US forest industry performance in February and March was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) edged up by 0.1 percent in February (+3.5 percent YoY) after decreasing 0.4 percent in January (originally -0.6 percent). Manufacturing production fell 0.4 percent in February for its second consecutive monthly decline; data for January was revised to -0.5 percent, from the original -0.9 percent. The index for utilities rose 3.7 percent in February, while mining moved up 0.3 percent.

“Investment spending has been a clear victim of the uncertainty generated by the trade war since mid-2018, and that continued through the end of 2018,” said Jefferies’ Thomas Simons. “2019 is getting off to a better start, but there is still so much uncertainty surrounding the trade war that there are certainly downside risks ahead.”

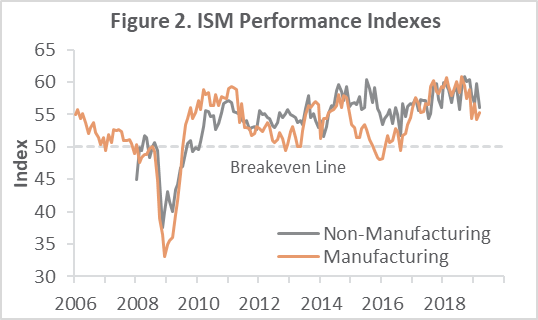

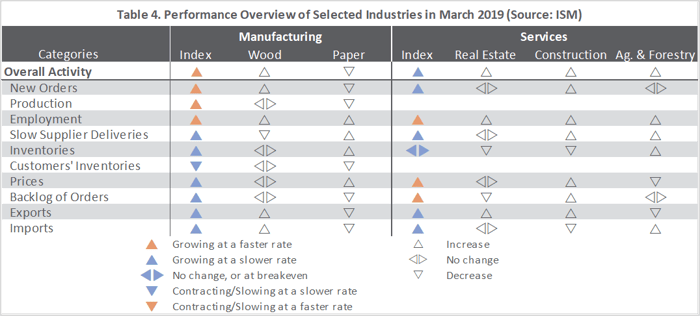

The Institute for Supply Management’s (ISM) sentiment survey for March showed the expansion in US manufacturing accelerating slightly (+1.1PP), to 55.3 percent. Increases in employment (+5.2PP) and input-price (+4.9PP) indexes were particularly noteworthy (Table 4). The pace of growth in the non-manufacturing sector decelerated (-3.6PP) to 56.1 percent. The drop in new orders (-6.2PP) and jump in input prices (+4.3PP) were significant. Of all the industries we track, only Paper Products contracted.

IHS Markit’s March survey headlines diverged from their ISM counterparts, which supports the conflicting-views point made above. “For 1Q as a whole, [Markit’s] surveys are consistent with the economy growing at an annualized rate of approximately 2.5 percent,” wrote Markit’s Chris Williamson, “painting a relatively rosy picture compared to official data.

Williamson is not entirely sanguine about the future, however. “Dig deeper and the picture darkens,” he continued. “Inflows of new work have moderated markedly compared to this time last year as manufacturing weakness and growing concerns about the economic outlook have increasingly spread to the service sector. Business optimism about the year ahead is now the lowest for two and a half years, posing downside risks to growth in coming months.”

The consumer price index (CPI) increased 0.2 percent in February (+1.5 percent YoY). The indexes for shelter and food increased (+0.3 percent and +0.4 percent, respectively), and the gasoline index rose 1.5 percent following three consecutive monthly declines. The indexes for personal care, apparel, and education rose in February while recreation, medical care, used cars and trucks and new vehicles fell.

Meanwhile, the producer price index (PPI) edged up 0.1 percent (+1.9 percent YoY), the outcome of a 0.4 percent rise in prices for final demand goods (largely attributable to a 3.3 percent jump in the gasoline index) and an unchanged index for final demand services.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products was unchanged (+2.3 percent YoY)

- Lumber & Wood Products: +0.8 percent (-1.7 percent YoY)

- Softwood Lumber: +4.8 percent (-12.2 percent YoY)

- Wood Fiber: +0.2 percent (-2.3 percent YoY)

Joe Clark

Joe Clark