During the first few months of 2014, the southeastern United States experienced extreme winter weather and more than its fair share of rainfall. Devastating ice storms in certain areas early in the year brought about necessary salvage operations that, combined with elevated rainfall across the entire region, caused prices to be volatile on a south wide basis.

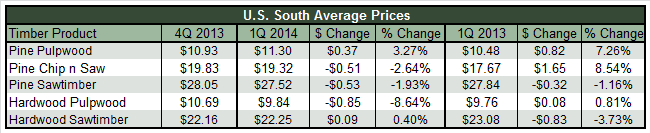

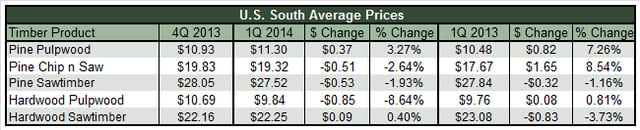

Across the South, pine pulpwood prices were pushed higher by the wet weather, with first quarter prices moving up 3.27% from $10.93/ton to $11.30/ton. Hardwood pulpwood dropped 8.64% to $9.84, and pine chip n saw fell by $0.51, or 2.6%, from $19.83/ton to $19.32/ton.

Over the last 12 months, prices of both pine pulpwood and chip n saw trended higher. Pine pulpwood increased 7.26% in price, while chip n saw has realized an 8.54% increase in price. Historically, if pine pulpwood prices swing higher, closing the gap between pulpwood prices and chip n saw prices, mills will substitute the larger diameter material for pulpwood. The increase in demand and price in the pulpwood market over the last year, mainly in the coastal plain, escalated pressure on the chip n saw market, causing prices to shift upward there as well.

First quarter pine sawtimber prices fell by just over 50 cents, dropping 1.9% from $28.05/ton to $27.52/ton, and hardwood sawtimber was virtually unchanged at $22.25/ton at the end of first quarter. Poor housing start numbers, mainly attributed to the weather in January and February being unfavorable for construction, has likely kept sawtimber prices suppressed.

In the East region quarter over quarter, pine pulpwood increased by 3% to $14.20/ton, while hardwood pulpwood decreased 4.2%, down to just under $10/ton. Both pine and hardwood sawtimber prices appreciated. Pine sawtimber increased from $25.54/ton to $26.26/ton, while hardwood sawtimber showed an increase of 5.7%, from $21.38/ton to $22.59/ton.

Pine pulpwood showed the largest increase in the Mid region. Pine pulpwood prices increased by 11.3% from $10.12/ton to $11.26/ton. This, however, was the only product that realized an increased during the first quarter in the Mid region. Pine chip n saw, pine sawtimber, hardwood pulpwood, and sawtimber all fell. Hardwood pulpwood saw the largest drop, down nearly 15% ($1.62) to $9.48/ton.

There was little change in the West region. Pine sawtimber rose slightly from $29.02/ton to $30.26/ton. Hardwood pulpwood and sawtimber both remained steady at $11.16/ton and $23.78/ton, respectively. Pine pulpwood dropped considerably, 8.75%, to just under $9.00/ton.

Joe Clark

Joe Clark