Latest data shows Chinese woodchip imports lifted to a seven-month high in September, hitting 1.302 million bone dried metric tons (bdmt) at an average price of USDCif152/bdmt. The big winner in the hardwood chip trade to China continues to be Vietnam, whose average price of supply in September was USDCif142/bdmt, an unbeatable price, at least over the longer term.

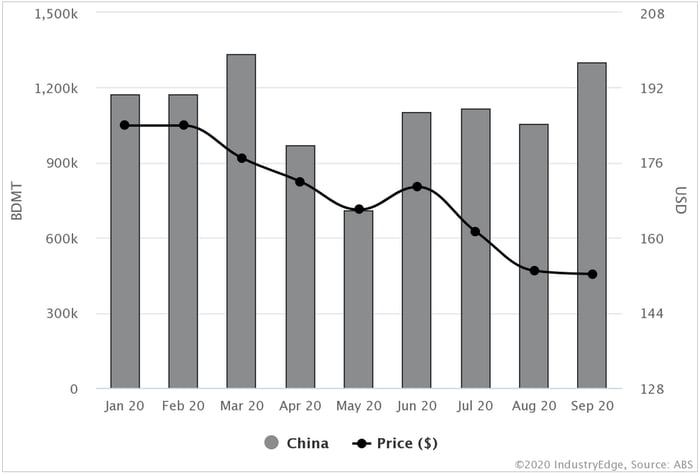

The chart here – created in IndustryEdge’s Wood Market Edge online – shows total woodchip imports to China over 2020 year-to-date. The early impact of the pandemic can be seen in April and May before some recovery in the subsequent months. Latest import data shows that shipments have largely returned to normal levels.

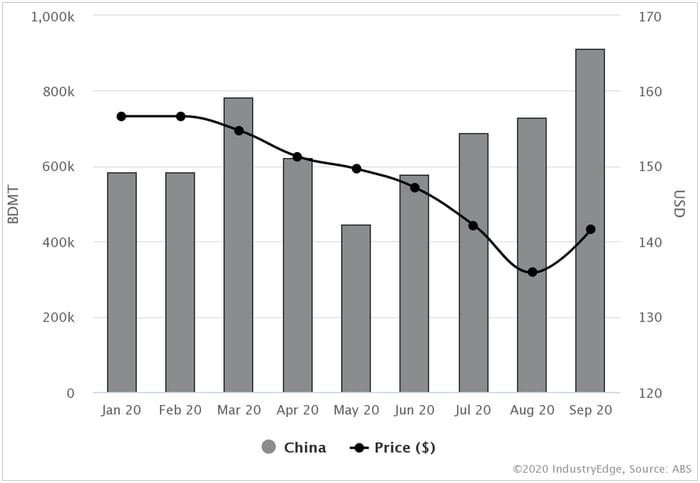

However, what is not normal is the rapid step-down in the average price of hardwood chips delivered into China. Dominated by the supply from Vietnam – displayed in the chart below – the average Chinese hardwood chip price has fallen from USDCif 187/bdmt in September 2019 to USDCif152/bdmt a year later.

Over the first nine months of 2020, Australia’s share of the shipments to China was just 18.4%, down from 29.7% for the same period in 2019. It is important to note, in the current climate, that the decline in Australian shipments is directly related to market moves and activity, and currently has no relationship to trade and political tensions involving China and Australia.

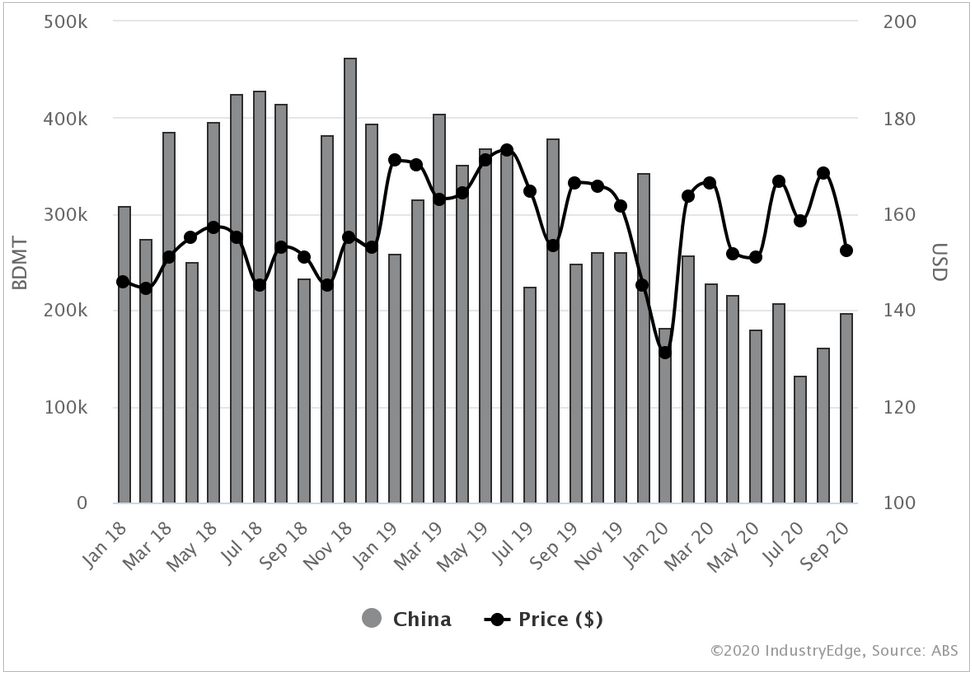

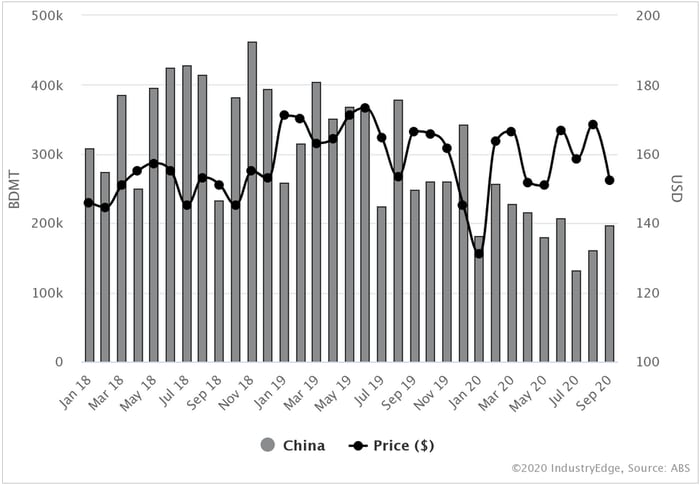

Australia’s exports of woodchips to China are shown in the chart below, but here, to emphasize the declines of the last year, exports are shown for the last three years.

The unique, leading information provided by the vessel tracking data and charts available on Wood Market Edge online provide the clear indication that Australia’s woodchip exports to China will continue to be under pressure until at least the end of December. Subscribers can interrogate the almost real-time vessel tracking data on the platform 24/7.

Chinese, Japanese and Taiwanese woodchip data – from all countries – is now visualized and available for download from IndustryEdge’s Wood Market Edge online, housed on the world’s leading forestry data and visualization platform, SilvaStat360, operated by Forest2Market.

Other data on Wood Market Edge online includes sawn wood consumption and trade for Australia and New Zealand, Asian woodchip trade data, Chinese log imports, full details on panel products, log, chip and related trade for both Australia and New Zealand.

Tim Woods

Tim Woods