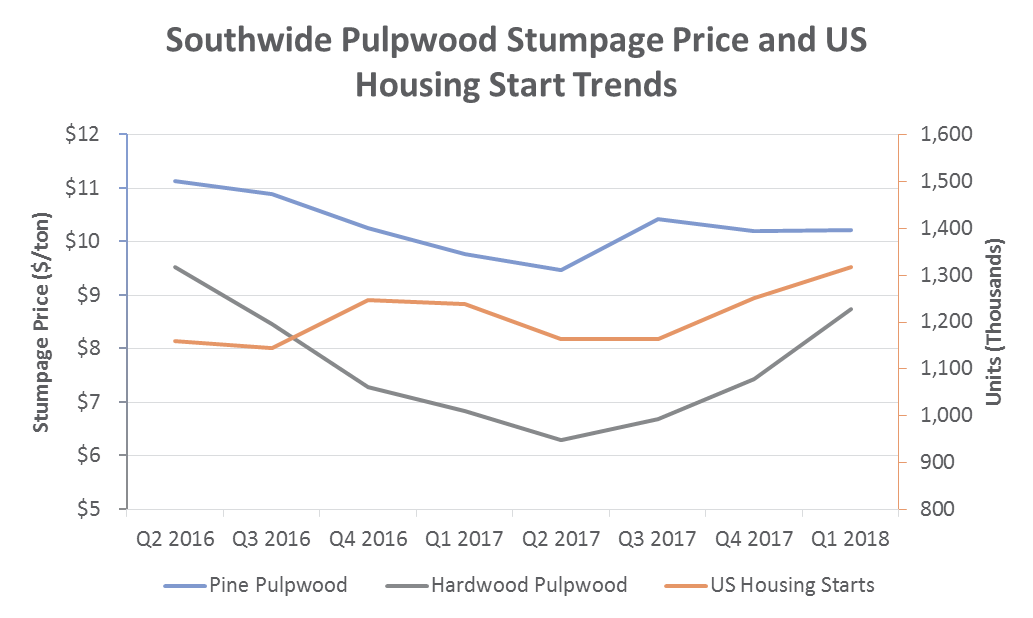

US South timber prices during 1Q2018 were mixed. Pulpwood products increased slightly and pine log products decreased, but the general trend of timber prices was downward in 1Q (-6 percent).

Pulpwood

On a Southwide basis, pine pulpwood prices remained flat at $10.22/ton during 1Q2018 (+0.1 percent), although two out of three regions experienced price increases for pine pulpwood. The Mid-South experienced the largest increase to $9.32/ton, or +9.4 percent. The East-South rose to $13.11/ton, an increase of +1.3 percent, and the West-South decreased to $7.80/ton, or -5.1 percent.

Southwide hardwood pulpwood prices increased in 1Q, rising to $8.74/ton (+14.8 percent). The West-South region experienced the largest surge to $11.30/ton, or +24.4 percent. The East-South rose to $4.49/ton (+19.1 percent), and the Mid-South increased to $10.01/ton (+10.5 percent).

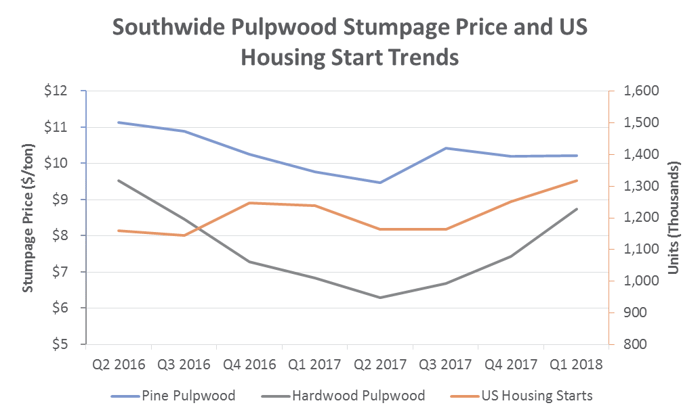

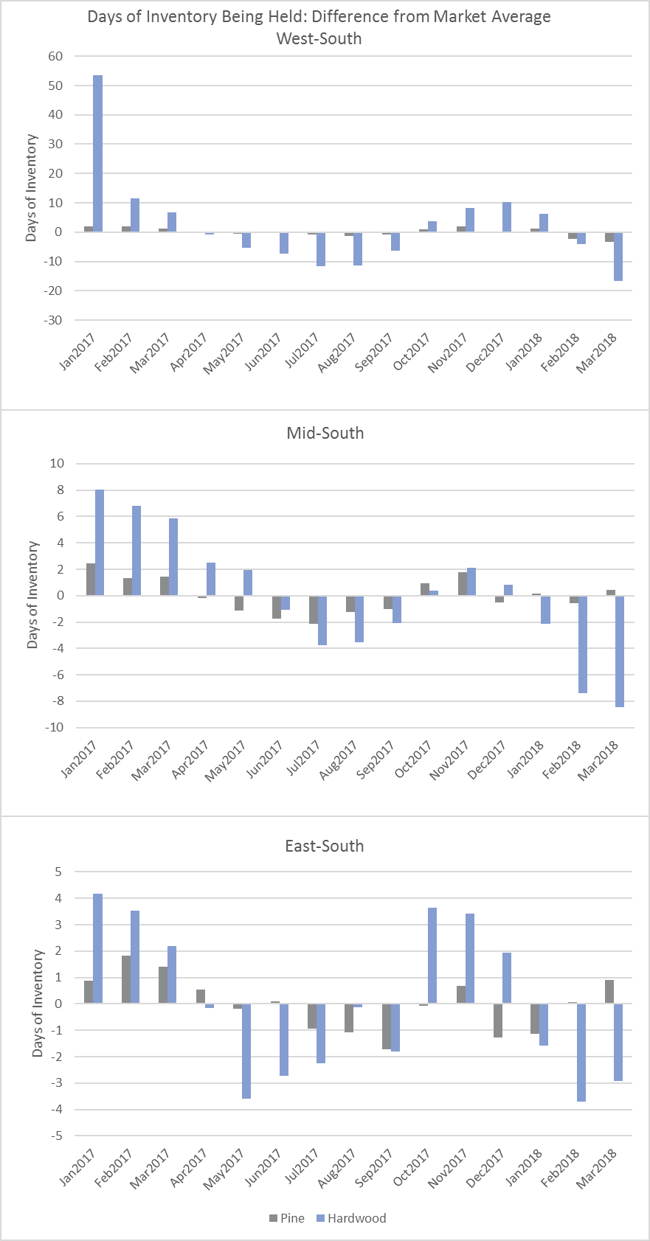

The reason hardwood pulpwood prices appreciated this period while pine pulpwood prices stayed relatively stable lies in mill inventory numbers, which are available in Forest2Market's Delivered Fiber360 tab via SilvaStat360.

In the West-South, mill inventory was 24 days lower in March 2018 than it was in March 2017, or 17 days below the market average days of inventory. In this context, a 24 percent increase in price is understandable. By contrast, pine inventories have been relatively stable in the West-South over the last 15 months, leading to more stable pricing.

While pine pulpwood inventories are a little less stable in both the Mid-South and the East-South, hardwood pulpwood inventories are also below the market average in March 2018 (8 and 3 days respectively).

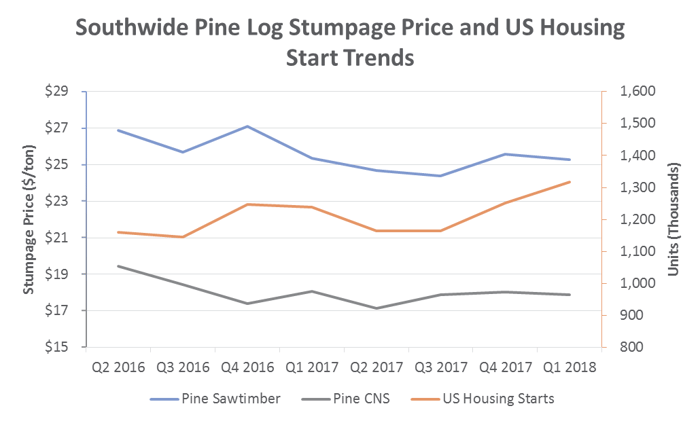

Pine Logs

Pine chip-n-saw prices dropped to $17.86/ton, a reduction of -0.9 percent Southwide. The West-South and East-South regions experienced a decrease, as prices dropped to $13.98/ton (-8.7 percent) and $20.35/ton (-4.0 percent). Prices in the Mid-South region surged to $17.62/ton, a +6.1 percent increase.

Pine sawtimber prices dropped -1.1 percent to a Southwide average of $25.28/ton. Mid-South pine sawtimber prices rose to $25.17/ton (+5.0 percent), and East-South were up slightly to $26.18/ton (+0.8 percent). Prices in the West-South dropped considerably to $24.46/ton (-15.0 percent).

Outlook

Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in 1Q2018 according to the "advance" estimate released by the Bureau of Economic Analysis, beating its projected forecast of 2.0 percent. Fresh data from the Atlanta Federal Reserve’s GDPNow model estimates that real GDP growth (seasonally adjusted annual rate) in 2Q2018 will be 4.1 percent. Based on recent construction spending information published by the U.S. Census Bureau, the Atlanta FED’s “nowcast” forecast of 2Q real non-residential structures investment increased from 2.9 percent to 5.3 percent, and the nowcast of real residential investment decreased from 3.5 percent to 2.9 percent.

Housing starts appear to be trending at a slow increase, and lumber prices remain at record highs amid strong demand. As Canadian producers continue to expand operations in the US South, demand for sawtimber logs in the region will remain robust. Despite the oversupply of large logs available on the market, we look for stumpage prices to tick upwards through 3Q.