1 min read

WATCH: Timber Market Expert Analyzes Developments in Florida/Georgia Wood Basin

Joe Clark

:

June 11, 2020

Joe Clark

:

June 11, 2020

Just about a month ago, Klausner’s Lumber One sawmill permanently shuttered and the Live Oak, FL facility filed for Chapter 11 bankruptcy. This shuts the door on a long and bumpy road that was the Klausner mill in Live Oak.

But in a recent article, it was announced that the site would be auctioned off within 90 days as part of the bankruptcy proceedings. The article also states there is considerable amount of interest in the site and, whoever buys it at auction is expected to turn the mill around and have it up and running again before the end of 2020.

WATCH: Joe Clark Discusses Wood Fiber Availability in Florida/Georgia Market

There are a few things to watch in this wood basin as we consider the potential impact of any new demand:

- Demand for pulpwood is strong in this area and supply in the pulpwood category is tight – the growth-to-removal ratio for the Live Oak basin is hovering right around 1 currently, which means that the basin grows the same amount of wood fiber that is harvested each year. It’s also not uncommon to see pulpwood consuming facilities in this area reach up and buy CNS size tracts to fulfill fiber needs.

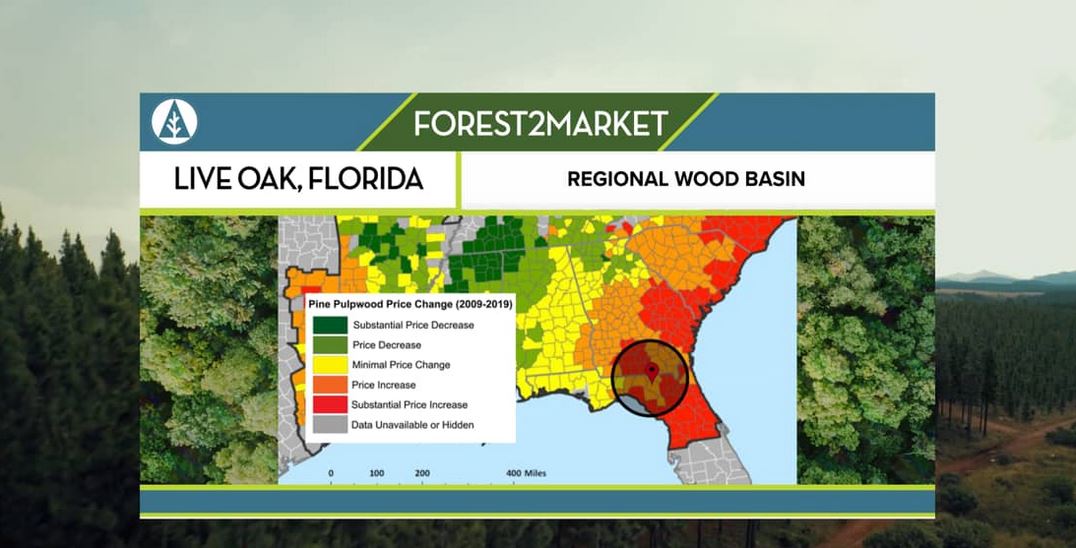

- This competition has raised the pricing floor in the basin. Since competition for fiber is very strong, this trickles up to the CNS and PST products as well. This has caused South GA/North FL area timber prices to appreciate faster than most areas throughout the South over the last decade.

In a wood basin that is already showing signs of tension, a sharp increase in log demand will undoubtedly have an Impact. The question, now, is how much?

To answer this question, you need to have a detailed understanding of the regional market and its resources, current market prices and the competitive landscape that currently exists, and what is coming down the line. For forward-looking consumers of wood fiber in the Georgia/Florida panhandle region, Forest2Market can answer these questions.