4 min read

Inflation, Recession Fears Slow US Housing and Manufacturing

ResourceWise : June 23, 2023

As inflation continues to dog the economy, industries surrounding the forestry market are feeling the pinch. Further speculation about more rate hikes and a recession has kept industry activity mostly muted.

Current State of Inflation Could Mean More Rate Hikes

At the end of its May 3-4 meeting, the Federal Open Market Committee (FOMC) boosted the federal funds rate (FFR) to a range between 0.75 and 1.0%. This was up another 0.5% from the range set in March. We could likely see more increases at this 0.5% increment this year.

In comments made since the meeting, Fed Governor Christopher Waller warned rate hikes could continue indefinitely:

“If inflation doesn’t go away, that... rate is going a lot higher, and soon. We are not going to sit there and wait six months… I am advocating [0.5% hikes] on the table every meeting until we see substantial reductions in inflation. Until we get that, I don’t see the point of stopping.”

Waller needs to be careful what he wishes for. As analyst Joe Carson pointed out, “It is not surprising to hear Fed policymakers say, ‘it will be challenging, not easy’ to bring inflation back to 2% from 8% without triggering a recession. That’s because it’s never been done.”

We will continue to monitor inflation and what it means for rate increases and recession risks. Right now, whether a recession is imminent depends on who you ask.

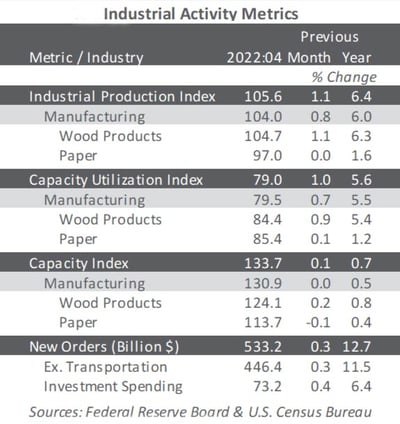

US Forestry and Wood Products Stagnant in Manufacturing

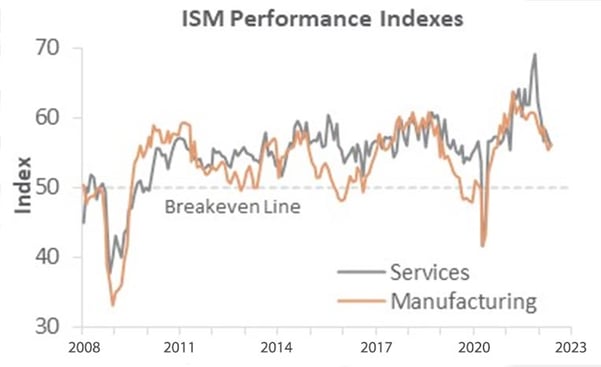

The Institute for Supply Management’s (ISM) monthly sentiment survey for May 2023 showed a slightly larger proportion of US manufacturers reporting expansion.

The PMI registered 56.1%, an increase of 0.7PP. 50% is the breakpoint between contraction and expansion.

Of the industries we track, Wood Products and Ag & Forestry did not expand. One respondent noted the following about how the paper market is currently operating:

"We’ve continued to transition to North American sales to avoid ocean vessels, and we are apprehensive about the West Coast ports’ labor contract negotiations. A challenge of doing more business by rail is the backlog of rail cars and embargos."

The transition to North American sales in this case likely reflects a chaotic European lumber market. Much of the disruption stems from the continued effects of Russia’s invasion of Ukraine.

IHS Markit’s survey headline results were mixed relative to their ISM counterparts. ISM’s manufacturing rose while Markit’s fell.

The biggest divergence in the two sets of reports seemed to be input prices. ISM indicated slowing price increases while Markit reported “soaring” prices.

“A solid expansion of manufacturing output in May should help drive an increase in GDP during 2Q, with production growth running well above the average seen over the past decade,” wrote Markit’s Chris Williamson. “However, the rate of growth has slowed as producers report ongoing issues with supply chain delays and labor shortages, as well as slower demand growth."

Besides supply chain issues, high prices also played a part in the slowdown of new orders.

Many customers pushed back on the prices considering a less-than-ideal future outlook. Fears of recession still weigh heavily across manufacturing.

Forest Products Price Indices Show Major Drop in Softwood

In the forest products sector, the price index for pulp, paper and allied products rose 1.3% to +17.4% year-over-year (YoY). Wood fiber saw a very modest +0.1% jump which was a +4.9% increase year-over-year.

Lumber and wood products saw an overall drop of -3.8%. The decrease still reflects a +9.6% increase from 2022.

The major point of note this month is softwood lumber prices. Softwood lumber dropped -17.7% with a -5.5% YoY reduction.

The tumble was not unexpected as the prior section reported. With hesitation about new orders, supplying feedstocks like softwood will see drops.

Even with a big decrease like this, we’re not seeing price fluctuations as severe as in 2022 and 2021.

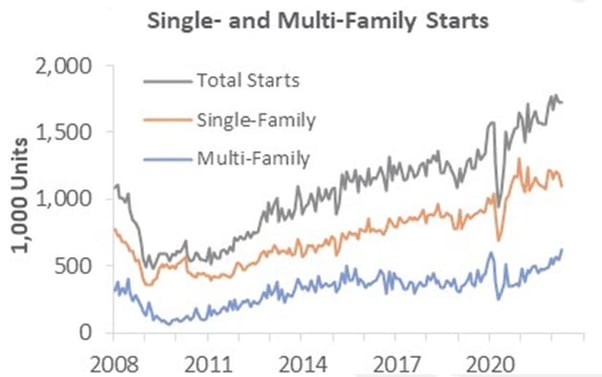

Housing Market Update a Mixed Bag

We experienced a modest rise in housing starts and permits in March. But many analysts were expecting that to change somewhat in April.

According to the NAHB’s homebuilder sentiment, we do indeed see retraction for a fourth month. Starts and permits dropped, but the overall picture was not all bad news.

Starts dipped just -0.2% month-over-month (MoM). This amount was a much better figure than the -2.1% projected fall.

As the below chart shows, single-family starts appear to have stalled. Multi-family starts are maintaining or even gaining momentum in some cases.

Single-family starts retreated in April to the lowest reading since September 2021. Multi-family starts jumped to their highest since January 2020.

Meanwhile, residential construction spending rose +0.9%, a +18.5% YoY increase. This included home improvement spending with a +1.5% MoM lift and an optimistic +22.6% YoY change.

Sales were “in the red” during April thanks to both rising mortgage rates and record-breaking home prices:

- New Homes: Median price of $450,600 (up $15,600 or +3.6% MoM) with an average of $570,300 (up $47,800 or +9.1% MoM). 15% of new homes sold in April were priced at or above $750,000—more than double the year-earlier proportion.

- Existing Homes: $391,200 (up $16,400 or +4.4% MoM).

On the future-facing side of housing, permits dipped by -3.2% MoM after only minimal revisions to March’s data. This marked -3.0% below what was predicted.

A -4.6% MoM drop in the single-family component dominated the slide in permits. The current drop marks the lowest point since October 2021. The multi-family segment was slightly more positive with permits down just -1.0% MoM.

Could these numbers mean the bubble is finally going to pop into housing? The permits, starts, and sales statistics suggest the first bit of air is seeping out of the housing bubble.

With further increases in mortgage rates, prospective buyers will find it harder to afford a purchase. What goes up must come down, so home prices could potentially retreat to keep sales moving.

A modest amount of price relief may come from the record 1.641 million (SA) housing units under construction. But work on these units is moving slowly. Supply chain issues are the likely reason for such a large volume of unfinished units.

Nearly half (815,000) of these units are single-family. This marks the highest level since November 2006.

Completing these units should help with rent pressure. Rent rates have risen faster than income across the US. Any relief at this point would be good news.

Declining lumber prices should offer some additional relief as well. Lumber futures are down to the lows we saw in November 2022. This comes in major contrast to the record price spikes we saw earlier in the year.

Lumber futures have also continued plummeting since late February. The 46% slump this year is nearly two-thirds below last year’s peak of $1,733 per thousand board feet (MBF).

Get Key Economic Data Your Business Needs

ResourceWise provides vital industry insights and economic data relevant to the forestry industry with our online platform SilvaStat360.

SilvaStat360 is an all-in-one source for the datasets and analytical tools that are most important to your success in the forest supply chain. You can access pricing, macroeconomic, forest inventory, precipitation data, and much more.

The data can be customized to report and display what is most important to your business. You can save search filters, download the datasets and customized images, and print charts as you need them.

See why SilvaStat360 has remained a trusted source of information to professionals across the forestry industry. Schedule a demo today and see just how much it can help your business.