US forest industry performance in October and November was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) fell 0.8 percent in October (-1.1 percent YoY), compounding September’s 0.3 percent decline. Manufacturing output decreased 0.6 percent in October, thanks largely to the strike at General Motors that chopped the output of motor vehicles and parts by 7.1 percent. The decreases for total IP, manufacturing, and motor vehicles and parts were their largest since May 2018, April 2019, and January 2019, respectively. Excluding motor vehicles and parts, the index for total IP moved down 0.5 percent, and the index for manufacturing edged down 0.1 percent.

The breadth of the cutback in production is evidenced by the observation that seven of the eleven durable goods sectors and six of the eight nondurables sectors posted declines; wood products’ +0.7 percent was an aberration.

Manufacturing output is off by 1.5 percent YoY, a clear sign—in conjunction with the continued falloff in commercial and industrial loans—that the “producer side” of the economy is in a shallow recession. “Evidence concerning the manufacturing sector tends to point to weakening conditions, with decent domestic demand being countered by an increasingly weak export sector,” said MFR’s Joshua Shapiro.

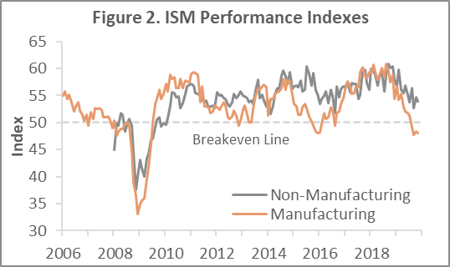

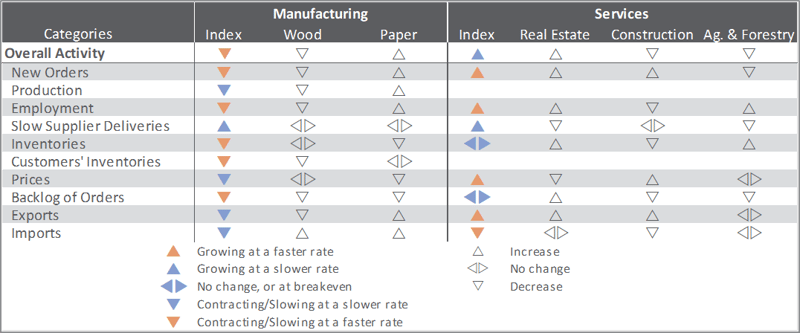

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that in November, US manufacturing contracted at a marginally faster pace. The PMI registered 48.1 percent, down 0.2PP from the October reading; recall that ISM readings above 50 percent signal expansion, less than 50 percent means contraction. New orders (-1.9PP), employment (-1.1PP), order backlogs (-1.1PP) and exports (-2.5PP) all fell further into negative territory. Meanwhile, the pace of growth in the non-manufacturing sector decelerated (-0.8PP, to 53.9 percent). Although growth in business activity slowed dramatically (-5.4PP), new orders (+1.5PP), employment (+1.8PP) and exports (+2.0PP) all rose. Meanwhile, imports (-3.5PP) contracted further.

Of the industries we track, only Paper Products and Real Estate expanded. Respondent comments included the following:

- Wood Products. “Markets have downshifted further. The continued confusion surrounding China trade has kept export markets on edge. Profits are elusive. Cash-flow planning is paramount. The general economy is slowing down.”

- “Activity is still up in all areas, but primarily in commercial construction.”

As has become common in recent months, findings of IHS Markit’s November surveys diverged from their ISM counterparts. “With both services and manufacturing reporting stronger rates of expansion, the November PMI surveys indicate the fastest pace of economic growth for four months,” said Markit’s Chris Williamson. “The improvement is coming from a low base, however, and even at these higher levels the survey is merely indicative of annualized GDP growth in the region of 1.5 percent.

The consumer price index (CPI) rose 0.4 percent in October (+1.8 percent YoY). The energy index (especially gasoline: +3.7 percent) increased 2.7 percent after recent monthly declines and accounted for more than half of the headline advance; increases in the indexes for medical care (+0.9 percent), recreation (+0.4 percent), and food (+0.2 percent) also contributed.

The producer price index (PPI) increased 0.4 percent (+1.1 percent YoY). The index for final demand services rose 0.3 percent (mainly on a +2.6 percent increase in margins for apparel, jewelry, footwear, and accessories retailing) while prices for final demand goods increased 0.7 percent (almost half of which is attributable to a 7.3 percent jump in the gasoline index).

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: -0.1 percent (-2.1 percent YoY)

- Lumber & Wood Products: +0.2 percent (-1.8 percent YoY)

- Softwood Lumber: 0.0 percent (+1.3 percent YoY)

- Wood Fiber: -0.3 percent (-4.8 percent YoY)

Joe Clark

Joe Clark