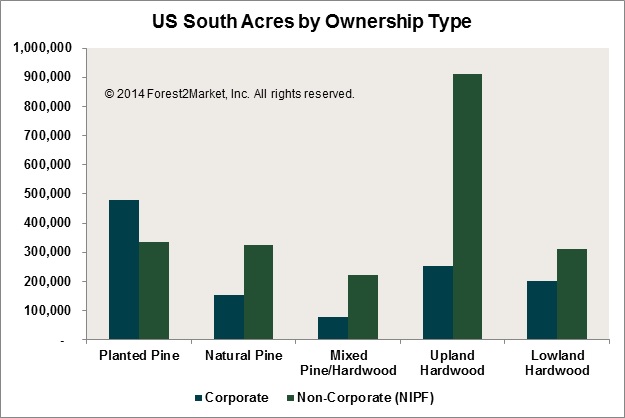

The fragmented nature of timberland ownership across the US South can make it difficult to identify wood suppliers. Non-industrial private forest (NIPF) landowners – whose primary business or means of income comes from a source other than timberland ownership – own a majority of the forestland in the Southern United States.

NIPF landowners own forestland for any number of reasons that range from recreation to conservation to a way to pass land down to their heirs. The varied ways NIPF landowners make use of their land is reflected in the range of acres – dominated by upland hardwoods – they own.

In contrast, corporate owners such as Timberland Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs) own more planted pine. The nature of their business – focused on clear return on investment objectives – necessitates the steady supply fast-growing pine offers. Unlike the small parcels owned by most private landowners, corporate owners also own a substantial volume of contiguous acres.

Data Source: USDA Forest Service, Forest Inventory and Analysis Program (2013).

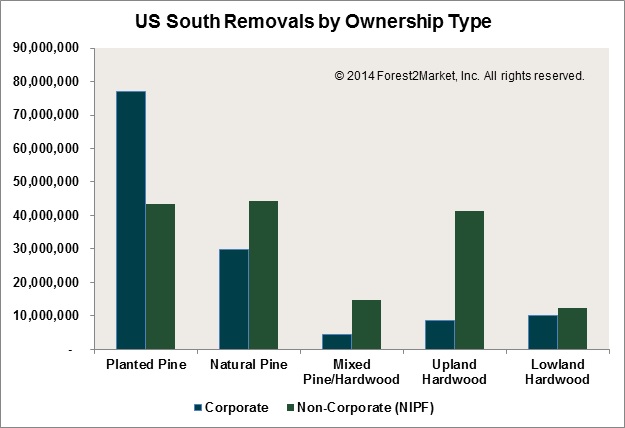

Nevertheless, non-contiguous parcels held by private landowners account for over half (55%) of timber sales in the US South. Given the majority of forestland in the South consists of these small parcels owned by private landowners, buyers can expect to work through wood dealers who source supply from multiple landowners.

Wood dealers organize fragmented forests owned by individuals and organizations with a wide range of objectives that affect harvest timing and type into a reliable supply chain. The dealer buys trees from the landowner, contracts with independent contractors to harvest and deliver the timber, and sells the harvested trees to the wood consuming facility.

Data Source: USDA Forest Service, Forest Inventory and Analysis Program (2013).

As with most things, the 80/20 rule also applies to wood dealers: 20 percent of dealers control 80 percent of supply. Buyers face the challenge of finding the right dealers (those in the 20 percent) who are known for good working relationships with both facilities and landowners.

Like wood dealers, some TIMOs and REITs act as direct suppliers of wood fiber. This eliminates the stumpage contract process and allows corporate owners to enter into contracts with wood consuming facilities and harvest and transportation contractors directly.

Whether a wood buyer works with a dealer or with a corporate owner, a key to developing strong trading relationships is the use of a price index free of survey-bias. When both parties trust the index, they can move on to address other matters such as quality and service at their respective businesses.