Wood fuel prices have declined over the last two quarters to an average of $21.32 per ton in 3Q2015. The primary factors that have contributed to this drop in price include:

-

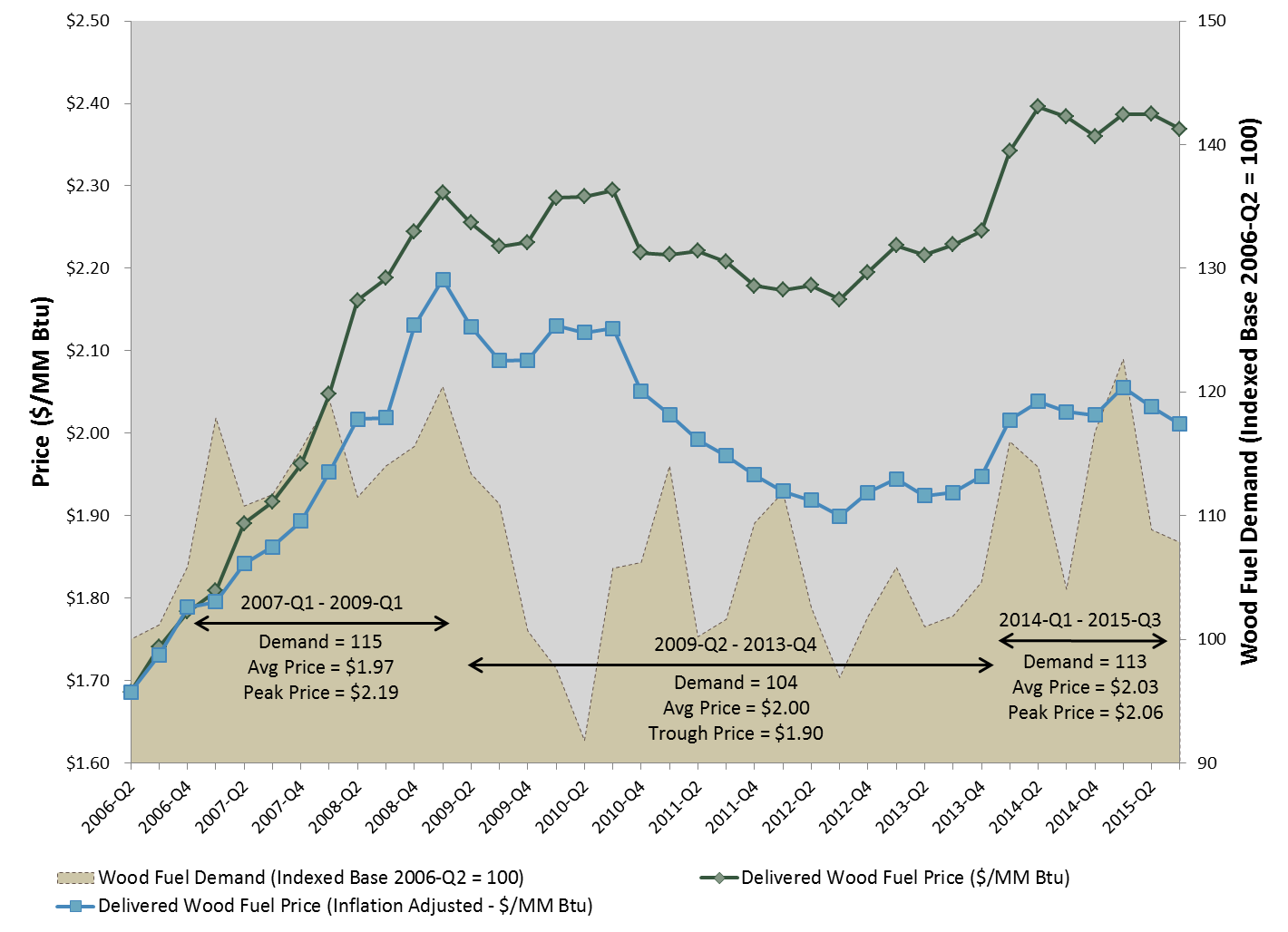

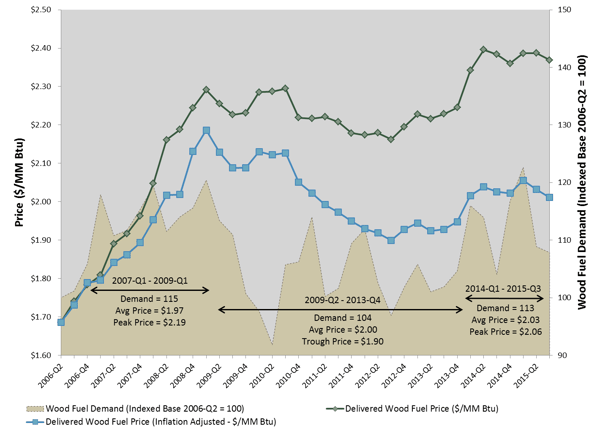

Demand for wood fuel has decreased as pulpwood purchases have increased, and as the price of natural gas has fallen.

-

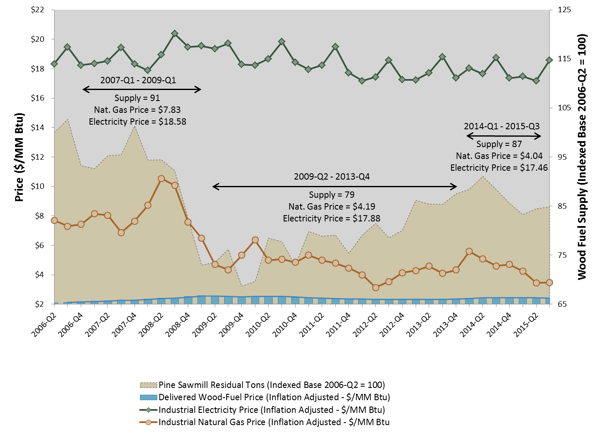

Supply of wood fuel has increased as lumber production and harvested biomass have also increased.

Demand

Compared to the first quarter, purchases of wood fuel dropped 11.2% in 2Q2015 and a subsequent 0.9% in the 3Q2015. Prices for substitute energy sources over the same time period experienced mixed results: natural gas fell 20.4% in 2Q2015 before slightly increasing 0.3% in the 3Q2015; industrial electricity decreased 1.7% in 2Q2015 before increasing 8.4% in 3Q2015. The combination and timing of these effects put downward pressure on wood fuel prices despite a substantial increase in electrical power rates this past quarter.

Supply

While lower pricing for substitute energy sources may have contributed to decreased demand for wood fuel, it is probable that the decrease in both demand and price was supply-side driven. Pulpwood purchases were up 1.6% in 2Q2015 and 7.5% in 3Q2015. As a result of debarking and chipping this pulpwood, internal supplies of boiler fuel increased. Simultaneously, as the supply of internal wood fuel increased, so did the supply of sawmill-produced residues, which increased 1.4% in 2Q2015 and 0.4% in 3Q2015.

Price Outlook: 4Q2015 and 1Q2016

Even though prices declined over the last two quarters, historic patterns demonstrate that prices are likely to rise in 4Q and into 2016. Since 2006, six out of the nine 4Qs (67% of the time) have experienced a price increase averaging $0.30 per ton. An increase in 1Q is even more likely, as seven out of the last nine 1Qs (78% of the time) have experienced an increase averaging $0.47 per ton. Our outlook suggests that 4Q2015 and 1Q2016 will be no different, which means that we should expect prices to increase as 2015 comes to an end.

Daniel Stuber

Daniel Stuber