The most recent survey by Brazil’s central bank showed that economists in Brazil expect higher inflation rates and lower growth for 2015 than their earlier findings. They raised the estimate of 2015 inflation from 8.13 to 8.23 percent, and dropped growth from -1.01 to -1.03 percent. The weaker numbers were attributed to ongoing negotiations between the government and Congress to rein in the budget deficit with some combination of tax increases and spending cuts and to reduced investment by Petrobras due to the fallout from the kickback scandal.

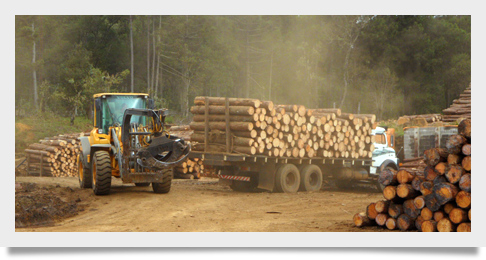

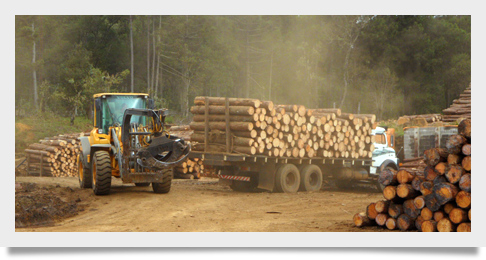

While the economy continued to weaken, however, Cenarios Iba, the monthly publication of the Brazilian Tree Industry, announced that the forest products industry had performed reasonably well in 1Q2015 compared to 1Q2014:

- The volume of pulp exports from Brazil increased 19.9 percent, while pulp production in the quarter increased by 7.0 percent.

- Wood panel exports were 43.3 % higher, with stable production volumes. Domestic sales were 1.4 % higher.

- Export revenues for all pulp, paper and wood panels were 3.1 percent higher.

Log prices in 1Q2015 were favorable for the forest products industry, reducing the negative impact of the increase in other important cost components, most notably fuel price increases. Forest2Market do Brasil’s delivered cost benchmark reported that fiber prices were generally lower across the board during the first quarter. The price of Pine between 8 and 18 cm in diameter fell 6.5 percent during the first quarter in Parana and Northern Santa Catarina. In Southeast Sao Paulo, Eucalyptus prices dropped nearly 15 percent over the same time frame.

Despite the fact that the sector’s performance is better than it was this time last year, some mill executives are holding off on making investment decisions fearing a future economic crisis. While we don’t recommend forest companies close their eyes to the threat of economic crisis, Forest2Market do Brasil analysts do not believe that investment delays are an appropriate strategy at this moment, as the delays will only increase both the likelihood of crisis and its severity. Instead, analysts here recommend that forest companies make strategic decisions based on good information. Making investment decisions now, while other companies are sitting on the sidelines, will pay off in the long run by providing companies willing to assume modest risk with competitive advantages.

Marcelo Schmid

Marcelo Schmid