3 min read

Chilean Wood Products Market Offers Export & Import Opportunities

John Greene

:

May 16, 2018

The modern forest products industry is truly a global endeavor on every level. Interconnected economies and trade flows allow a vast assortment of forest products—raw materials, energy feedstocks, manufacturing provisions and finished products—to circle the globe in increasing volumes. Nations with large forest resources and forest industries are able to serve both the domestic and export markets, and they are able to participate in the global economy due to supply chain enhancements and increased overseas demand.

With over 43.7 million acres (17.6 million hectares) of total forest area, Chile is well-positioned as a global wood products trading partner. Per a recent report by the Global Agriculture Information Network (GAIN), roughly 85 percent of the country’s forests are native while 15 percent are planted. According to Chile’s Forestry Institute (INFOR), there are 5.9 million acres (2.4 hectares) of plantation forests in Chile, of which 3.5 million acres (1.4 million hectares), or 58 percent are radiata pine plantations, and 2 million acres (.85 million hectares) or 35 percent are eucalyptus plantations.

Domestic Industry Snapshot

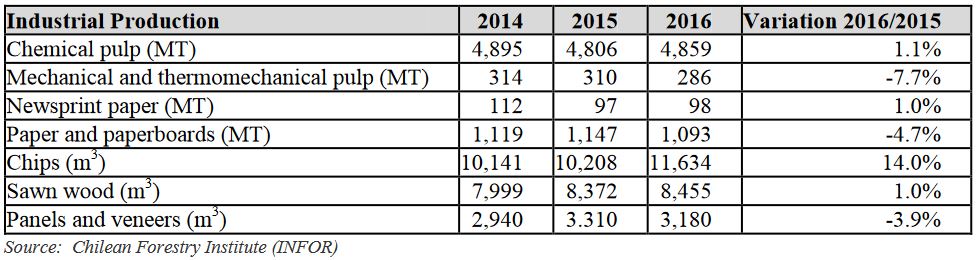

In 2016, gross domestic product (GDP) for Chile’s wood and wood manufacturing sector was $7.7 billion, which represents 3.7 percent of total GDP. Wood sales in 2016 were $5.7 billion, and $1.6 billion (28 percent) were domestic. Similar to its neighbor Brazil to the east, the most prevalent industrial wood products manufactured in Chile are chemical pulp, wood chips, sawn wood and wood panels and veneer. Wood products exports in 2017 increased by 2.7 percent (over 2016) to $5.4 billion; 58 percent of these exports were cellulose, paper and related materials, and the remaining 42 percent were in the wood and panels segments.

In early 2017, Chile suffered the most devastating wildfires in the nation’s history, which resulted in a significant loss to working forests that amounted to eight percent of Chile’s total forest area. The fires destroyed 15 percent of the total radiata pine planted area. While Chile declared a state of emergency and requested international assistance in the wake of the fires, the scorched areas could take up to 30 years to recover.

The Maule region of Chile was particularly hard hit and according to Chilean Wood Corporation (CORMA), regional sawmill activity will begin to taper off in mid-2018 due to a scarcity of quality sawlogs. As a result of the fires, domestic wood supplies are expected to drop in 2018, which will likely lead to increased demand for imported wood products to make up the deficit.

Chilean imports of forest products in 2017 increased by 2.4 percent over 2016 and totaled $260 million. The top imported product was oriented strand board (OSB) used in construction ($28.6 million), followed by wooden casks and barrels, which are used by Chile’s booming wine industry ($15.6 million). Imports of medium density fiberboard were also notable, which is used in Chile’s furniture manufacturing industry ($14.5 million).

According to a 2017 report from the Chilean Construction Chamber, there is a housing deficit of over 500,000 units for roughly 1.5 million people. This presents a unique challenge, as Chile is in a seismically active region of South America and its strict building codes and construction standards are designed to prevent catastrophic damage from earthquakes. However, the prevalence and affordability of wood products, as well as the latest technological advancements with wood products engineering, open up real possibilities for both domestic producers and exporters into the Chilean market.

While strict building codes are being reevaluated, wood is still used as the primary construction material in 80 percent of residential buildings and 20 percent of commercial/service buildings. Precast metal panels and concrete are also popular building materials that can be used alongside wood in many cases.

Opportunities for Exporters

With a domestic industry facing a shortage of timber due to 2017’s wildfires and a current housing shortage, Chile will likely increase its imports of wood products in the near term. Per the GAIN report, exporters looking for growth opportunities in Chile might have the most success with two unique products: cross-laminated timber products (CLT) and southern yellow pine lumber.

- CLT

Over 90 percent of structural failures during earthquakes result from failed connections. CLT beams combined with tension cables have been used successfully in buildings located in seismic zones like Chile, reducing the need of rigid metal fasteners. Tension cables also oftentimes allow for the salvage of materials, which can then be repositioned and reused in the wake of an earthquake. This results in substantially lower repair costs and prevents additional demolition and materials costs.

- Southern Yellow Pine (SYP) Lumber

While US exports of SYP lumber to Chile have been virtually nonexistent, SYP is an excellent substitute for Chilean radiata pine. Based on the significant loss of the planted pine resource in Chile, a combination of SYP and radiata pine could be an option for Chilean residential construction. This opens a real opportunity for producers in the US South looking for new export destinations. The GAIN reports notes that “Results from Timber Research and Development Association (TRADA) show that SYP is significantly more resistant to indentation than Chilean radiata pine, Brazilian elliotis pine, European redwood, and European whitewood.”

SYP also tested significantly stronger in impact bending than all the other species, and it was “considerably denser than the other species, which indicates that furniture, cabinets, doors, and flooring made of SYP are less susceptible to dents, scratches, and other signs of wear.” While SYP isn’t a perfect substitute for Chilean radiata pine in all capacities, it can play a significant role to help offset Chile’s lack of timber and current housing needs.

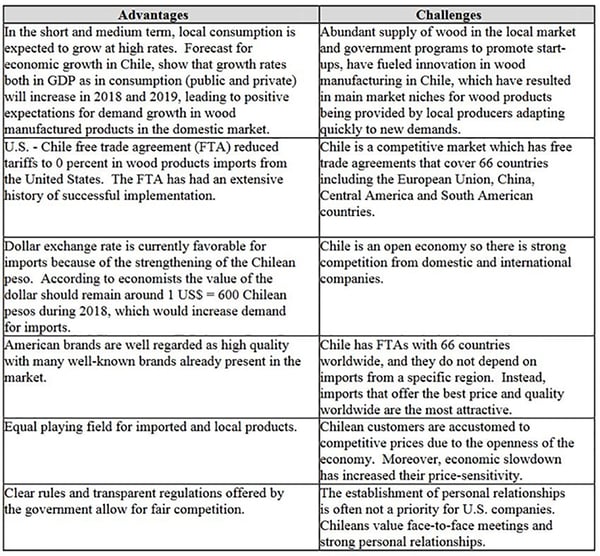

Additional wood products that have export potential in the Chilean market include casks/barrels, wooden beams, windows, frames and doors, sawn and chipped oak fiber and staves. The GAIN report also includes a section that includes detailed advantages and challenges for foreign wood products manufacturers looking to enter the Chilean market.