US forest industry performance in March and April was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) fell 5.4 percent in March (-5.5 percent YoY), as the coronavirus pandemic led many factories to suspend operations late in the month. Manufacturing output fell 6.3 percent; most major industries posted decreases, with the largest decline registered by motor vehicles and parts. On a percentage basis, the decreases for total IP and for manufacturing were their largest since January 1946 and February 1946, respectively. The indexes for utilities and mining declined 3.9 percent and 2.0 percent, respectively.

New orders tumbled by a record 10.3 percent (also -10.3 percent YoY), led by a 41.3 percent drop in transportation equipment orders; most noteworthy was a 296.2 percent MoM plunge in civilian aircraft and parts orders—which, presumably, means not only were no new orders placed, but customers also cancelled existing orders. Excluding transportation, new orders fell by 3.7 percent (-3.1 percent YoY). Business investment spending slipped by 0.1 percent (and -0.1 percent YoY).

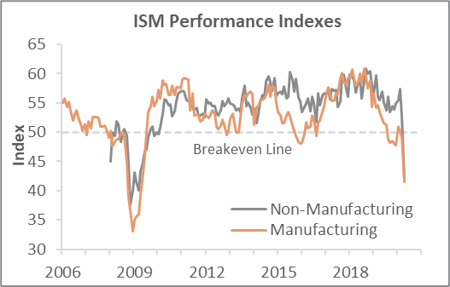

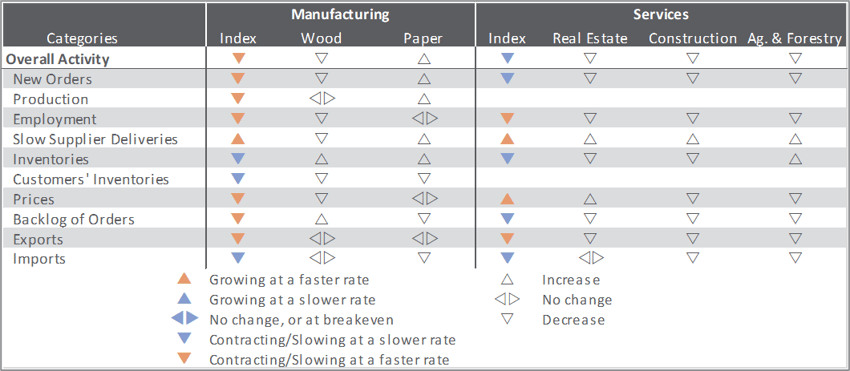

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that US manufacturing contracted further in April. The PMI registered 41.5 percent, down 7.6PP from the March reading. (50 percent is the breakpoint between contraction and expansion.) Except for another surge in slow deliveries (+11.0PP), all sub-indexes were negative (and generally more so than in March). Declines in new orders (-15.1PP), production (-20.2PP) and employment (-16.3PP) were particularly noteworthy.

The non-manufacturing sector dropped into contraction (-10.7PP, to 41.8 percent). A further jump in slow deliveries (+16.2PP, to a record-high 78.3PP) limited the decrease in the composite NMI; tumbling new orders (-20.0PP) and employment (-17.0PP) were also among the most noticeable changes.

Of the industries we track, only Paper Products expanded. Common themes among respondent comments included demand volatility from the coronavirus, supply chain disruptions, and oil.

- Paper Products: “Our packaging business is starting to see signs of a slowdown in May after two strong months into COVID-19.”

- Construction: “COVID-19 is altering the operation, supply chain and sales process of home-building. Stay-at-home orders have hampered business in residential construction. As ours has been deemed an essential industry, we continue to navigate changing guidelines and restrictions on a daily basis.”

Findings of IHS Markit’s April surveys paralleled those of their ISM counterparts.

The consumer price index (CPI) declined 0.4 percent in March (+1.5 percent YoY). A sharp decline in the gasoline index was a major cause of the MoM decrease in the all-items index, with decreases in the indexes for airline fares, lodging away from home, and apparel also contributing. The energy index fell 5.8 percent as the gasoline index decreased 10.5 percent. The food index rose in March, increasing 0.3 percent as the food at home index rose 0.5 percent.

Meanwhile, the producer price index (PPI) for final demand fell 0.2 percent (+0.7 percent YoY) thanks to final-demand energy (especially gasoline, which dropped 16.8 percent).

While it's important to note that the situation is changing rapidly and the next batch of data from the Bureau of Labor Statistics will tell a different story, index performance from the forest products sector included:

- Pulp, Paper & Allied Products: +0.4 percent (-1.7 percent YoY)

- Lumber & Wood Products: +1.5 percent (+1.2 percent YoY)

- Softwood Lumber: +4.6 percent (+10.7 percent YoY)

- Wood Fiber: +0.9 percent (-1.1 percent YoY)

Joe Clark

Joe Clark