3 min read

Will Russia’s Invasion of Ukraine Trigger More Renewable Hydrocarbon Investment?

Doris de Guzman

:

March 24, 2022

Doris de Guzman

:

March 24, 2022

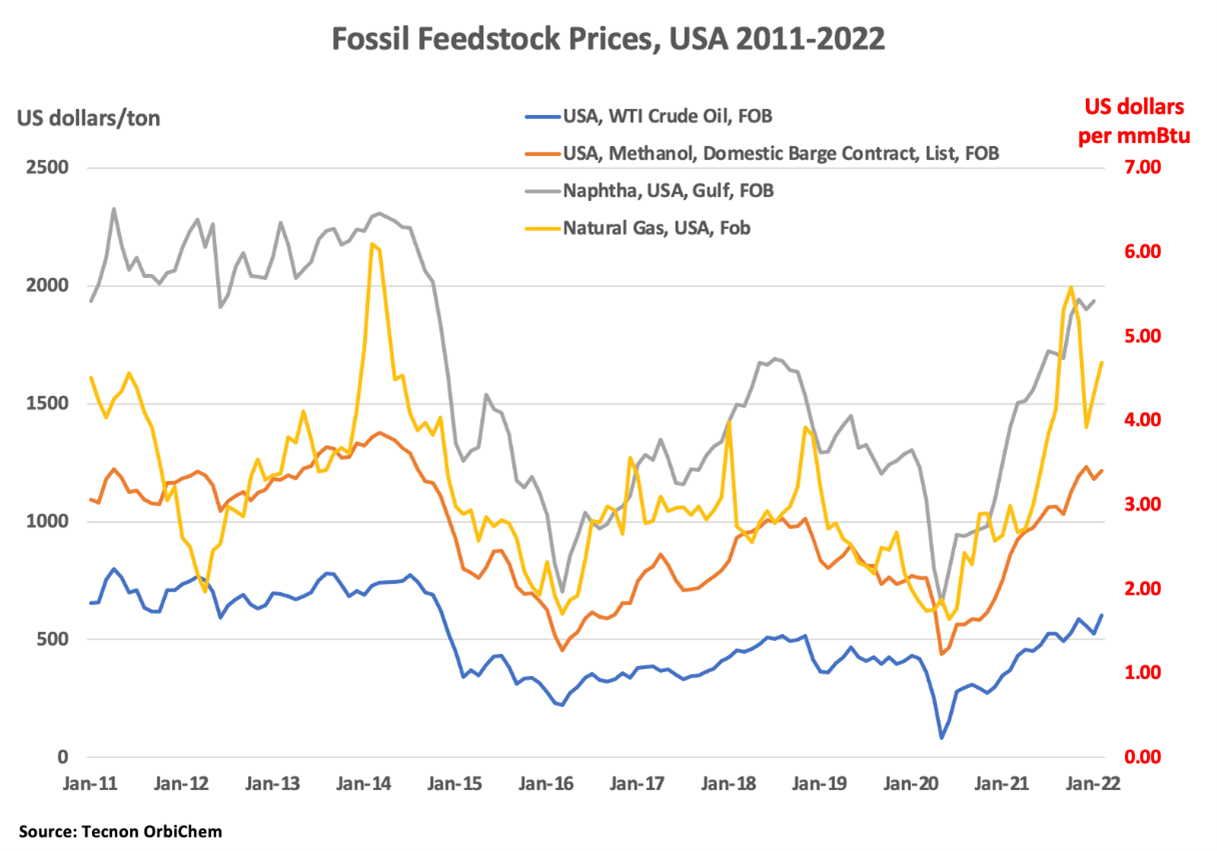

Russia’s invasion of Ukraine has accelerated the surging fossil feedstock price where WTI crude oil futures traded as high as $131 as of 7th March 2022, which is the highest front-month contract finish since the 2008 recession, while Brent crude reached a peak of $139.13/bbl, the highest settlement since April 2012. The recent price surges are mostly led by the recently announced US ban on Russian oil and gas imports as a response to Russia’s unprovoked invasion of Ukraine. The EU recently unveiled its plan to cut Russian gas imports by two-thirds within a year while the UK government also decided to phase out its import of Russian oil by the end of the year as well as reduce its imports of Russian gas. Retail gasoline prices in the US topped $4/gal on the 7th of March while US natural gas futures prices hit $5/mmBTU on 4 March.

According to the International Energy Agency (IEA), Russia plays an outsized role in global energy markets given that it is the world’s third-largest oil producer and the largest exporter. Its exports of about 5 million bbls/day of crude oil represent roughly 12% of global trade – and its approximately 2.85 million bbls/day of petroleum products represent around 15% of global refined product trade. Around 60% of Russia’s oil exports go to Europe and another 20% to China.

The IEA recently announced that the 31 Member Countries of the Governing Board of the International Energy Agency agreed to release 60 million bbls of oil from their emergency reserves, an equivalent of 4% of IEA’s stockpiles or 2 million bbls/day for 30 days, to send a unified and strong message to global oil markets that there will be no shortfall in supplies as a result of Russia’s invasion of Ukraine. Russia’s invasion comes against a backdrop of already tight global oil markets, heightened price volatility, commercial inventories that are at their lowest level since 2014, and a limited ability of producers to provide additional supply in the short term.

The Petrochemical Sector on Edge

Methanol market participants in West Europe had been watching developments in Ukraine with growing concerns as Russia has been a key supplier of imported methanol for a number of years. According to methanol market participants, several major methanol consumers in west Europe are refusing to accept any methanol supplies produced by Russian companies. Methanol spot prices jumped to €425-430/ton fob Rotterdam for March deliveries during the morning of 3 March, and spot deals for April delivery were reported at €450/ton fob Rotterdam during the afternoon of 3 March. Market participants said further increases are likely as the sanctions imposed against Russia have increased in pace and severity during the week. Russia accounts for around 20%-25% of the EU's total methanol imports on an annual basis and replacing that volume will be difficult as methanol is a highly contracted market globally.

Meanwhile, Russian naphtha supplies reportedly represent around half of the naphtha consumed in Europe and sanctions against Russia have already caused naphtha prices to further escalate. European chemical prices have already been settling at record highs in the first week of March as the war in Ukraine intensifies.

Bio-naphtha is primarily produced today as a by-product in the manufacture of hydrotreated vegetable oil (HVO) or also more popularly known as renewable diesel. It can also be produced as a by-product of sustainable aviation fuel manufacture or as a standalone product via gasification although commercial volumes for these pathways are said to be very low. HVO-derived naphtha volumes are roughly estimated at around 150 kt-250 kt by Nova Institute primarily supplied by producers such as Neste, UPM Biofuels, Eni, Preem and TotalEnergies. Several HVO projects around the world are expected to start-up over the next 2-3 years the volume of bio-naphtha coming out of these projects are still expected to be small and not sufficient enough to meet growing demand. Several European and Asian petrochemical companies are already using bio-naphtha as feedstock for their mass balanced-based renewable intermediates portfolio typically by blending bio-naphtha with fossil-based naphtha. Some industry sources estimate the price of bio-naphtha is 2x-3x the price of fossil-based naphtha although it could be possible that this gap could narrow this year with crude oil price already above the $100/bbl-level.