3 min read

US Forest Industry Performance Remains Strong, But Capacity Worries Persist

Joe Clark

:

June 28, 2021

Joe Clark

:

June 28, 2021

US forest industry performance in April and May was recently reported by both the US government and the Institute for Supply Management.

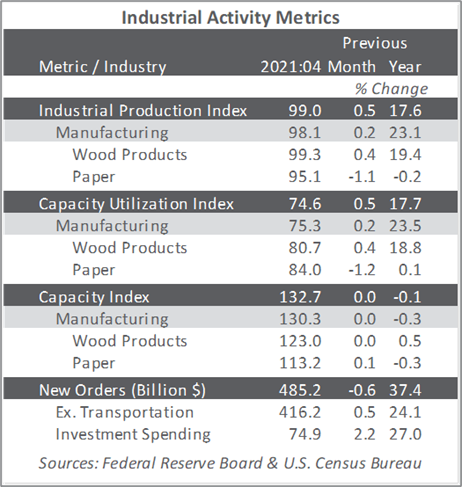

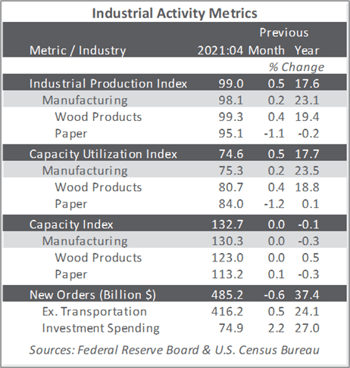

After revisions in late May to indexes of industrial production (IP), capacity utilization and capacity, total IP was shown to have expanded in April by 0.5 percent MoM. The revisions were more extensive than typically undertaken each year—including a change of base year from 2012 to 2017, a conversion of the industry-group indexes to the 2017 North American Industry Classification System, incorporation of comprehensive annual production data for 2017 through 2019, and addition of new utilization-rate survey data for 2019 and 2020.

On net, the revisions to total IP were negative for recent years. Notably, the updated rates of change were 1.0-1.5PP lower per year from 2017 through 2019 than previously reported. The cumulative effect of these revisions left the level of total IP in April 2021 about 3.5 percent below its pre-Great Recession peak in December 2007; previously, total IP in April 2021 was slightly above its peak before the Great Recession.

The Institute for Supply Management’s (ISM) monthly sentiment survey showed a slight increase in the proportion of US manufacturers reporting expansion in May. The PMI registered 61.2 percent, a rise of 0.5PP from the April reading. (50 percent is the breakpoint between contraction and expansion.) The sub-indexes for new orders (+2.7PP), slow deliveries (+3.8PP) and backlogged orders (+2.4PP) all rose.

The services sector rebounded to a new all-time high of respondents reporting expansion (+1.3PP, to 64.0 percent). The most noteworthy changes in the sub-indexes included slow deliveries (+4.3PP), input prices (+3.8PP) and imports (-5.3PP).

All of the industries we track expanded. Respondent comments included the following:

- Construction: “We are still busy and adding employees. One of the biggest concerns now is shortages of crucial material and equipment… Equipment and material suppliers have been raising prices since the first of the year. We hear of a new increase almost daily.”

- Real Estate: “Business is very strong, and customer orders continue to increase at a rapid pace. Material shortages, increased prices and qualified personnel shortages are becoming a much larger concern.”

Findings of IHS Markit’s May survey results were generally consistent with their ISM counterparts. “U.S. manufacturers are enjoying a bumper 2Q, with the PMI hitting a new high for the second month running in May,” wrote Markit’s Chris Williamson. “Inflows of new orders are surging at a rate unsurpassed in 14 years of survey history, buoyed by reviving domestic demand and record export sales as economies reopen from COVID-19 restrictions. However, elevated levels of other survey indicators are less welcome: prices charged by manufacturers are also rising at an unprecedented rate, linked to soaring input costs and unparalleled capacity constraints.

“Not only is operating capacity being curbed by record supply chain delays so far in 2Q, but firms have also been increasingly unable to hire sufficient staff. Hence backlogs of work are building up at an unprecedented rate, as firms struggle to meet demand.

“These backlogs of orders should support further production growth in the next few months, adding to signs of impressive economic expansion over the summer. But manufacturers’ expectations further ahead have moderated, hinting that the growth rate is peaking, linked to worries about capacity limits being reached, rising prices hitting demand and a peaking of stimulus measures,” Williamson concluded.

The consumer price index (CPI) increased 0.8 percent in April (+4.2 percent YoY, the largest annual increase since September 2008’s +4.9 percent). A 10.0 percent jump in the index for used cars and trucks (the largest MoM increase since that series’ start in 1953) accounted for over a third of April’s all-items increase. Since January 2020, used car prices have gone up by 16.7 percent, causing one used car dealer to observe that, “what is normally a depreciable asset has been appreciating. It’s... surreal.”

Meanwhile, the producer price index (PPI) advanced by 0.6 percent in April (+6.2 percent YoY, the highest rise in the final-demand index’s admittedly short history beginning in November 2009). About two-thirds of the MoM change can be traced to a 0.6 percent increase in prices for a variety of services including portfolio management; airline passenger services; food retailing; fuels and lubricants retailing; physician care; and hardware, building materials, and supplies retailing. The index for final-demand goods also moved up 0.6 percent, led by an 18.4 percent jump in the steel mill products index.

In the forest products sector, price index performance included:

- Pulp, Paper & Allied Products: +1.9 percent (+7.5 percent YoY)

- Lumber & wood products: +3.8 percent (+36.5 percent YoY)

- Softwood lumber: +6.4 percent (+121.1 percent YoY)

- Wood fiber: 0.0 percent (+8.3 percent YoY)