US South timber prices during the fourth quarter of 2017 were mixed. Hardwood pulpwood and pine log products increased more than +0.6 percent over the third quarter, but pine pulpwood prices dropped during the same time period.

Pulpwood

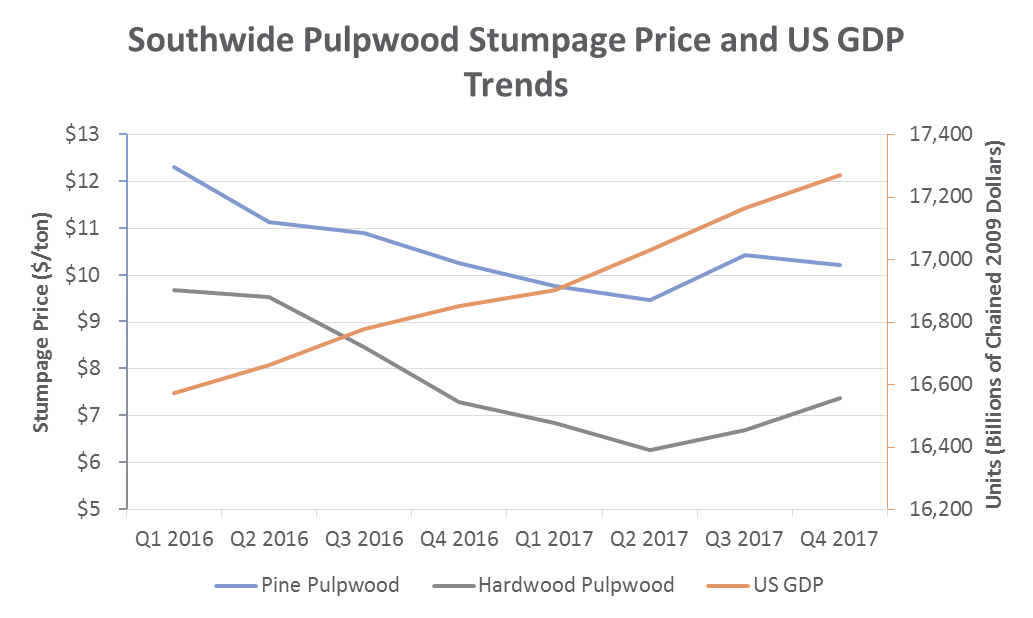

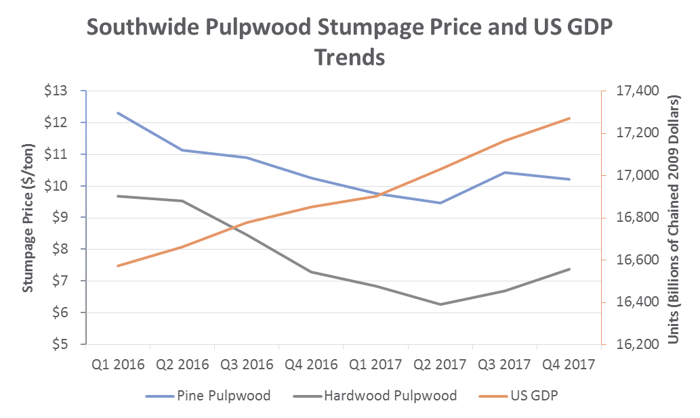

On a Southwide basis, pine pulpwood prices dropped to $10.21/ton during 4Q2017 (-2.1 percent), and two out of three US South regions saw price decreases for this product. The Mid-South experienced the largest decrease to $8.29/ton, or -10.8 percent. The East-South declined to $12.87/ton (-3.2 percent), and the West-South showed a rise in price to $8.39/ton (+5.1 percent).

Hardwood pulpwood prices increased on a Southwide basis, rising +9.2 percent during 4Q to $7.38/ton. The Mid-South region experienced the largest surge to $8.96/ton (+14.2 percent); the West-South dipped to $8.42/ton (-2.1 percent) and the East-South slipped drastically to $3.58/ton (-13.5 percent).

Pine Logs

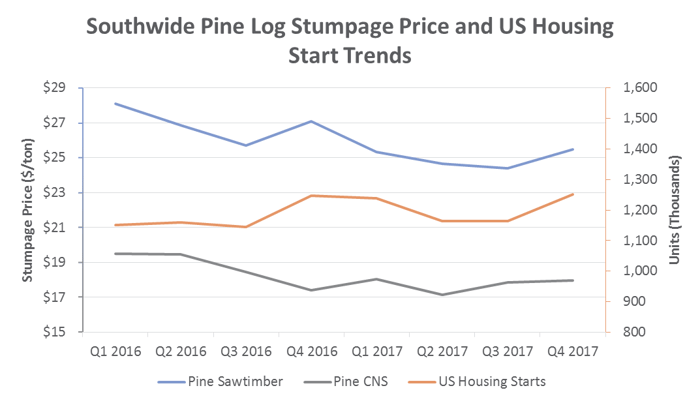

Pine chip-n-saw prices rose to $17.95/ton, an increase of +0.6 percent Southwide. The Mid-South region saw a decrease, as prices dropped to $16.39/ton (-2.5 percent). Prices in the East-South increased to $20.97/ton (+1.4 percent) and prices in the West-South region surged to $15.41/ton, a +15.5 percent increase.

Pine sawtimber reversed its downward trend from 3Q2017, climbing to a Southwide average of $25.49/ton (+4.3 percent). All regions saw an increase in price; Mid-South pine sawtimber prices rose to $23.93/ton (+4.0 percent), and East-South prices inched up to $25.84/ton (+1.6 percent). Prices in the West-South grew the most, surging to $28.67/ton (+11.7 percent).

Outlook

US Gross Domestic Product (GDP) continues to increase from quarter to quarter and is forecast to continue its steady rise through 2018. The Atlanta Federal Reserve recently projected that the US economy grew by 2.6 percent in 4Q2017. Continued growth at this pace could affect demand for pulp and sawtimber in the coming months as residential construction and remodeling remain strong.

Forest2Market is forecasting housing starts growth to 1.26 million units in 2018 (+4.0 percent relative to 2017) as Canadian forest products companies continue to expand operations in the US South to meet demand. However, there continues to be an oversupply of large logs available on the market and regional stumpage prices will reflect this. The wide regional price variance for pine sawtimber seen in 4Q2017—from a 1.6 percent increase to an 11.7 percent increase—will likely be the norm in the near term.