1 min read

As Lumber Prices Plummet, Manufacturers are Asking 2 Important Questions

Forest2Market

:

June 13, 2022

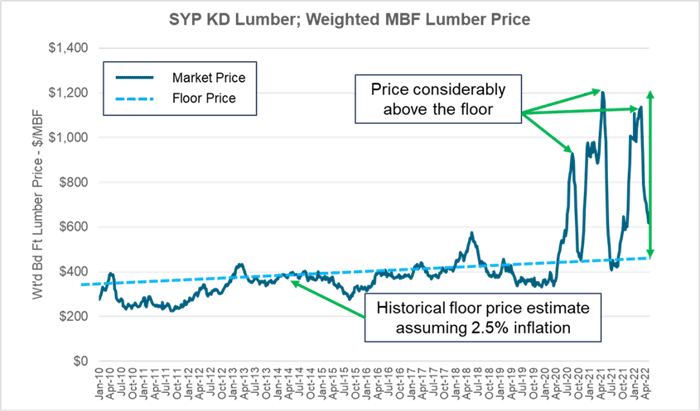

The North American softwood lumber market remains highly volatile, and the sawmill industry is being forced to react and evolve quickly. Finished lumber prices have demonstrated tremendous fluctuations during the last 12 months, moving from over $1,000/MBF to under $600/MBF — a decrease of nearly 60% — not once, but twice.

During the peaks, Southern sawmills have enjoyed strong demand and increased profits for their end products despite the market turbulence. As volatility continues to be the norm, executives are focused on determining what the business landscape will look in both the near and long terms to help inform better decision-making today.

Executives across the solid-wood sector are now looking for the most efficient ways to deploy capital within their businesses. Most are reinvesting back into existing assets, looking to acquire other mills, or building new greenfield facilities. While a high degree of uncertainty will continue to be pervasive in a business climate still dominated by inflation, stressed supply chains and shifting geopolitical dynamics, there are two recurring questions/concerns we continue to hear:

- Is the market becoming overproduced?

- What happens when demand falls off for a more prolonged period of time?

With more technology-driven, low-cost production coming online, a glut of lumber (or shrinking demand) will drive high-cost producers out of the market. This will ultimately lower the floor price for lumber – which is where it will inevitably return.

In the next downturn, what existing production will be pushed from “competitive” to “marginal” due to flattening of the cost curve?

When high-cost production is forced out of the Southern lumber market, this will flatten the cost curve across the entire region. Mills that were relatively competitive just a few quarters ago could potentially become marginal producers (mid-4th quartile).

Forest2Market has developed a fundamental cost model that can help Southern lumber producers understand which mills are at risk under various scenarios. Using the cost curve to play out potential situations (worst, moderate, best) around housing demand, remodel demand, etc., Southern sawmillers can better understand the risk of capacity exiting the market, how this will affect the floor price, and where their assets sit on the curve under each scenario.

This unique data allows executives and mill managers to dig into the details to understand precisely where they are most disadvantaged. They can then pinpoint improvements within the mill to maximize return on capital projects in a volatile market.