Australia’s average softwood log export price slumped to a reported AUDFob109/m3 in May 2021, down 16% on the prior month. Exports totaled 158,095 m3 lifting from the prior month, but still 51% lower than exports in May 2020 at the absolute height of the pandemic. The driver for the decline, of course, has been China’s decision to ban the importation of logs from Australia. The faltering prices appear to have impacted both larger (>15 cm) and smaller (<15 cm) dimension log exports.

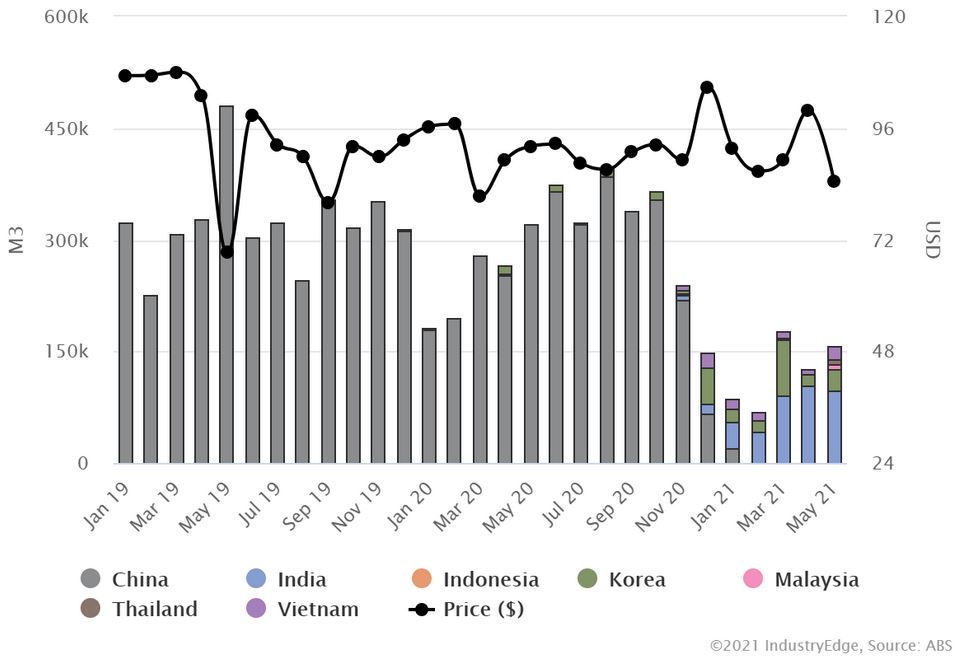

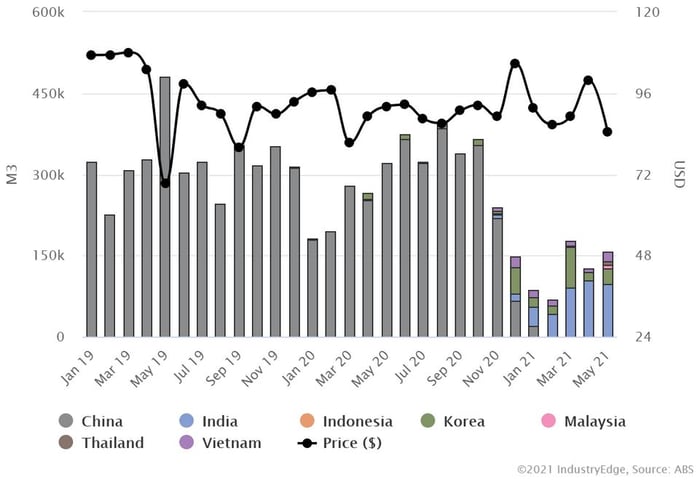

Monthly exports, by main country, can be observed below, along with the price in US dollars.

While notable that other countries are now receiving Australia’s softwood logs, what might be the most notable feature is there are a range of countries who have been acquiring locally produced softwood logs, and as the average prices indicate, more than a few of them are paying prices equivalent to or better than those paid by Chinese customers.

Australian Softwood Log Exports by Main Country: Jan ’19 – May ’21 (m3 & USDFob/m3)

It is clear to see that since China exited the Australian market in late 2020, exports have not significantly rebounded. New markets have proved to be somewhat less substantial as to volume, but in general, prices have been relatively stable. Despite the recent decline, in USD terms, the average export price is operating inside the recent range. More detailed analysis of the data available in Wood Market Edge online shows that average prices are trending down, rather than stumbling lower.

While the bans were a momentary shock to the supply chain, the reality for Australian exporters is that exports have always been a supplement from a far larger monthly harvest, representing what is left available, rather than being a core volume, for the most part, anyway. Moreover, as the detailed data shows, in most cases, exports are of logs that cannot be processed in Australia, in most cases.

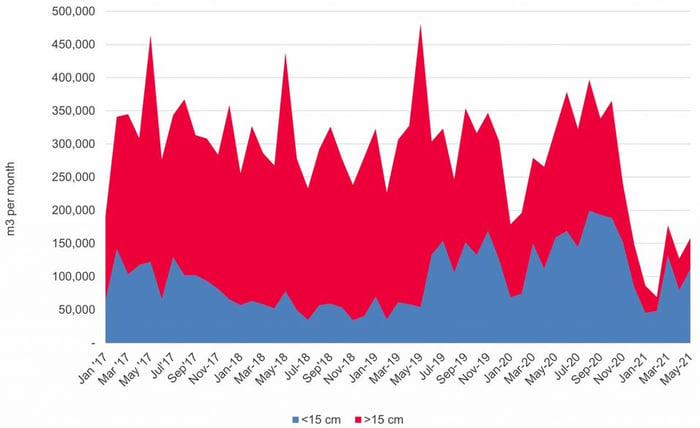

Here, we can see that the remaining exports are mainly smaller dimension logs (<15 cm SEDUB). To be explicit, few if any of these logs can be processed in Australia and certainly no logs of this dimension can be sawn. Our subscribers review the very detailed port-to-port data we supply each month. None have advised us recently they think logs able to be processed locally are being exported in any significant volume.

Australian Softwood Log Exports by Size: Jan ’17 – May ’21 (m3)

Source: ABS, derived and IndustryEdge

Source: ABS, derived and IndustryEdge

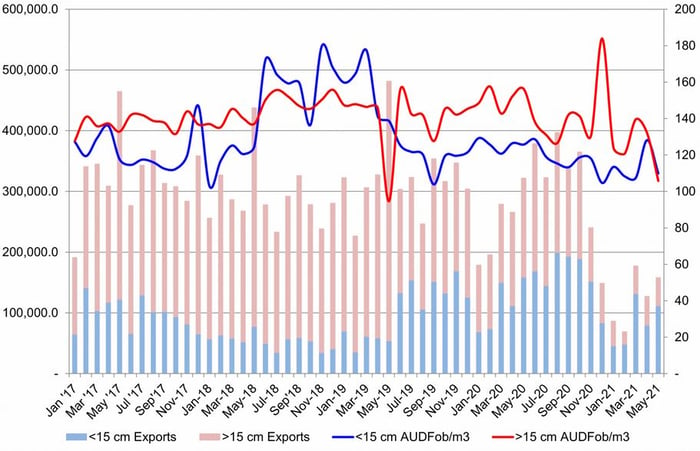

Taking the analysis a step further, the chart here shows the same data, but adds in the weighted average export price, in Australian dollars, by size. The trend decline in prices is evident, even prior to the end of exports to China.

Australian Softwood Log Exports by Size: Jan ’17 – May ’21 (m3 and AUDFob/m3)

Source: ABS, derived and IndustryEdge

Source: ABS, derived and IndustryEdge

All evidence points to a continuation of exports at or around these new levels, but the situation is quite different across the States and from each export facility.

Wood Market Edge provides the most comprehensive monthly trade and market analysis of wood products available in Australia and New Zealand. Covering all relevant products and trade and economic information for both countries, Wood Market Edge provides the market pulse for:

- Woodchips

- Logs

- Sawnwood

- Panel and Engineered Wood Products

Detailed data and all of the charts on the platform can be queried dynamically alongside IndustryEdge’s comprehensive commentary that includes ongoing demand driver assessments for Australian housing and global pulp markets. All data and charts can be downloaded for further analysis.

Tim Woods

Tim Woods