US forest industry performance in May and June was recently reported by both the US government and the Institute for Supply Management.

Reflecting the view that “manufacturing is starting to rebound, but full recovery is a long way off,” total industrial production (IP) increased 1.4 percent in May (-15.3 percent YoY), as many factories resumed at least partial operations following virus-related shutdowns. Even so, total IP in May was 15.4 percent below its pre-pandemic level in February. Manufacturing output rose 3.8 percent in May after sharp drops in March and April. Most major industries posted increases, with the largest gain registered by motor vehicles and parts (+120 percent MoM, although that index remained more than 60 percent below its February 2020 level). Mining and utilities declined 6.8 percent and 2.3 percent, respectively.

New orders increased by 8.0 percent (the biggest PP rise since August 2014), led by an 82.0 percent jump in transportation equipment. Business investment spending increased by a far more sedate 1.6 percent (-7.3 percent YoY).

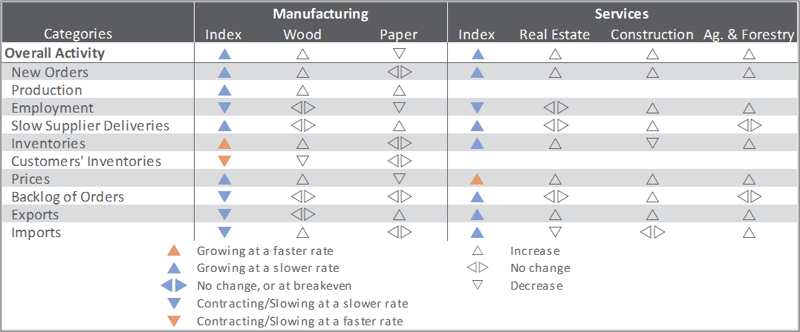

The Institute for Supply Management’s (ISM) monthly sentiment survey showed US manufacturing moving back into “an expected expansion cycle” during June. The PMI registered 52.6 percent, up 9.5PP from the May reading. (50 percent is the breakpoint between contraction and expansion.) All of the sub-indexes showed improvement: the drop in slow deliveries (-11.1PP) indicates firms are ramping up activity, and thetick downward in customer inventories (-1.6PP) is suggestive of a potential upturn in demand.

The non-manufacturing sector also jumped back into expansion (by a record +11.7PP, to 57.1 percent). The most noteworthy changes in the NMI sub-indexes included business activity (+25.0PP), new orders (+19.7PP), and exports (+17.4PP). “Respondents remain concerned about the coronavirus and the more recent civil unrest,” said ISM’s Anthony Nieves, but “are cautiously optimistic about business conditions and the economy as businesses are beginning to reopen.”

Of the industries we track, only Paper Products contracted. Comments from respondents included:

- Wood Products: “The building industry continues to defy expectations, as we continue to rebound stronger from the previous month. Being an essential business across most states and a surge in DIY projects has fueled the industry forward. While the industry will follow the greater economy, we do believe it will be more resilient than most due to potential migration from larger cities and an undersupplied housing market.”

- Construction: “Sales have picked up tremendously. Sporadic supply issues. Biggest concern for us is lumber shortages.”

- Real Estate: “COVID-19 and the riots have disrupted the normal flow of business. There is no new normal yet.”

Findings of IHS Markit’s June surveys paralleled those of their ISM counterparts, although both Markit surveys remained in contraction. “June saw a record surge in the PMI’s main gauge of business activity in the U.S. as increasing numbers of companies returned to work and expanded their operations amid the reopening of the economy,” wrote Markit’s Chris Williamson. “The survey points to a strong initial rebound from the low point seen at the height of the pandemic lockdown in April, with indicators of output, demand, exports and employment all showing steep gains… Many, however, remain constrained by social distancing measures.”

The consumer price index (CPI) retreated by 0.1 percent in May (+0.1 percent YoY) after falling 0.8 percent in April. Declines in the indexes for motor vehicle insurance, energy, and apparel more than offset increases in food and shelter indexes to result in the monthly decrease in the seasonally adjusted all-items index. The gasoline index declined 3.5 percent in May, leading to a 1.8 percent decline in the energy index. The food index, in contrast, increased 0.7 percent as the index for food at home rose 1.0 percent.

Following declines of 1.3 percent in April and 0.2 percent in March, the producer price index (PPI) rose 0.4 percent (+0.8 percent YoY) in May. The advance is attributable to prices for final demand goods, which climbed 1.6 percent (especially a 40.4 percent jump in meat prices). In contrast, the index for final demand services fell 0.2 percent.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: +0.1 percent (-0.5 percent YoY)

- Lumber & Wood Products: +0.3 percent (-0.4 percent YoY)

- Softwood Lumber: +3.9 percent (+3.2 percent YoY)

- Wood Fiber: -1.5 percent (-2.7 percent YoY)

Joe Clark

Joe Clark