Seaborne exports are an important part of the forest products industry in the Pacific Northwest. The overwhelming majority (nearly 96 percent by weight) of seaborne exports of forest products[i] shipped via Pacific Northwest[ii] ports were destined for Asia (Figure 1). Of the remaining tonnage, 1.7 percent was exported to other North American countries, 1.0 percent to Australia/Oceania, 0.9 percent to South/Central America, 0.6 percent to Europe and 0.1 percent to Africa.

Sunset at the port of Seattle

Sunset at the port of Seattle

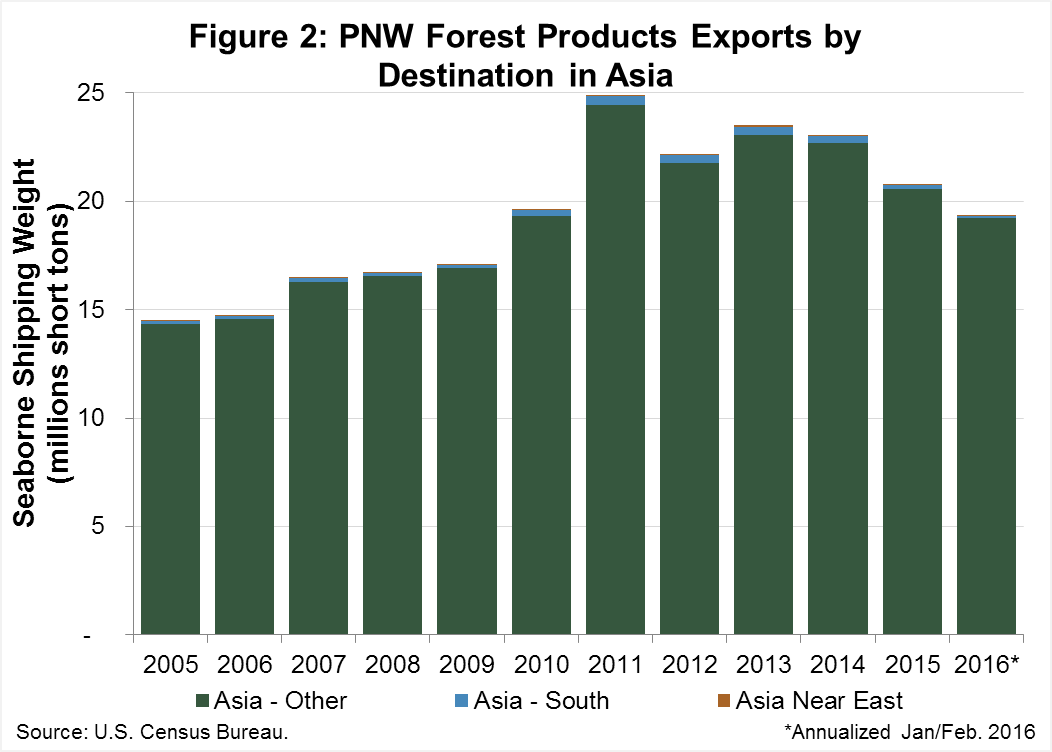

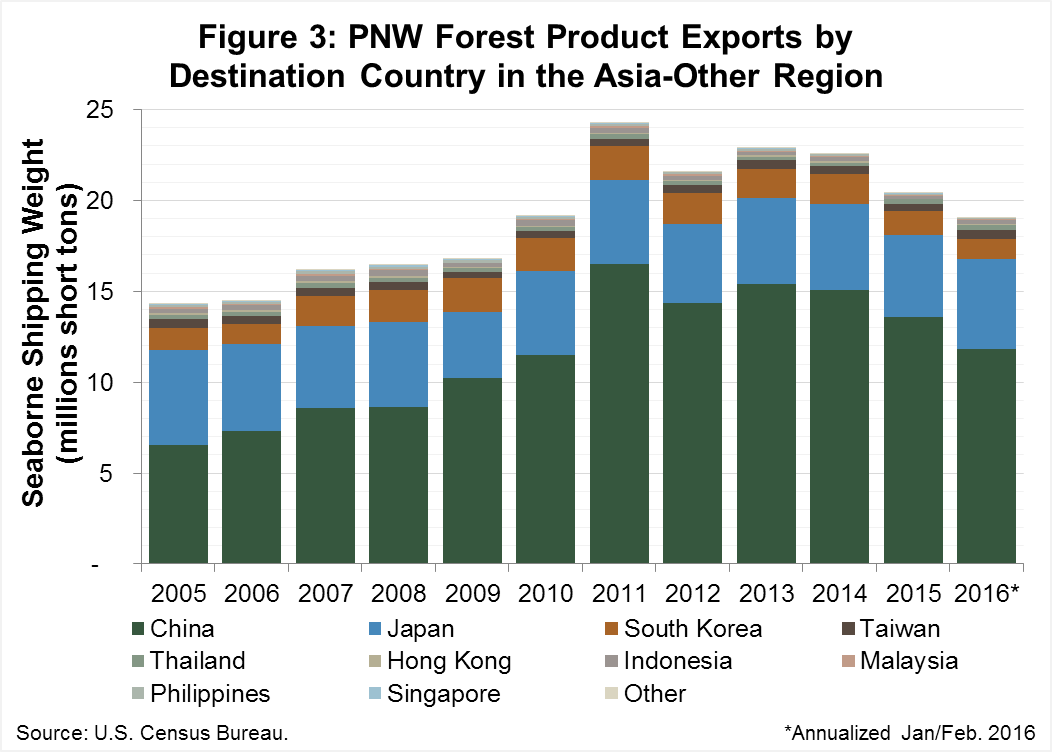

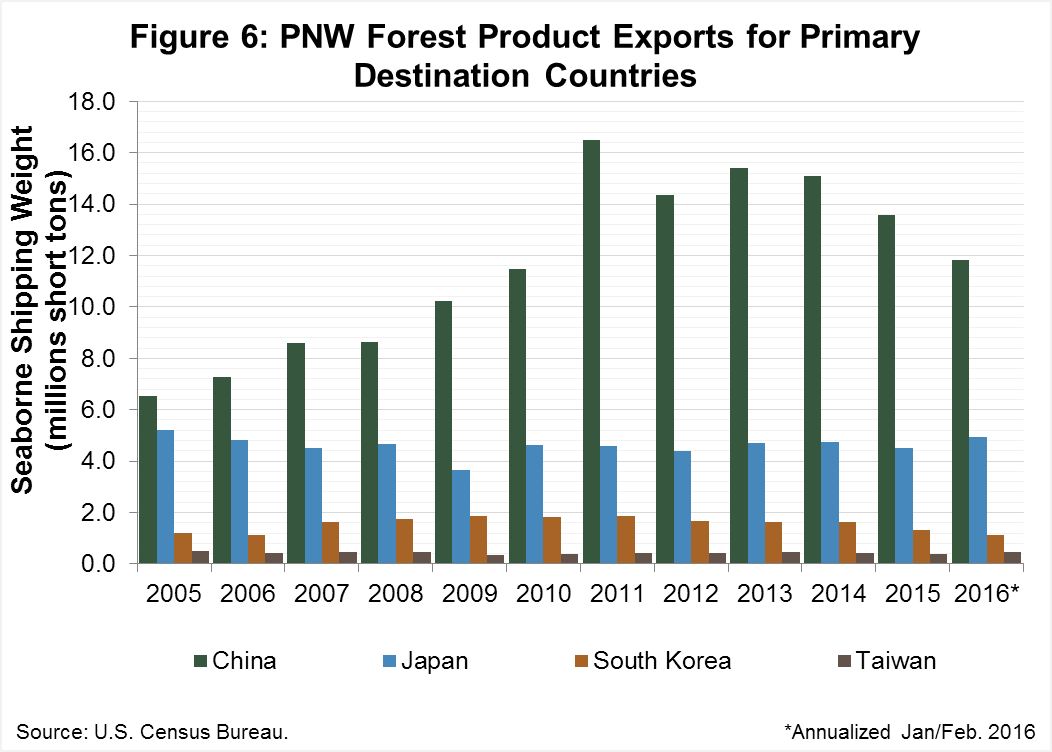

Almost all PNW forest products exported to Asia are delivered to countries in the “Asia-Other” category, which includes countries in Southeast Asia and the Pacific Rim (Figure 2, Figure 3). Of the forest products exported to this region, most are delivered to China. Japan, South Korea, and Taiwan are other important markets for forest products shipped from the PNW.

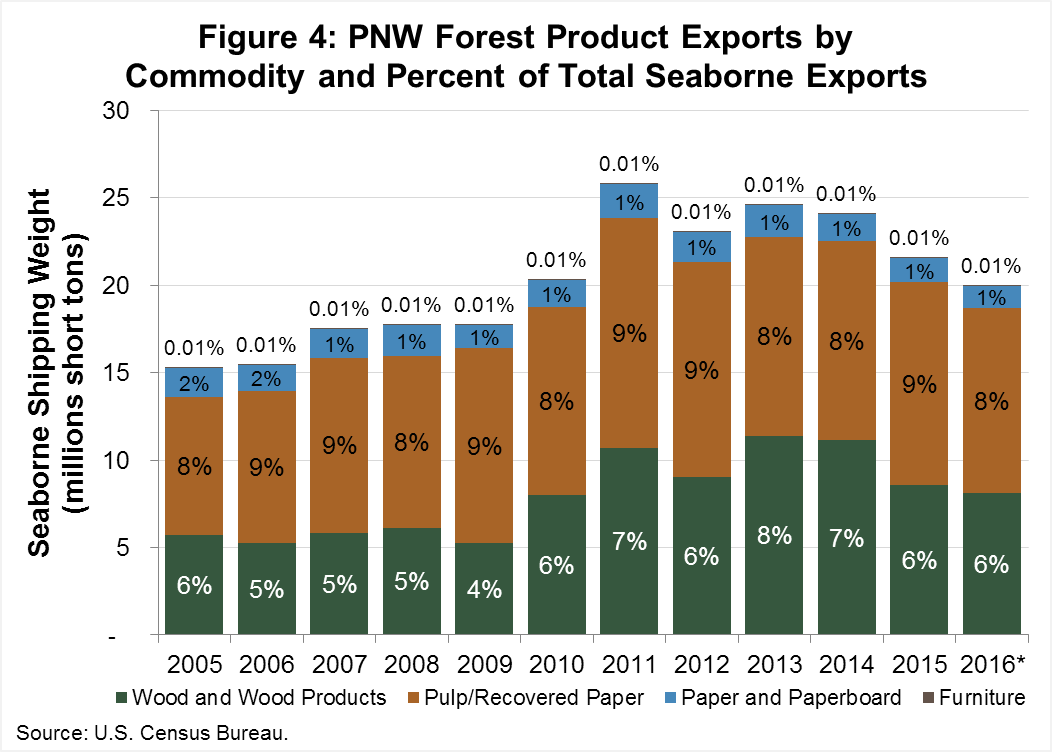

Forest product exports between 2005 and 2015 averaged 15.8 percent of all vessel shipments by weight (Figure 4). On average, 8.4 percent of export weight was pulp or recovered paper/paperboard, and 6.1 percent was wood or wood products (Figure 4). Approximately 1.3 percent was paper or paperboard, and 0.01 percent was wooden furniture.

Exports of forest products from Pacific Northwest ports increased in 2010 as the world economy began to recover from the effects of the global economic downturn (Figure 4). Between 2010 and 2015, Pacific Northwest ports exported an average of 23.2 million short tons (46.4 trillion pounds or 21.1 trillion kilograms) of forest products annually. However, since 2013, forest product exports out of Pacific Northwest ports have declined.

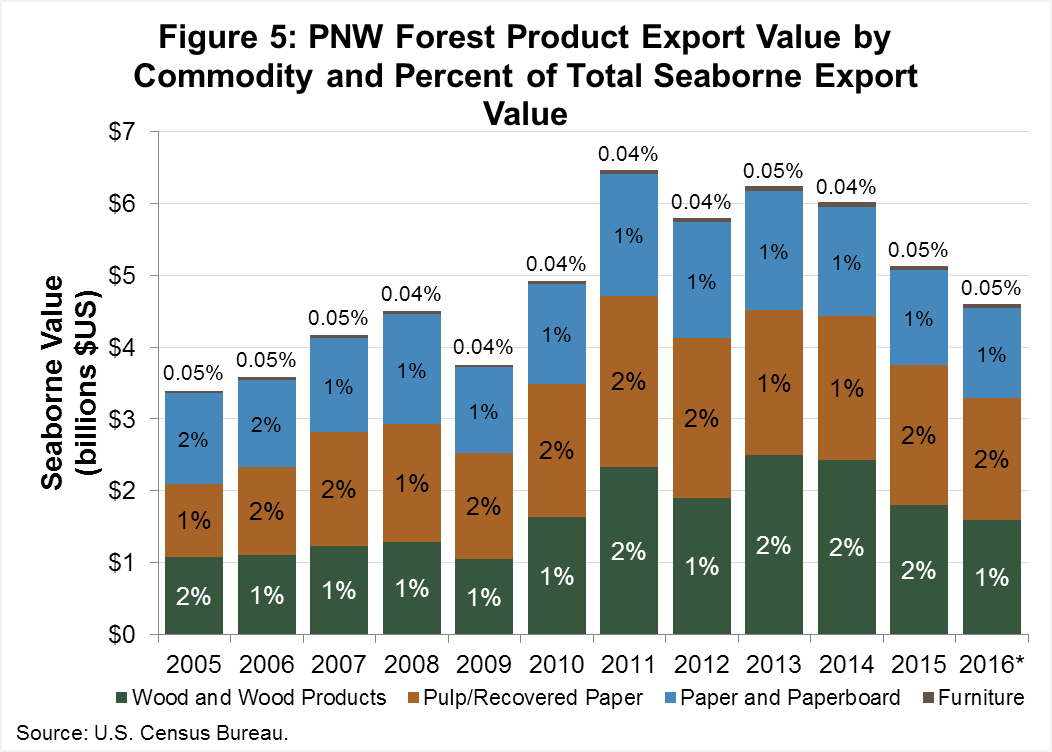

Forest products are a smaller share (4.3 percent) of the total Pacific Northwest seaborne export value (Figure 5). Between 2005 and 2015, the average value of exported forest products was approximately $5.8 billion annually. On average, pulp and recovered paper/paperboard represented 1.5 percent of total seaborne export value, and wood and wood products represented 1.4 percent. Paper and paperboard was 1.3 percent and wooden furniture was 0.05 percent of total Pacific Northwest export value.

While the West Coast port slowdown from late 2014 to early 2015 played a role in reduced forest product exports out of Pacific Northwest ports, annualized export data from January and February 2016 suggest that this declining trend will continue in 2016 (Figure 4, 5, 6). Year-to-date export tonnage to Japan and Taiwan is on pace to exceed 2015’s exports by 9 percent and 19 percent, respectively, but annualized export tonnage to China and South Korea is down 13 percent and 14 percent, respectively, compared to last year.

We expect the strength of the US Dollar and the slowdown in China’s economic growth to continue to dampen forest product exports in 2016. Approximately 63 percent of all Pacific Northwest exports by weight in 2015 were shipped to China, so the 13 percent reduction from 2015 tonnage will have a notable impact on the forest products industry this year.

[i] Includes the following HS Codes: 44 (wood and wood products, including logs, lumber, panels, pellets, chips); 47 (wood pulp and recovered paper/paperboard); 48 (paper and paperboard); 940330, 940340, 940350, 940360 (wooden furniture).

[ii] California, Oregon, Washington