2 min read

US Forest Industry, Manufacturing Sector Gained Ground in July

Joe Clark

:

August 20, 2020

Joe Clark

:

August 20, 2020

US forest industry performance in June and July was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) rose 5.4 percent in June (-10.8 percent YoY), the largest MoM gain since December 1959; even so, it remained 10.9 percent below February’s pre-pandemic level. For 2Q as a whole, IP fell at an annualized rate of 42.6 percent, its largest quarterly decrease since the downturn when WWII ended. Manufacturing output climbed 7.2 percent in June as all major industries posted increases; motor vehicles and parts registered the largest gain (105.0 percent MoM), while factory production elsewhere rose 3.9 percent. Mining production fell 2.9 percent, and the output of utilities advanced by 4.2 percent.

New orders bounced by 6.2 percent (but -8.8 percent YoY). Excluding transportation (dominated in June by motor vehicles): +4.4 percent MoM; -4.8 percent YoY. Business investment spending increased by $2.1 billion or 3.4 percent (-0.7 percent YoY).

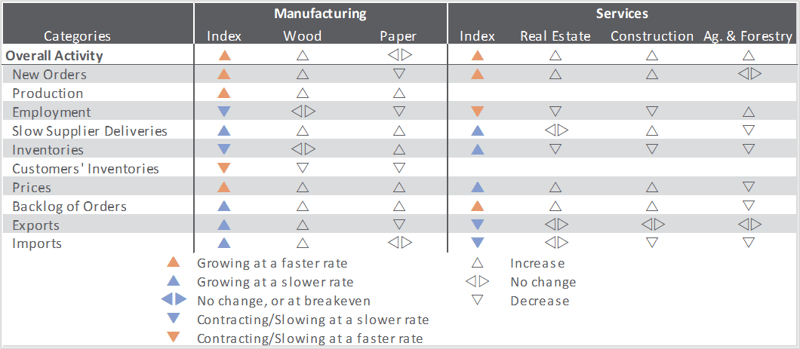

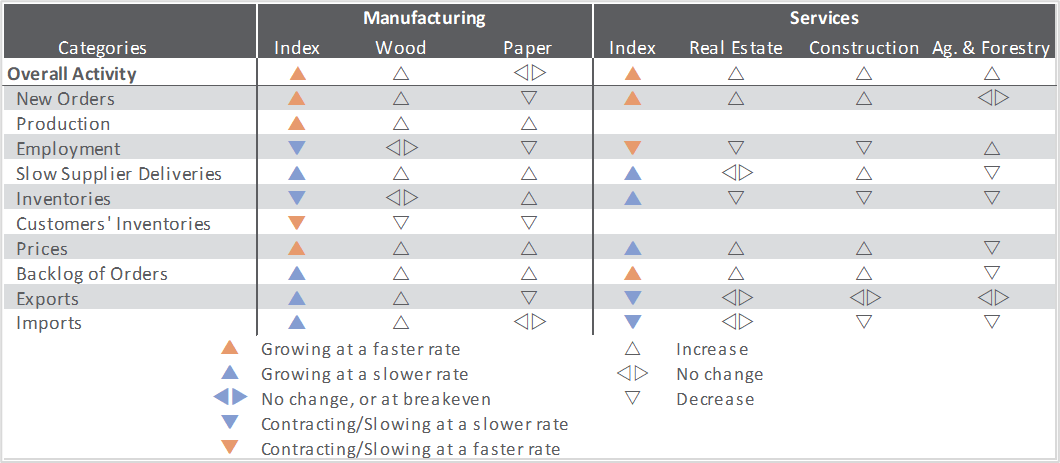

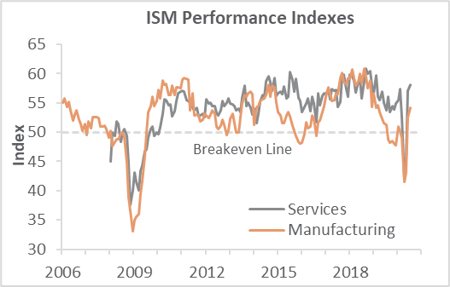

The Institute for Supply Management’s (ISM) monthly sentiment survey showed expansion of US manufacturing to be accelerating in July. The PMI registered 54.2 percent, up 1.6PP from the June reading. (50 percent is the breakpoint between contraction and expansion.) All of the sub-indexes showed improvement: Besides a jump in new orders (+5.1PP), the drop in slow deliveries (-1.1PP) indicates firms are ramping up activity; also, the declines in inventories (-3.5PP) and customer inventories (-3.0PP) suggest the potential for a future upswing of output.

The services sector also expanded further—albeit at a significantly slower rate (+1.0PP, to 58.1 percent) than in June. The most noteworthy changes in the services PMI (formerly known as NMI) sub-indexes included new orders (+6.1PP, to a record-high 67.7 percent), inventories (-8.7PP) and export orders (-9.6PP).

Of the industries we track, only Paper Products did not expand. “Sales have remained strong in homebuilding,” wrote one Construction respondent. “We are experiencing longer lead times for lumber, interior trim components, appliances and light fixtures. Lumber prices are near all-time highs as lumber mills have yet to increase capacity as demand has increased.”

Findings of IHS Markit’s July surveys paralleled those of their ISM counterparts, although both Markit surveys either barely crossed the threshold into expansion (manufacturing) or stopped at the breakeven point (services).

“The [surveys show] welcome signs of stabilizing after the unprecedented downturn seen during 2Q,” Markit’s Chris Williamson wrote. However, “the United States was the only major economy to see Covid-19 containment measures tighten again in July, and this is reflected in the data, with new business inflows falling at an increased rate to hint at the possible start of a double dip in business activity. “More encouragingly, businesses have on balance become more optimistic about recovery in the year ahead, and [taken] on extra staff to ensure capacity is sufficient to meet future growth. However, whether this optimism can be sustained and result in faster growth will of course depend on infection rates falling,” Williamson concluded.

The consumer price index (CPI) increased 0.6 percent in June (+0.6 percent YoY), over half of which was attributable to a sharp (12.3 percent) rise in the gasoline index. Despite a 5.1 percent MoM jump, the broader energy index remained 12.6 percent lower than a year earlier, however. The index for food at home was up 5.6 percent YoY whereas food away from home was +3.1 percent YoY, reflecting pandemic-related changes both to the way consumers purchase food as well as supply-chain interruptions, which tended to lift food prices.

Continuing its recent weakening trend, the producer price index (PPI) fell 0.2 percent (-0.8 percent YoY). Declining margins among a variety of wholesale and retail sectors drove the June retreat. In contrast, prices for goods at the producer level were all over the board; e.g., gasoline jumped 26.3 percent whereas meats dropped by 27.7 percent.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: -0.1 percent (-0.2 percent YoY)

- Lumber & Wood Products: +1.9 percent (+2.5 percent YoY)

- Softwood Lumber: +11.0 percent (+18.6 percent YoY)

- Wood Fiber: -0.5 percent (-2.8 percent YoY)