3 min read

Accurate Stumpage Prices Are Crucial for Reliable Timber Valuations

Tom Hittle : December 4, 2017

This post was written by guest blogger Tom Hittle, who is Senior Vice President at Steigerwaldt Land Services, Inc. Steigerwaldt provides forest and real estate services to all types of land owners and business clients, including federal, state, county, and tribal governmental and natural resource agencies, land conservation groups, the pulp and paper industry, utility companies, and private landowners in the Midwest and beyond.

Information pertaining to current stumpage markets and prices is a key piece of knowledge for most of us working in the timber supply chain. At Steigerwaldt Land Services (Steigerwaldt), we are constantly seeking stumpage data and using stumpage price information to assess market trends, sell stumpage and appraise timber and timberlands. Stumpage price information in Wisconsin is readily available from public agencies for timber sold on state and county forests.

Wisconsin has about 3 million acres of county and state managed forestland that, on average, sells roughly 2.2 million tons of stumpage annually. Despite this large acreage of actively-managed public lands, private lands still account for about two-thirds of the total fiber harvested. Because of the availability of public stumpage data—and the difficulties inherent in compiling private stumpage—the “stumpage market” has a tendency to be defined by timber sold by the public agencies.

However, there are important questions to be asked: Is it reliable to assume that this public data accurately portrays the broader market? Can public stumpage price data be applied to private timber?

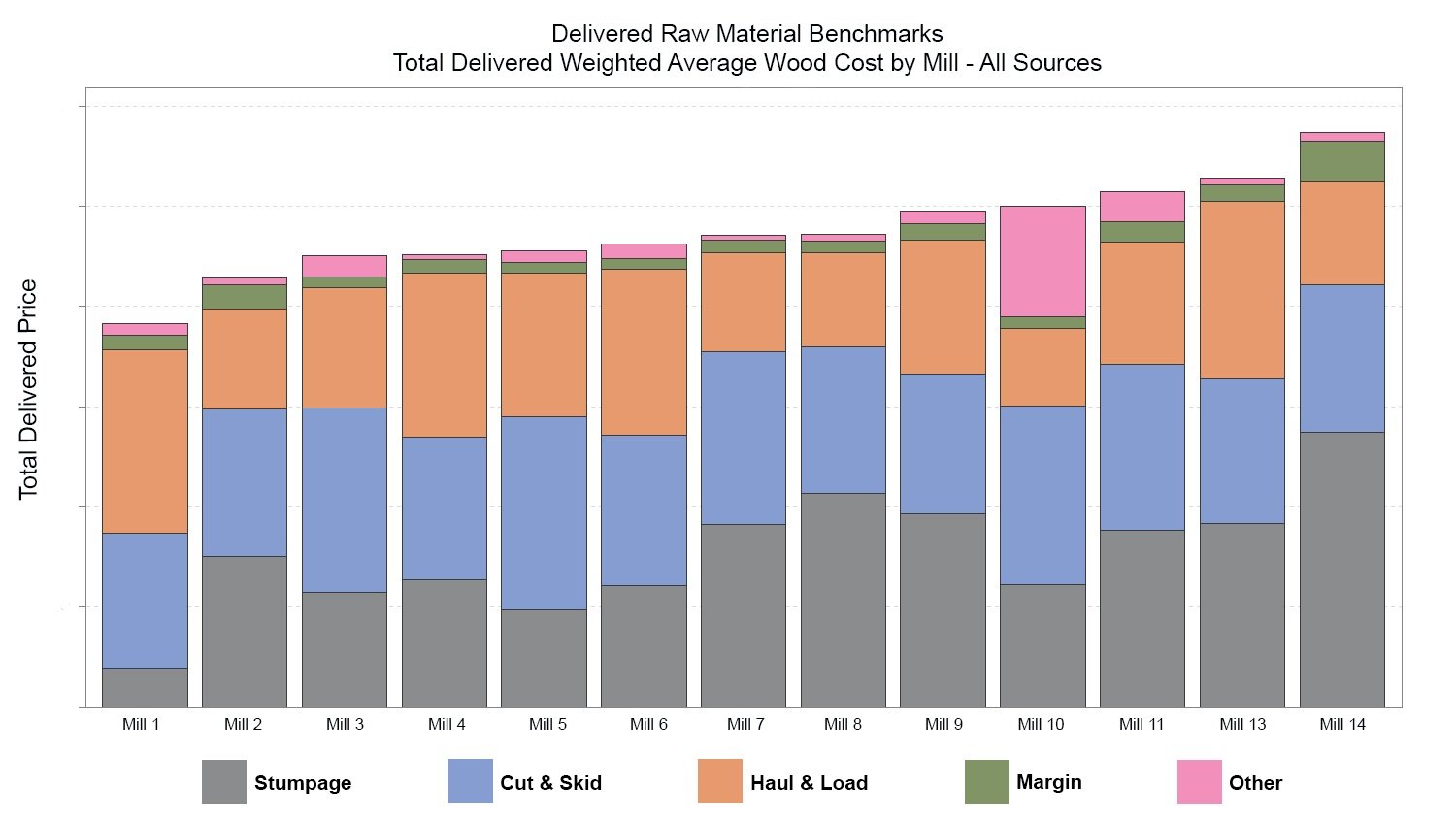

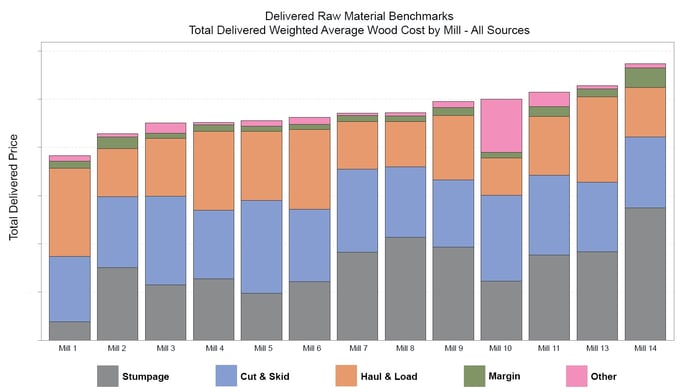

Steigerwaldt and Forest2Market recently partnered on a project that was completed for the Wisconsin Forest Practices Study that looked specifically at the various costs of the fiber supply chain (including stumpage) in Wisconsin.

With the total delivered cost figure known in the sample above, it is evident that all of the individual costs need to sum to the whole, and thus the stumpage component should be accurately reflected. A casual initial observation of this data in this recent effort seemed to show that the stumpage component appeared to indicate a price less than what typical stumpage market prices were thought to be. Looking more in depth at compiled state and county average stumpage prices for aspen and mixed hardwood cordwood, as well as Forest2Market data since 2013, confirmed the initial observation—but only in part.

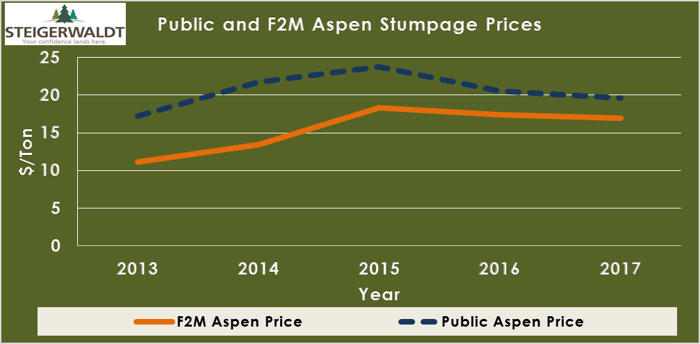

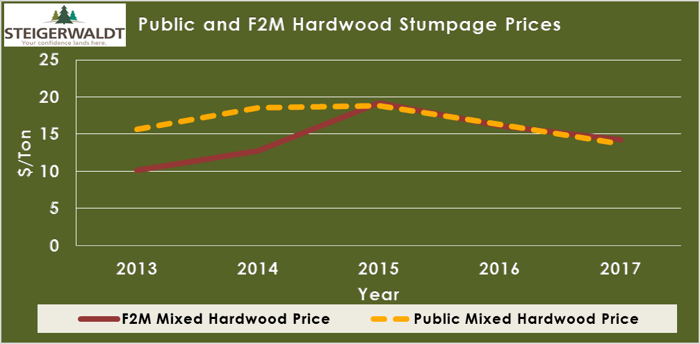

As shown in the charts below, public aspen stumpage has consistently been above Forest2Market’s price, which represents the broader market of multi-source delivered loads. This was the case for hardwood too, but only until markets turned downward in about 2015. In fact, since that time, the average price from the public data and Forest2Market’s data is nearly identical.

If at least some of the aspen price difference can be attributed to ownership type, lower stumpage value on private lands shouldn’t be a surprise. When compared to public sales, private timber sales may be smaller in size and include production costs not typical to sales on public lands. Private stumpage is also often sold without the benefit of a professional forester or consultant working on the landowner’s behalf. As noted in the article “The Value of a Consultant” published by Greg Conner, ACF, and Joe Clark of Forest2Market, evidence supports increased stumpage prices of at least 11 percent resulting from a consultant’s involvement.

Diving deeper into issues oftentimes raises additional questions, and that is certainly the case here. For example (and for further contemplation), are there different market elements at play impacting stumpage on public or private lands in increasing versus decreasing price periods? Are these elements unique and related to the species of wood?

It is well known that stumpage prices paid for an individual timber sale are dependent on a number of factors: sale volume, wood quality, access and overall operability including seasonality constraints, to name a few. It also seems, more so recently, that stumpage is also impacted by the short-term ups and downs in mill demand. Applying average market prices to individual ownership categories or specific timber types is even more risky when there is a sawlog component and when that component value is heavily influenced by grade.

At Steigerwaldt, our approach is to address sawlog valuation in a similar fashion to how individual real estate comparable sales are investigated and adjusted to yield the market value of the subject property. It takes more effort to find and investigate individual log sales, but when the dollar amount at stake is high, the need for an accurate assessment becomes critical.

While a more structured and detailed study would better answer the question of how applicable public stumpage prices are for private lands, a safe conclusion can be reached: Applying stumpage data to a specific ownership type or timber tract has its inherent risks. In fact, such an application may be more misleading than on point. However, having accurate data to start the valuation process is essential, and possessing the knowledge of how to properly apply the data is crucial for maximizing value.