2 min read

US Housing Starts Skyrocket in January, Lose Ground in February

John Greene

:

March 28, 2019

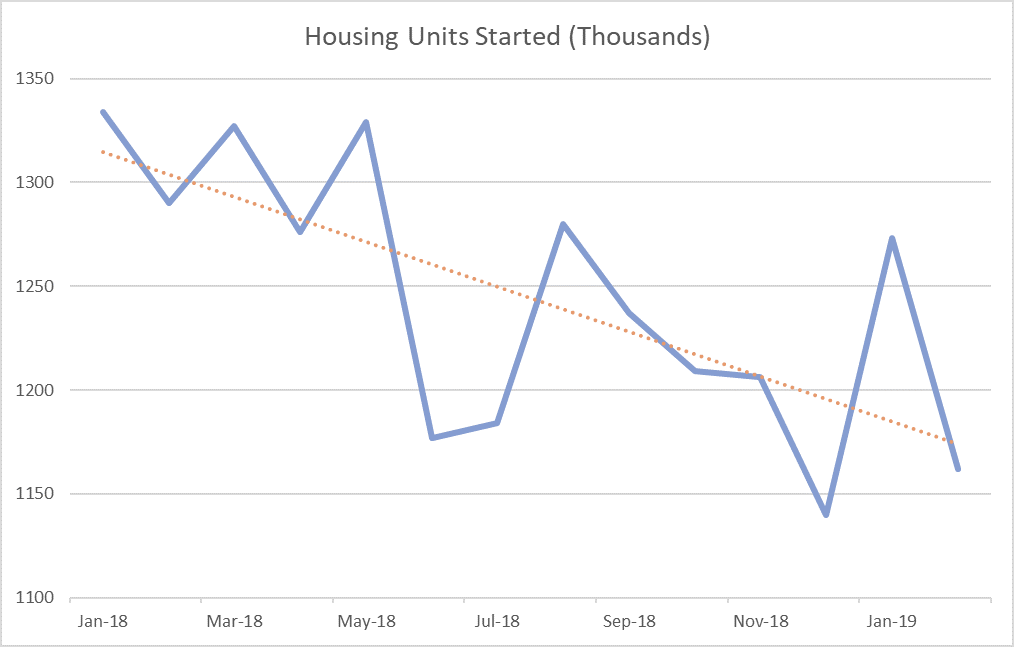

US housing starts skyrocketed in January, increasing more than expected as construction of single-family housing rallied after four straight months of declines. However, the gain was short-lived; February starts then fell more than expected as single-family builds dropped to an 18-month low. But with mortgage rates inching down and other economic indicators holding steady, the outlook for the housing market is improving as we head into the meat of the building and buying season.

Housing Starts, Permits & Completions

- Privately-owned housing starts skyrocketed 18.6 percent in January to a seasonally adjusted annual rate (SAAR) of 1.230 million units. Single-family starts, which account for the largest share of the housing market, surged 25.1 percent to a rate of 926,00 units in January, the highest since May 2018. Starts for the volatile multi-family housing segment rose 2.4 percent to a rate of 304,000 units in January.

- Just a month later, the trend reversed course sharply. Privately-owned housing starts dropped 8.7 percent in February to a seasonally adjusted annual rate of 1.162 million units. In stark contrast to January, single-family starts dropped 17.0 percent to a rate of 805,00 units in February. Starts for the volatile multi-family housing segment jumped 17.8 percent to a rate of 357,000 units in February.

Privately-owned housing authorizations were down 1.6 percent to a rate of 1.296 million units in February. Single-family authorizations were unchanged at a pace of 821,000 units. Privately-owned housing completions were up 4.5 percent to a SAAR of 1.303 million units. Per the US Census Bureau Report, seasonally-adjusted total housing starts by region included:

- Northeast: -29.5 percent (+58.5 percent in prior month)

- South: -6.8 percent (+13.8 percent in prior month)

- Midwest: +26.8 percent (-5.7 percent in prior month)

- West: -18.9 percent (+29.3 percent in prior month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -42.0 percent (+66.0 percent in prior month)

- South: -12.1 percent (+15.5 percent in prior month)

- Midwest: -8.3 percent (+18.5 percent in prior month)

- West: -24.4 percent (+44.9 percent in prior month)

Despite the dismal performance at the end of 2018, a recent survey showed growing confidence among single-family homebuilders. In February, the index component that tracks views of current sales conditions rose three points to a reading of 67, and the tracker of expectations for the next six months jumped five points to 68.

Mortgage Rates & Builder Outlook

The 30-year fixed mortgage rate has dropped 7.8 percent since peaking at 4.87 in late November. Mortgage rates over the last four months: 4.64 in December, 4.46 in January, 4.37 in February and 4.28 in March. “Looking back, the December drop in housing production correlated with the peak increase in mortgage rates and corresponding decline in builder sentiment,” said NAHB Chairperson Greg Ugalde. “During that time, builders adopted a cautious wait-and-see approach as demonstrated in the rise of single-family and multifamily units that were permitted but not under construction.”

As is the case each year during 1Q, severe weather has impacted builders’ ability to complete construction projects. Matthew Speakman, an analyst at real estate company Zillow noted that “Winter weather had an impact on home construction in February, with housing starts taking a step backward from the momentum of January’s report. Many attributed January’s strong release—which broke a streak of four straight monthly declines and improved market conditions for buyers—specifically to mortgage rates retreating from multiyear highs, a recovering stock market and a less ambitious interest rate outlook.”

Speakman continued, "[February’s] lackluster release is likely due to poor weather conditions, which led to a decline in construction activity and jobs from the month prior. What starts activity there was was driven largely by the volatile multifamily sector. The outlook for home construction should improve as we turn the corner into spring, but that could take longer in parts of the country where flooding continues into late March.”