The Bureau of Labor Statistics’ (BLS) establishment survey reported growth in non-farm payroll employment cooled considerably during December when rising by 145,000 jobs (+160,000 expected). Also, October and November employment gains were revised down by a combined 14,000.

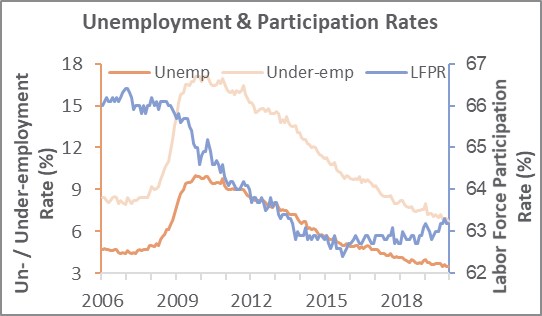

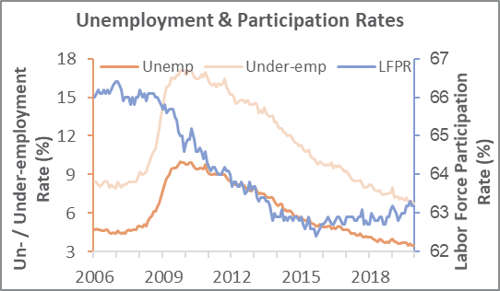

Meanwhile, the unemployment rate (based upon the BLS’s household survey) was unchanged at 3.5 percent even as growth in the number of employed persons (+267,000) exceeded expansion of the labor force (+209,000); the under-employment rate ticked down to a record-low 6.7 percent, however. The number of working-age persons not in the labor force was little changed (-48,000) at 95.6 million. Although the labor force grew faster than the working-age civilian population (+161,000), the labor force participation rate was unchanged at 63.2 percent.

The establishment (+145,000 jobs) and household survey results (+267,000 employed), while at least directionally consistent, were otherwise poorly correlated. Had average (since 2009) December CES (business birth/death model) and seasonal adjustments been used, job gains might have been an even more sedate +120,000.

Goods-producing industries lost 1,000 jobs, while service-providing employment jumped by 146,000. Manufacturing shrank by 12,000 jobs (the second biggest drop since the summer of 2016). That result aligns with ISM’s manufacturing employment sub-index, which contracted at a faster pace in December. Wood Products employment added 1,200 jobs (ISM decreased); Paper and Paper Products: +200 (ISM unchanged); Construction: +20,000 (ISM decreased).

As a related point, there are 891,000 fewer manufacturing jobs today than at the start of the Great Recession in December 2007, but 2.67 million more lower-paying Food Services & Drinking Places (i.e., wait staff and bartender) jobs. In 2019, manufacturing added 46,000 jobs while FS&D jobs expanded by 271,300.

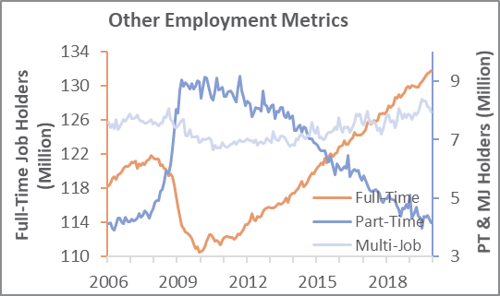

Full-time jobs jumped up by 194,000, to a new record of 131.8 million; there are now nearly 9.9 million more full-time jobs than the pre-recession high; for perspective, however, the non-institutional, employment-age civilian population has risen by over 27.2 million. Workers employed part time for economic reasons fell by 140,000. Those working part time for non-economic reasons rose by 54,000 while multiple-job holders dropped by 161,000.

Average hourly earnings of all private employees inched up by $0.03, to $28.32 (+2.9 percent YoY). Although the average workweek shrank by 0.1 hour (to 34.3 hours), average weekly earnings increased by $1.03, to $971.38 (+2.6 percent YoY). With the CPI running at an annual rate of 2.1 percent in November, workers are maintaining purchasing power according to official metrics.

2020 Outlook

Per a BLS decade-long employment forecast issued in September 2019, “Employment is projected to grow by 8.4 million jobs to 169.4 million jobs over the 2018–28 decade, the U.S. Bureau of Labor Statistics (BLS) reported today. This expansion reflects an annual growth rate of 0.5 percent, which is slower than the 2008–18 annual growth rate of 0.8 percent. An aging population and labor force will contribute to changes expected over the coming decade including a continued decline in the labor force participation rate and continued growth in employment in healthcare and related industries and occupations.”

As noted by the BLS, the aging US workforce will continue to impact the labor market. In December, a record 37.8 million workers were 55+ years old; that demographic is also the largest cohort in the labor force (23.8 percent of the total). The next-largest group of workers is the 25- to 34-year-old cohort (36.2 million, and 22.8 percent of the total workforce). The other prime working-age cohorts are either treading water (35- to 44-year-olds) or losing ground in both absolute and representation terms (45- to 54-year-olds).

But for now, the employment picture seems reasonably bright despite an apparent slowing in hiring. “The most disappointing number in the [December] report was wage growth, which fell to 2.9 percent,” said ZipRecruiter’s Julia Pollack. “It likely reflects both a statistical quirk and the broader truth that the U.S. job market is not yet at full employment.”

FHH Financial’s Chris Low found it “astonishing that a 10-year expansion and a 50-year low 3.5 percent unemployment rate is not generating more wage pressure.”

That said, a current robust labor market, low interest rates and improving trade tensions with China are likely to extend the economic expansion in the near term, which bodes well for employment metrics in 2020.