2 min read

August Housing Starts Inch Up, But Single-Family Building Continues to Slow

John Greene

:

September 27, 2021

Total US housing starts inched up in August, though the pace of single-family building contracted for the second month in a row. Addressing the trend, CNBC noted that, “… builders continued to struggle with shortages of materials and labor, suggesting the housing market could remain a drag on economic growth in the third quarter.”

Housing Starts, Permits & Completions

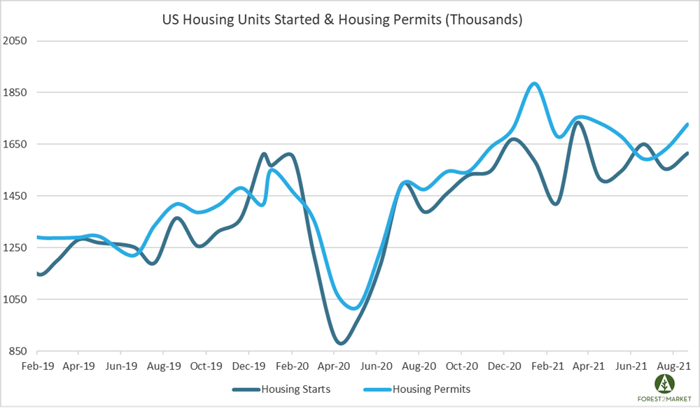

Privately-owned housing starts increased 3.9 percent in August to a seasonally adjusted annual rate (SAAR) of 1.615 million units. Single-family starts decreased 2.8 percent to a rate of 1.076 million units. Starts for the volatile multi-family segment surged 21.6 percent to a rate of 530,000 units.

Privately-owned housing authorizations were up 6.0 percent to a rate of 1.728 million units in August, and single-family authorizations were up 0.6 percent to a pace of 1.054 million units. Privately-owned housing completions were down 4.5 percent to a SAAR of 1.333 million units. Per the US Census Bureau Report, seasonally-adjusted MoM total housing starts by region included:

- Northeast: +167 percent (‐49.3 percent last month)

- South: +1.4 percent (+2.1 percent last month)

- Midwest: +11.4 percent (‐6.9 percent last month)

- West: -21.1 percent (+11.3 percent last month)

Seasonally-adjusted MoM single-family housing starts by region included:

- Northeast: +52.4 percent (‐39.7 percent last month)

- South: +2.5 percent (‐0.9 percent last month)

- Midwest: -12.5 percent (+9.9 percent last month)

- West: -20.5 percent (‐9.9 percent last month)

“Supply issues will constrain production for some time yet and we expect single-family starts will see only a gradual rise from here, reaching 1.16 million annualized by end-2021 and 1.20 million annualized by end-2022,” said Matthew Pointon, a senior property economist at Capital Economics.

The 30-year fixed mortgage rate dropped in August from 2.87 to 2.84, and the NAHB/Wells Fargo Housing Market Index (HMI) inched up 1 point in September to 76.

Market Trends

Per fresh housing market insights published in our most recent issue of the Economic Outlook, current home sales reflect gains despite median prices being either at (new: $390,500) or just below (existing: $359,900) record levels. Residential construction spending increased (+0.5 percent MoM; +26.8 percent YoY) including home improvement spending (+0.2 percent MoM; +8.8 percent YoY).

Some analysts speculate the slowdown in housing starts might be a reflection of construction companies needing to “pump the brakes” a bit to match the pace of building activity to the availability of supplies and labor. “We believe the slowdown in present sales is still more driven by supply constraints as builders have fewer homes to sell after robust demand and/or are intentionally slowing sales to match demand with production capacity,” wrote analysts at investment bank BTIG.

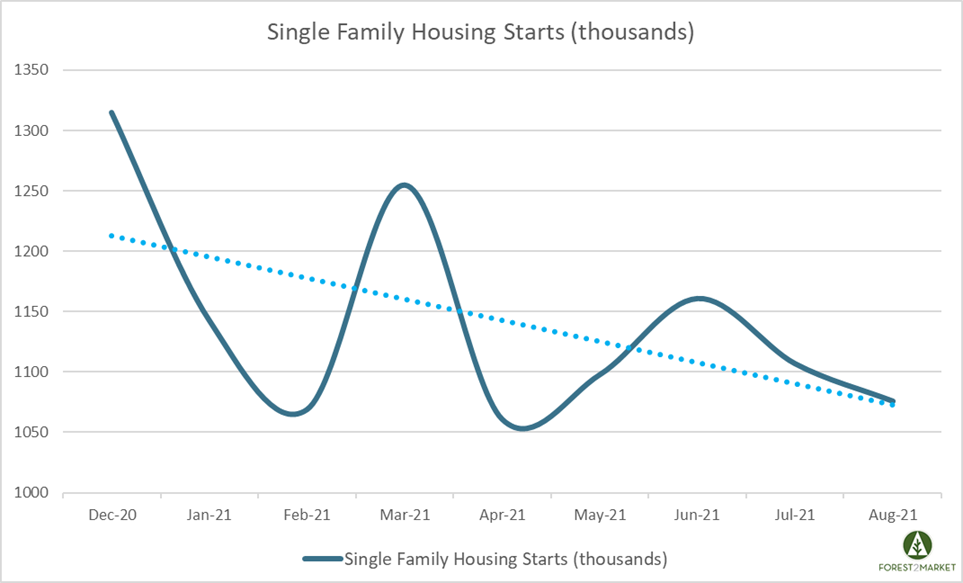

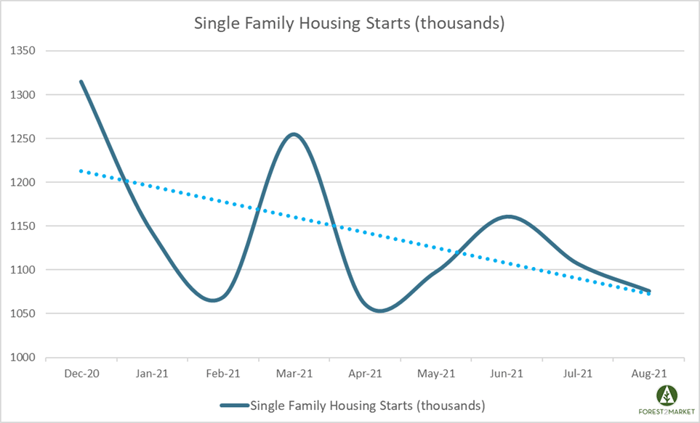

Looking more specifically at the single-family metric, after bottoming during the peak of the pandemic lockdowns in April 2020, single-family starts bounced back quickly before cresting in December. Since then, however, single-family starts have been on a bumpy downward trend as illustrated in the chart below.

The pickup in permitting, meanwhile, is a positive sign in light of other indicators suggesting home buyers may be souring on the housing market. E.g., July’s pending home sales unexpectedly fell for a second month (-1.8 percent MoM; -8.5 percent YoY). Also, mortgage applications submitted for loans to purchase homes have declined in recent weeks, according to data from the Mortgage Bankers Association—including the not-seasonally adjusted purchase index for the week ending August 27 (-2 percent WoW; -16 YoY).

“The big questions now are how much of the recent trends we are seeing in home sales and mortgage applications for home purchase are fundamental in nature, how much are just temporary corrections/consolidations, and how much are due to seasonal adjustment difficulties given that pandemic-related trends have been more important in the housing industry than normal seasonal patterns,” wrote Joshua Shapiro of consultancy Maria Fiorini Ramirez. Shapiro argues that while the housing market is still going to be on relatively solid ground, it “is not going to be as red-hot going forward as it had been, nor is it going to continue to slide for very long like it has recently.”