3 min read

Australia’s Forest Products Industry Continues to Grow in 2017

John Greene

:

November 16, 2017

Per a new report from Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the Australian forestry sector continued to grow in 2016 - YTD2017 despite a softening of domestic demand driven primarily by lower housing starts. Preliminary estimates indicate that the volume and value of logs harvested reached record levels, and the value of wood products exports reached a record $3.4 billion. Strong international demand conditions helped to boost Australia’s forestry sector performance over recent years, and China’s continued importance as a key trading partner was evident; the value of wood products exports to China reached a record $1.6 billion, or 47 percent of total wood products exports.

Forest Industry Performance

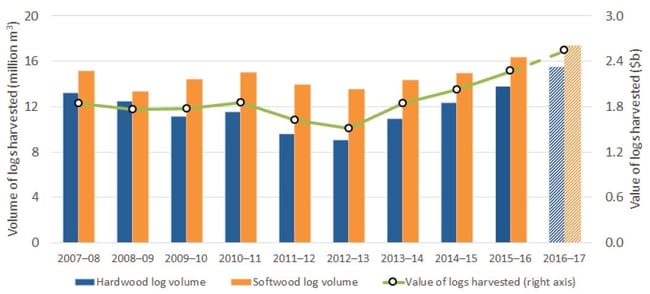

The latest Australian Bureau of Statistics industry data indicate that forestry sector sales and service income grew from $22.2 billion in 2014–15 to $23.7 billion in 2015–16, an increase of 7 percent.

The forestry sector’s contribution to Australia’s gross domestic product (GDP) rose significantly, up 9 percent to $8.6 billion in 2015–16. Increases in the wood and paper products manufacturing industry (+5 percent to $6.9 billion) and the forestry and logging industries (+23 percent to $1.7 billion) led this growth.

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

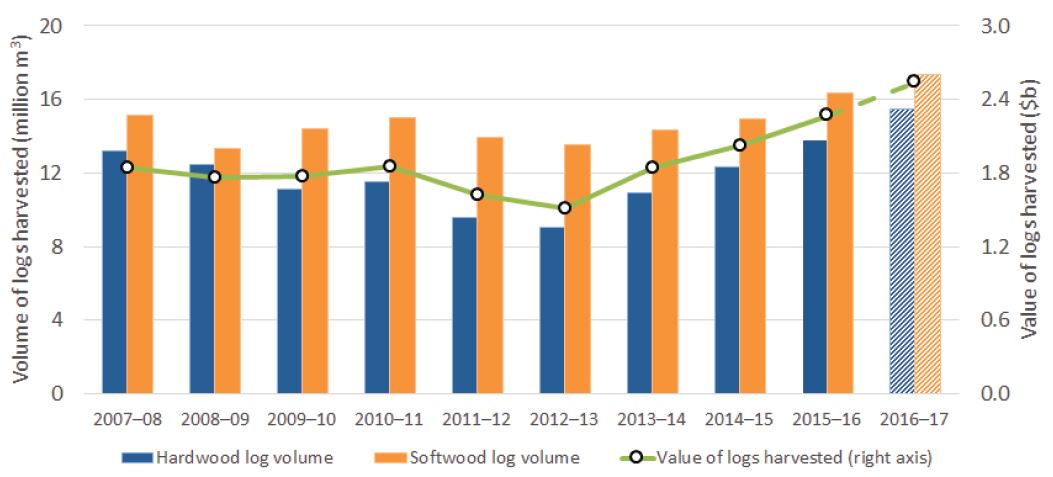

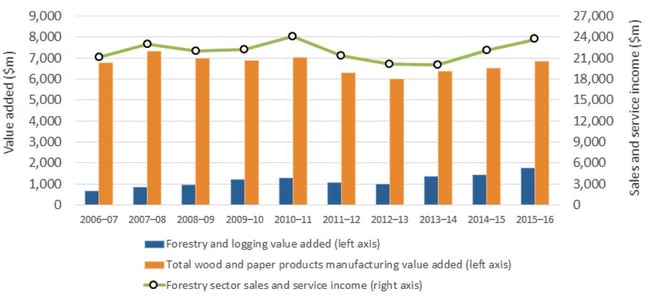

Log Harvest Volume and Gross Value of Production

Based on interim estimates from ABARES, the volume of total logs harvested (hardwood and softwood) increased to 32.8 million cubic meters (m3) in 2016–17, which is an increase of 9.1 percent from 30.1 million m3s in 2015−16. The estimated value of total logs harvested increased 11.8 percent to $2.5 billion m3 in 2016–17.

The estimated hardwood log harvest volume was 15.5 million m3 in 2016–17, an increase of 12.6 percent from 2015–16. Based on ABARES estimates, the total value of hardwood logs harvested is $1.2 billion, an increase of 11.3 percent).

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

The estimated softwood log harvest volume was 17.3 million m3 in 2016–17, an increase of 6.1 percent from 2015–16. ABARES estimates that the average price of softwood logs rose by 5.9 percent over the year, which corresponds with the total value of softwood logs harvested of $1.3 billion, an increase of 12.3 percent.

Wood Products Exports and Key Export Destinations

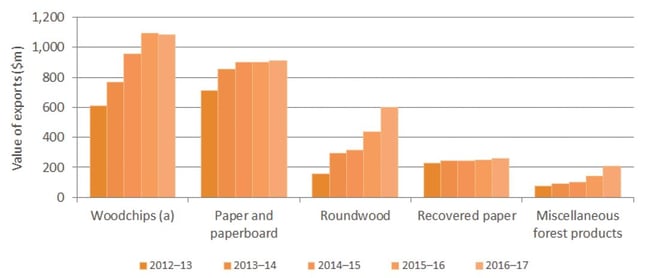

Though housing starts fell by 6.1 percent from 233,600 to 219,300 units in 2016-2017, demand for Australian wood products increased and the value of wood product exports offset this in-country decline; exports jumped 9 percent to $3.4 billion. Increases in the export value of roundwood, newsprint and miscellaneous forest products contributed largely to the overall growth in exports. In terms of value, woodchip exports represent the largest component (nearly one-third) of Australia’s total exports at $1.1 billion in 2016–17, a 1 percent decrease from the previous year.

However, the value of other export categories reached all-time highs in 2016–17:

- Paper and paperboard exports increased by 1 percent to $911 million (driven by a surge in newsprint exports to $97 million)

- Roundwood exports increased by 37 percent to $600 million

- Miscellaneous forest product exports increased by 47 percent to $208 million

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

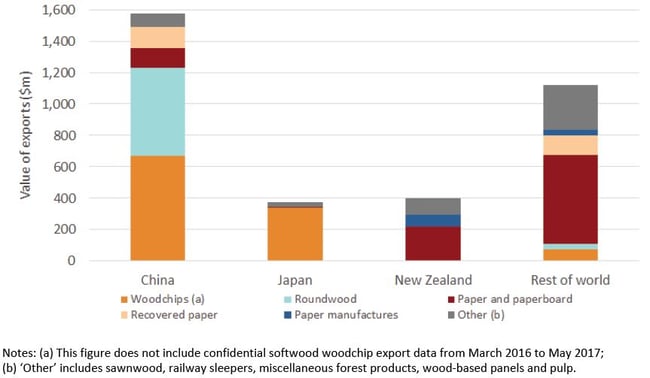

Australia’s top export destinations (in terms of value) in 2016–17 were China, Japan and New Zealand, which together accounted for over two-thirds of Australia’s total wood product exports.

- The value of exports to China reached an all-time high in 2016–17, increasing by 18 percent to $1.6 billion (from $1.3 billion in 2015–16) and represented most of the growth in total wood product exports over the year. Exports to China alone accounted for 47 percent of Australia’s total wood product exports, 62 percent of total woodchip exports and 93 percent of total roundwood exports in 2016–17.

- Japan was Australia’s second largest wood products export destination with $373 million of total exports (down 13 percent from $427 million in 2015–16). Exports to Japan accounted for 11 percent of Australia’s total wood product exports and consisted almost entirely of woodchips (91 percent), and were 31 percent of total woodchip exports in 2016–17.

- Exports to New Zealand increased by 3 percent in 2016–17 to $328 million and accounted for 10 percent of Australia’s total wood products exports by value. Paper and paperboard ($215 million) and paper manufactures ($72 million) were the main commodities exported to New Zealand, which accounted for 66 percent of Australia’s total paper and paperboard export value and 24 percent of Australia’s total paper manufactures export value.

Source: Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)

Other notable Australian wood products export destinations in 2016–17 also included: