During periods of even mild fluctuations in diesel prices, the cash flows of both buyers and sellers can be affected. Wood supply agreements that include adjustments for diesel can incorrectly reflect the delivered price for biomass feedstock.

Because harvest and freight activities are fuel and labor intensive, one could reasonably assume that these costs are highly correlated to diesel and CPI. When we took a close look at how these supply chain cost components changed relative to changes in diesel and CPI, we expected to see consistent response to changes over time. Instead, we found that as diesel prices and inflation rose, haul distances and dealer commissions fell and total delivered price did not change proportionally to the change in cost of diesel and CPI.

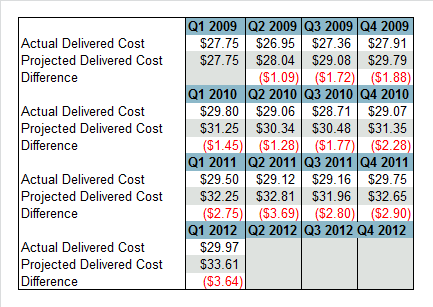

Starting with a Q1 2009 pine pulpwood stumpage price for a southeast coastal region, we calculated harvest and haul components using the percent change in diesel prices and CPI from the previous quarter. The Q2 2009 calculated price was $1.09 above actual market price, the Q3 2009 calculated price was $1.72 over actual market price, and by Q1 2012 the calculated price overshot the market by $3.64.

In fact, the calculated price stayed higher than the market price for the entire period (Q2 2009 – Q1 2012). The actual market price change over the period was $2.22: $29.97 (Q1 2012) compared to $27.75 (Q1 2009); $0.60 of the change is attributable to stumpage price variation. Therefore, removing the stumpage price change, the market price only increased by $1.62, not the calculated $3.64.

Instead of the consistent response to changes in diesel and CPI that one would expected to find, we found instead a flexible and smart supply chain. And in case you are thinking our control price was flawed, the explanation of our Wood Raw Material Benchmark Methodology explains why it was not.

In markets where diesel and inflation fluctuations are mild, using a 90-day rolling average price will reduce price volatility. This is favorable to both buyer and seller and helps to alleviate supplier cash flow concerns. However, neither quarterly nor 90-day rolling average price indexes will suffice in a long-term, hyper-inflationary or deflationary period or in a long lasting period of rising or falling diesel prices. To account for these periods, supply agreements should include specifics addressing what both parties’ rights are when the index can never “catch-up” to the economic trends.

Stan Parton

Stan Parton