US forest industry performance in July and August was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) declined 0.2 percent in July (+0.5 percent YoY). Manufacturing output decreased 0.4 percent (-0.5 percent YoY) and has fallen more than 1.5 percent since December 2018. In July, mining output fell 1.8 percent, as Hurricane Barry caused a sharp but temporary decline in oil extraction in the Gulf of Mexico. The index for utilities rose 3.1 percent, however.

Wood Products (-1.1percent) was among the largest decliners in durables, whereas Paper (+1.3 percent) posted the only increase among nondurables. With Wood Products capacity expanding, capacity utilization dropped; by contrast, Paper capacity utilization rose in July.

On a more positive note, new orders rose 1.4 percent (+1.8 percent YoY); excluding transportation, the gain was a less robust 0.3 percent (+0.8 percent YoY), however. Business investment spending nudged up 0.2 percent (+0.6 percent YoY).

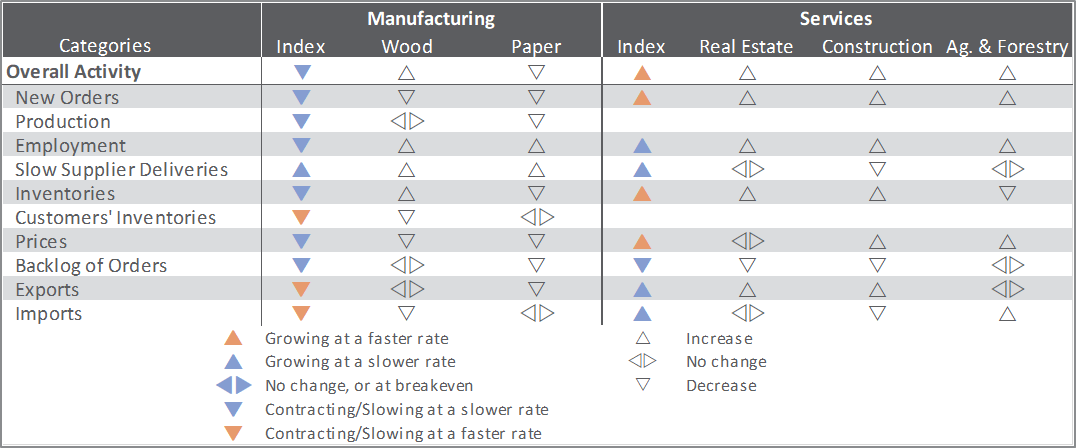

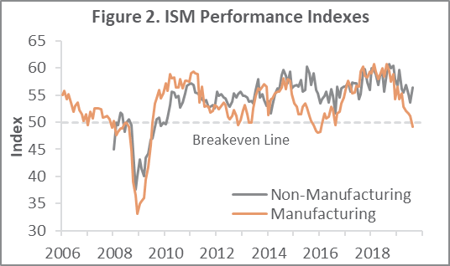

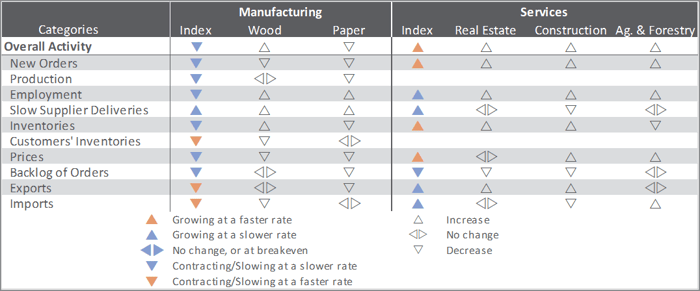

The Institute for Supply Management’s (ISM) monthly survey showed that in August, US manufacturing contracted for the first time since August 2016. The PMI registered 49.1 percent, down 2.1PP. Significant declines were seen in the indexes for new orders (-3.6PP), employment (-4.3PP) and exports (-4.8PP). By contrast, the pace of growth in the non-manufacturing sector accelerated (+2.7PP, to 56.5 percent). The increase was driven primarily by jumps in business activity (+8.4PP) and new orders (+6.2PP). Of the industries we track, only Paper Products contracted.

The consumer price index (CPI) increased 0.3 percent in July (+1.8 percent YoY); contributing factors included the indexes for gasoline (+2.5 percent), electricity (+0.6 percent) and shelter (+0.3 percent). Meanwhile, the producer price index (PPI) advanced 0.2 percent (+1.7 percent YoY), mainly on a 5.2 percent jump in the gasoline index that was only partially offset by a drop in the guestroom (motel) rental index (4.3 percent). Prices for final demand construction rose 0.6 percent.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: -0.4 percent (-1.3 percent YoY)

- Lumber & Wood Products: -0.1 percent (-5.9 percent YoY)

- Softwood Lumber: +1.7 percent (-19.5 percent YoY)

- Wood Fiber: -0.3 percent (-4.6 percent YoY)

Joe Clark

Joe Clark