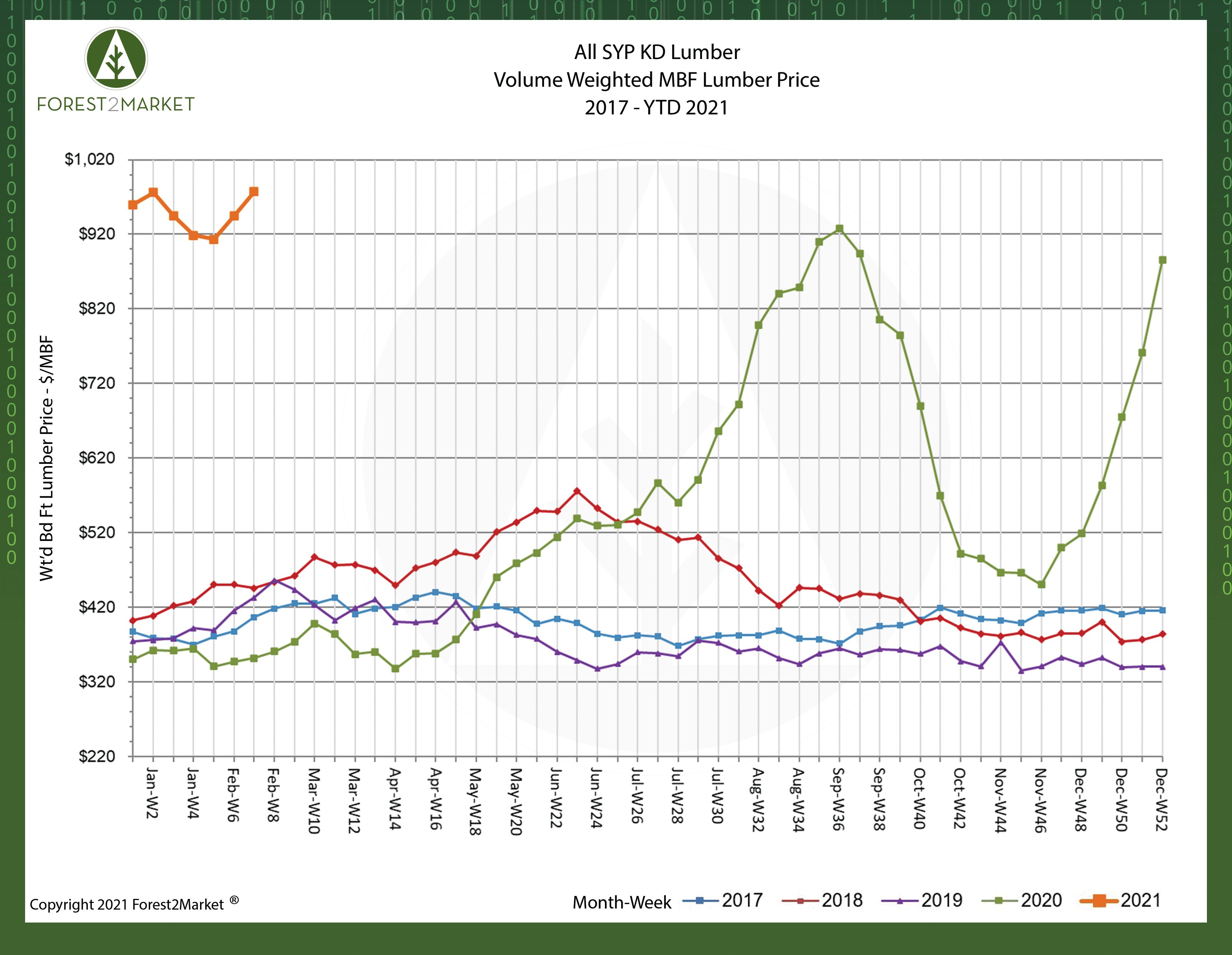

Prices for North American softwood lumber continue to move ever higher as we cross the midway point of 1Q2021. Southern yellow pine (SYP) lumber prices set new records last month before temporarily dropping for three consecutive weeks. We’re now seeing a two-week rally take shape that has driven Forest2Market’s composite SYP lumber price to a new all-time high.

Forest2Market’s composite SYP lumber price for the week ending February 19 (week 7) was $977/MBF, a 3.4% increase from the previous week’s price of $945/MBF and a 178% increase over the same week last year.

A look back at 2020 price trends illustrates the incredible surge that developed in 2Q before peaking in 3Q, and the trend that has formed thus far in 2021 is equally astonishing.

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- 4Q2020 Average Price: $580/MBF

- YTD2021 Average Price: $948/MBF

According to fresh data from the US Census Bureau, privately-owned housing starts in January were at a seasonally adjusted annual rate of 1.580 million units (MU), which is 6.0 percent below the revised December estimate of 1.680 MU and 2.3 percent below the January 2020 rate of 1.617 MU. Single-family housing starts in January were at a rate of 1.162 MU, which is 12.2 percent below the revised December figure of 1.323 MU.

CNBC notes that “higher lumber costs are likely behind a drop in January housing starts.”

“Builders report concerns over increasing lumber and other construction costs and delays in obtaining building materials,” wrote Robert Dietz, chief economist at the National Association of Home Builders. “Rising interest rates will also erode housing affordability in 2021, as inventories of existing homes remain low.”

A reasonably robust economy (all things considered) has driven strong demand for new homes, which has combined with record low interest rates to push prices higher. “At some point, however, the basic reality of affordability should at least slow some of the growth,” added CNBC.