3 min read

Why Record Log Exports from the Asian South are Under Pressure

Tim Woods

:

September 16, 2019

Tim Woods

:

September 16, 2019

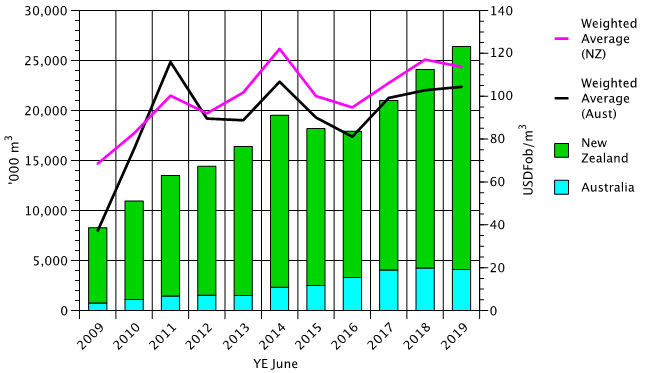

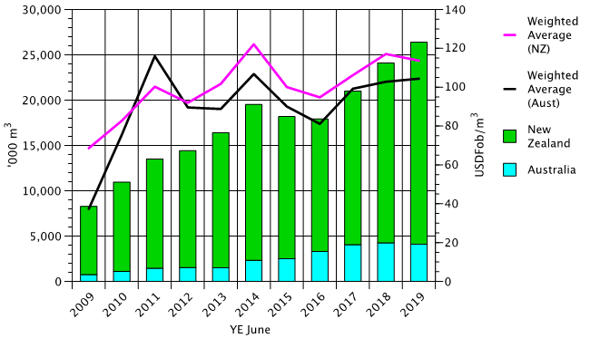

Combined exports of softwood logs from New Zealand and Australia totalled 26.4 million cubic meters (m3) in the 2018-19 financial year. Total exports from the two countries lifted 9.5% compared to the prior year, in line with the 10.5% per annum increases recorded over the decade since 2009.

When diving into the details, New Zealand’s softwood log exports dwarf those of Australia. At 22.3 million m3, New Zealand’s exports were 12.3% higher than the year before and accounted for 84% of total regional exports. Australia’s 4.1 million m3 of exports were down 3.5% on the prior year and accounted for just 16% of total exports.

NZ and Australian Softwood Log Exports: 2009 – 2019 (‘000 m3 & USDFOB/m3)

Source: ABS, Statistics NZ, RBA, RBNZ & IndustryEdge

Marking their third successive annual record, the combined increase in softwood log exports are considered by some to be impressive growth for the export sector. For others, they represent a worrying and long-standing trend of growing raw commodity export sales, as log volume available for local processing continues to shrink. For those committed to domestic value adding, increased exports are not all good news. Australia, in particular, has seen its log exports grow in conjunction with an increase in sawnwood imports.

As the chart below shows, log prices are, on average, following very similar trends when converted to US dollars. The marginally higher average prices for supply from New Zealand appear to reflect three factors.

- The New Zealand harvest is positioned more towards export rather than domestic utilization. It is the opposite case in Australia, with exports still (despite the strong growth over the last decade) representing an arising, rather than a preference.

- Australian exports include a significant quantity of logs for which there is no realistic and economic domestic use. Typically, this limitation is driven by the structure of the resource (log size) and/or location (too distant from market).

- Higher prices are achieved from New Zealand because the supply chain, port logistics and costs are lower than those in Australia. The delivered cost of softwood logs to the customer may be the same as in Australia, but the price returned for the log is higher.

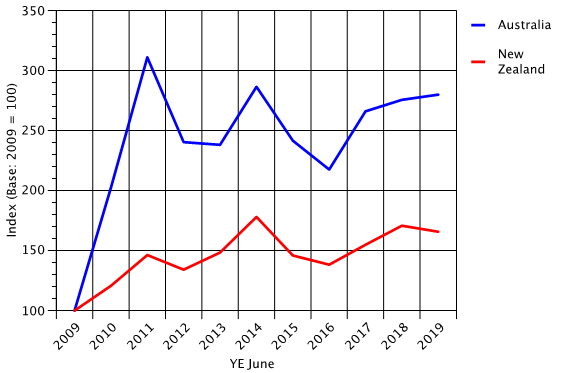

New Zealand & Australian Softwood Log Export Price Index: 2009 – 2019 Index (Base: 2009 = 100)

Source: ABS, Statistics NZ, RBA, RBNZ & IndustryEdge

For New Zealand, log exports are still a primary market; for Australia, they are a secondary market, but one that appears to have become quite attractive.

When considering the growth in Australian softwood log exports, it is important to examine the evolution in pricing over the last decade. The index chart below shows growth in softwood log export prices for both countries, since 2009.

In 2009, Australia’s actual average log export prices were half those of New Zealand. Even though New Zealand’s log prices increased 46% from 2009 to 2011, Australia’s prices caught up with the New Zealand price by more than tripling. Since then, the price growth has been largely consistent and generally, very strong.

Over the last decade, New Zealand’s softwood logs returned an average 65% more per cubic meter, while Australia’s returned close to 280% more per cubic meter by the end of the decade.

What happened to cause this surge in Australian export prices?

Until 2010, Australia’s softwood log exports were largely comprised of logs that were unable to be processed domestically. Some logs were too large for domestic sawmills, others were too small, and some constituted pulpwood.

Beginning in 2010, softwood plantations actively began right-sizing harvests resulting in more sawlogs being exported, as growers initiated the process of realigning their specific estates to ensure they delivered long-term needs. Average export prices moved up as the average value of the logs increased. For Australian timber growers, it was a win-win. They were able to improve profit margins, sending a strong signal to domestic markets about the actual value of their logs, while enhancing their timberlands for future demand.

Outlook

Market signals suggest that this process could be coming to an end, which is evidenced by Australia’s consistent log export growth beginning to taper in 2019. The trend is expected, however, as domestic demand for softwood lumber remains relatively high (despite a housing downturn) alongside record softwood lumber imports. Pressure to supply logs domestically is intense in some regions.

New Zealand’s situation is less clear at this point. On balance, it is likely that its export-driven harvests still have latent growth potential. However, the long-term outlook is not as rosy, as log processors are increasingly concerned that their future supply is being exported—not unlike the dynamic occurring in Australia.

To address inventory at the timberland level, both countries are pursuing policies and strategies to plant “one billion trees” (around 400,000 hectares in each country) to supplement long-term supply, which is a welcomed development.

Meanwhile, the primary Chinese market is showing signs of weakness and lumber demand is reportedly slowing as a result. If this development really takes shape in the coming months, it will put the brakes on softwood log exports from New Zealand and Australia over the second half of 2019 and into 2020.