3 min read

A 1% Cost Savings Can Save Your Bottom-Line Hundreds of Thousands

Forest2Market

:

December 1, 2022

At the beginning of the year, ResourceWise’s VP of Global Sales Matt Elhardt shared his predictions for the forest products industry in 2022. One of those predictions was for increased investment in Industry 4.0-related technology – and as we enter another year filled with the promise of continued inflation and other economic uncertainties, this prediction is expected to remain true for 2023 as well.

While most people understand that inflation means rising prices, they tend to stop there and assume they need to cut costs immediately. However, BDO explains in its 2021 Industry 4.0 Survey that those who adopted Industry 4.0 strategies prior to the pandemic were better equipped to mitigate the disruptions and were positioned for growth compared to those less digitally advanced. Meaning, investing in Industry 4.0 technology when entering a period of uncertainty is more likely to bode well for a company’s success, than it is to be an unnecessary cost.

Industry 4.0 refers to the fourth industrial revolution and, generally speaking, describes the growing trend towards automation and data exchange in technology and processes within manufacturing. Industry 4.0 technology is built upon nine pillars – Big Data being one of them.

What Is Big Data?

According to a study in conjunction with the MIT Center for Digital Business, companies that inject Big Data and analytics into their operations can outperform their peers by 5% in productivity and 6% in profitability. According to the National Institute of Standards and Technology, Big Data is defined as consisting of “extensive datasets – primarily in the characteristics of volume, velocity, and /or variability – that require a scalable architecture for efficient storage, manipulation and analysis.” Companies can benefit from Big Data because it provides insights that can be leveraged to help improve operations, decision-making and other actions that can ultimately increase profits in nearly every area of supply chain management.

Within the global forest products sector, the smallest changes along the supply chain can have cascading impacts. As participants in the forestry value chain plan for ongoing uncertainty, access to reliable insights at the local, national and global levels is imperative for confident planning and budgeting.

Purposeful, data-driven decision-making imbues innovative businesses with an inherent competitive advantage. Business owners and managers who take advantage of Big Data and business intelligence resources can both aggregate massive amounts of data and refine it to address specific goals.

The Importance of Big Data in the Global Forestry Sector

When forest products manufacturers evaluate their raw material supply chains, a broad focus on overall costs leaves too much to chance. On an annual basis, the average North American sawmill consumes roughly 600,000 tons of sawtimber, and the average pulp mill consumes more than 1.5 million tons. When purchasing raw material on this scale, pennies matter.

Forest2Market’s deep databases of actual transaction data equip customers with the most accurate and precise raw material pricing data available – down to the penny. Using our benchmarks and reports, our customers can pinpoint inefficiencies in their supply chains, implement strategies to eliminate them and track improvements over time.

But – this is only achievable thanks to the uniqueness of our data.

We possess an exclusive, current and proprietary database of delivered wood raw material transactions and the extensive data collection infrastructure necessary to collect millions of market transactions every year.

Our Delivered Price Benchmark is:

- Transaction-based for maximum market accuracy and precision

- Effective for identifying absolute and relative cost positions

- An excellent tool for supply chain management

- A superior resource for strategic planning

Unlike Forest2Market’s data, survey-based data is neither accurate nor precise, not applicable for identifying cost position, and not useful for strategic planning or decision making.

Use-Case Examples

To make better sense of this, let’s look at a hypothetical use-case.

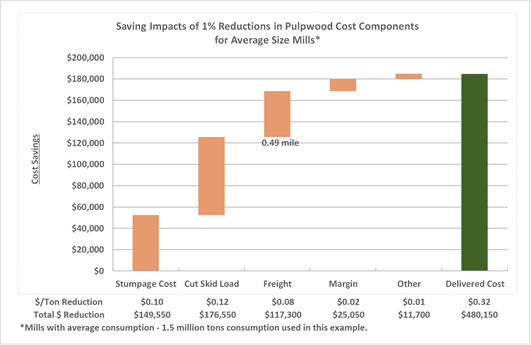

Significant savings can be uncovered in stumpage, cut-skid load and freight for pulp mills, as each makes up nearly 1/3 of the total delivered cost. A 1% savings on the average freight cost ($0.08/ton) equates to $117,300 in annual savings. As a freight rate ($/ton/mile), this suggests that by reducing the average haul distance by ½ mile, these savings can be realized.

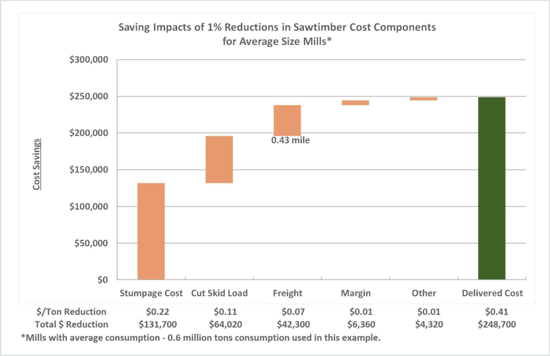

For our second example, let’s look at cost savings for a sawmill. By breaking down the total delivered cost for our hypothetical sawmill, we can see that stumpage is clearly the largest cost component (nearly half) and should likely receive the most attention when identifying improvements and cost savings opportunities. A 1% reduction in the average stumpage cost ($0.22/ton) for the average-sized sawmill results in $131,700 of savings.

Sustainable profits come from the value gained through constant refinement of utilized assets. In commodity businesses like the forest products sector, that effectiveness is driven by a wide range of decisions which, when made marginally better, result in higher prices, higher operating rates, lower costs, and lower volatility than in less well-run firms.

While capital investment is the cost of entry, profitability comes from superior decision-making. Industry 4.0 is the next step in uncovering the insights necessary to drive tactical, meaningful, and profitable business decisions.