3 min read

Global Wood Markets Shift as China Lifts Timber Ban on Australia

Håkan Ekström

:

June 21, 2023

Håkan Ekström

:

June 21, 2023

Global wood markets will see another changeup in the coming months. Australian exporters can again ship logs to China following a 2.5-year ban. But exports are not expected to reach historic levels seen a few years ago.

At the end of 2020, China banned the importation of plantation pine logs from Australia. This was not due to political strife or economic issues. It was actually about beetles.

Bark Beetles Devastate Global Wood Markets

China’s ban on Australian timber was implemented because bark beetles had infected the logs the country exported. The pesky little bugs have become a scourge in global wood markets for imports and exports.

Bark beetles damage timber in multiple ways. Their infestation can quickly destroy entire stands of forests if left unmanaged. The best way to respond to the beetles is by preventing their spread in the first place.

The pests occur throughout many growing regions with over 600 species in North America alone. Increased global trade of wood products has led to greater spread of the beetles.

The problem endures in many regions across Europe. For example, Latvia declared a state of emergency due to infestation. One species of bark beetle destroyed over 5,600 acres of spruce forest in 2022 alone.

Many countries, like China, will refuse imports from regions that suffer from infestation.

Australia Faces a Long Way Back in Timber Recovery

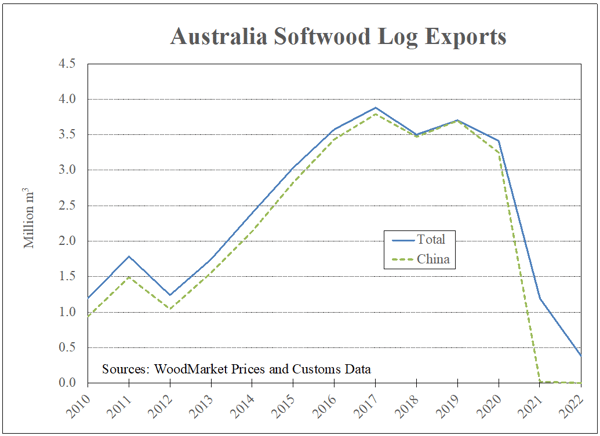

China’s decision to ban Australian logs resulted in a collapse of Australian exports. China was practically the only log market being served by the country. As a result, total annual shipments from Australia fell a shocking 89% in 2022 compared to 2016-2020.

When the ban was implemented, Australian log traders started exploring other spaces in Asia and nearby markets. In 2021, they began shipping to previously insignificant markets.

As reported on WoodMarket Prices, these included the following countries:

- India

- South Korea

- Vietnam

However, the jump in shipments to those markets was short-lived. A sharp drop occurred in 2022. This occurred partly because of increased competition from US log exporters.

The decline continued in the early part of this year with a 76% decrease in shipped logs between 2022 and 2023. Without China’s demand, Australia had a serious amount of trouble staying competitive in global wood markets.

Australia can likely resume trade with China now that the ban has been lifted. But shipments will probably not reach levels seen in the past.

Global Competition Changes Australian Log Standards

Previously, a large share of the pine logs Australia shipped to China was of lower quality. The rating was somewhat close to "pulplog" material-type wood.

This standard was less desirable for Australian sawmills. However, the domestic industry in Australia will increasingly compete with the export market for small-diameter logs. The change comes as log supply tightens across the country.

Pine plantations have only seen limited growth over the past 30 years (0.3% annually). Using this trend, it’s safe to assume that domestic timber supply is unlikely to increase in the coming decades.

In addition, many large pine plantations were destroyed by fires in 2019 and 2020. The total losses were roughly 6% of the plantation area.

The damages will limit log availability even more for domestic sawmills in the next few years. This will likely create a surge in lumber demand.

How Australia Can Meet an Upswing in Demand

As lumber demand goes up, Australia will have to respond to meet it. They can achieve this in three ways:

-

Upgraded sawmills that can utilize smaller logs and increase their lumber yields.

As sawmills invest in upgrades, they will better handle the wood needed to meet demand. Over time, this will improve the country’s ability to keep up.

-

Increased lumber imports.

If the country can’t keep up with demand, they will have to look into imports. Don’t be surprised if Australia begins to up its lumber imports.

-

Decreased log exports.

The China ban will yield long-term impacts on Australian lumber. Now that the country’s demand is going up, the need to export will decrease.

Global Softwood Lumber Will Likely See Rise in Import Prices

Softwood lumber has seen several drops in demand due to economic factors like US mortgage interest rates. But many global prices have remained mostly steady. For instance, SYP lumber prices in the US South have not fluctuated too much this year compared to 2021 and 2022.

The outlook of softwood lumber prices looks to increase worldwide. This could make imports from European sources increase in price soon.

This scenario could expand shipments of logs and lumber from New Zealand to Australia in the coming decade. But this would require higher timber qualities than for logs shipped to China.

The goal, then, is to have sufficient domestic softwood timber supply in the long term. The conifer plantation area in Australia must increase to achieve this, though.

Global Wood Market Insights You Can Trust

Wood Resources International, a ResourceWise company, reports on all vital news and developments impacting the global wood markets. Our online platform, WoodMarket Prices (WMP), brings together all insights and data in one place.

WMP’s unique indices provide pricing data and market analytics for countries and regions around the world. This includes major global wood markets in North and South America, Europe and Asia/Oceania.

With price data and trends, global trade flows, and industry developments, WMP provides a powerful tool for your business. You can streamline your strategies and make more informed decisions that matter to you.

Learn more about how our platform can benefit your business.