US South timber prices during 2Q2018 were mixed; weighted average prices for pulpwood products slipped slightly, however, prices for pine log products increased.

Pulpwood

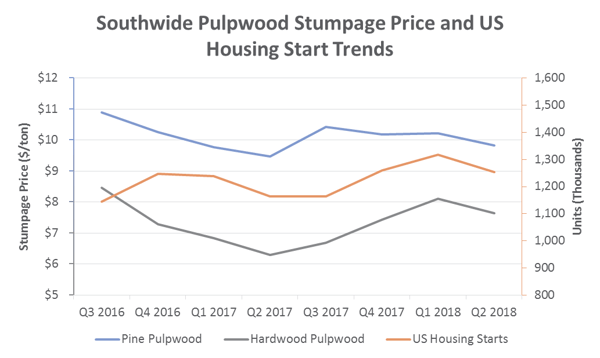

On a Southwide basis, pine pulpwood prices dropped to $9.84/ton during 2Q2018 (-3.7 percent), and all three regions saw prices decrease for this product. The West-South experienced the largest decrease to $6.65/ton (-14.8 percent), the Mid-South dropped to $8.23/ton (-10.8 percent), and the East-South dropped to $12.67/ton (-2.8 percent).

Southwide hardwood pulpwood prices also decreased, dropping 5.8 percent during 2Q to $7.64/ton. The West-South decreased to $11.24/ton (-0.2 percent), the Mid-South experienced the largest drop to $8.93/ton (-10.5 percent), but the East-South rose +24.8 percent to $4.71/ton.

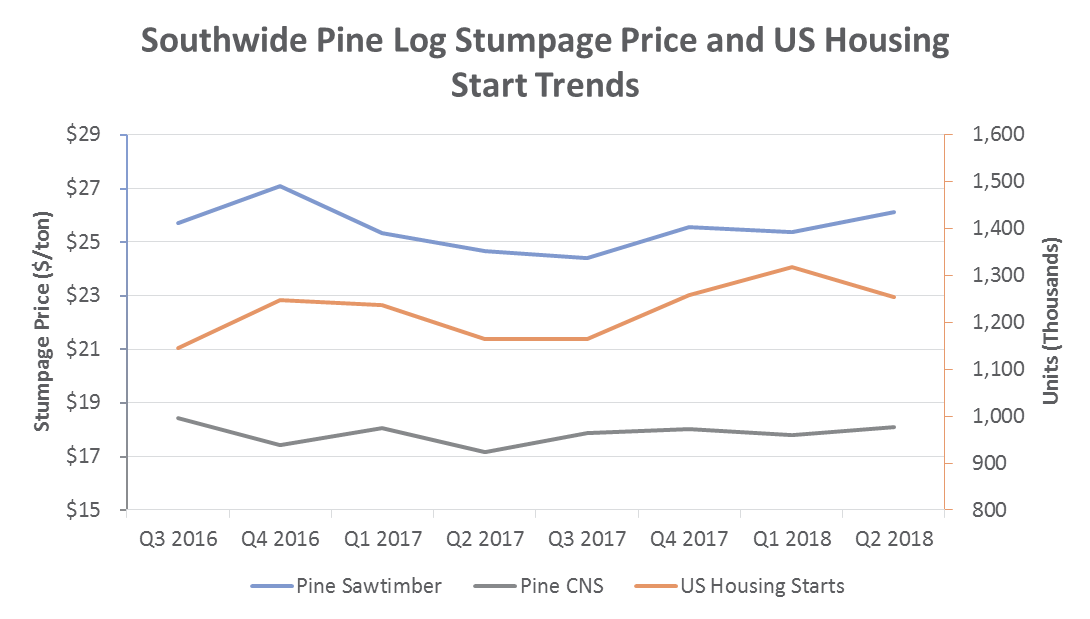

Pine Logs

Pine chip-n-saw prices increased slightly to $18.10/ton, a gain of 1.7 percent Southwide. The West-South and Mid-South regions experienced decreases, as prices dropped to $12.83/ton (-7.4 percent) and $17.15/ton (-2.7 percent) respectively. Prices in the East-South region increased to $20.86/ton, a +2.5 percent increase.

Pine sawtimber prices increased to $26.11/ton on a Southwide basis, a +3.0 percent jump. West-South pine sawtimber prices rose to $27.08/ton (+10.6 percent) and East-South prices were up slightly to $27.00/ton (+3.1 percent). However, prices in the Mid-South dropped to $24.94/ton (-1.4 percent).

Outlook

Real gross domestic product (GDP) increased at an annual rate of 4.2 percent in 2Q2018 according to the Bureau of Economic Analysis, beating its projected forecast of 4.1 percent. Fresh data from the Atlanta Federal Reserve’s GDPNow model estimates that real GDP growth (seasonally adjusted annual rate) in 3Q2018 will be 4.4 percent. Despite strong economic performance in 1H2018, the tax increase of tariffs on a widening pool of imports could exert greater drag on growth—especially after the mid-term elections. Post-hurricane Florence reconstruction, however, which may amount to $170+ billion, represents a minor upside risk to 4Q GDP. As such, demand for southern timber products will remain strong in the near term; we look for stumpage prices to continue to tick upwards through 3Q and into 4Q.