The US trade and tariff war with China that has been reignited in recent weeks is directly impacting American log and wood products exporters, timberland owners and other members of the global wood fiber supply chain. The situation is fluid and there is a great deal of speculation and hyperbole driving much of the media coverage surrounding the issue. These developments have far-reaching consequences for many readers of Forest2Market’s blog, and we believe that cautious discretion in reporting these developments is of the utmost importance. The last thing we want to do is promulgate fear or misinformation in a highly contentious and unstable environment.

So, what do we actually know about the current situation?

- The US has imposed a new round of 25 percent tariffs on $250 billion in Chinese imports and is threatening to tax another $300 billion in imports in the future.

- China has responded by imposing retaliatory tariffs on $60 billion worth of US products.

- A number of US wood raw materials, as well as wood and paper products will be affected by China’s punitive tariffs.

This development comes on the heels of a separate round of tariffs that took effect in 2018. As the Washington Post recently noted, “Over a six-month period ending in March[1], exports from the United States to China dropped by $18.4 billion, or 26 percent, compared to a year earlier. Some of the decline was offset by other markets, with exports increasing to the European Union and Mexico. Imports from China declined as well.”

Some industries have been harder hit than others; US soybean exports to China, for instance, have decreased 80 percent since last year’s round of tariffs took effect. American log and wood exporters have also been significantly pinched. The Post article notes that, “Wood exports to China dropped by $700 million, or 42 percent. Industries affected included firms that buy logs of hardwoods like walnut, maple and cherry and turn them into boards for furniture and flooring. Before the tariffs, about 1 in 4 of these boards went to China, said Michael Snow, executive director of the American Hardwood Export Council.”

The Post continues, “Snow said his industry is looking for alternative markets. ‘But at the end of the day, there really are no other markets out there that can absorb anywhere near the volume that China was taking in,’ Snow said. He added, ‘If this continues for several months, I think there’s no question that we’ll see mill closures and layoffs in the industry.’”

Another view of the situation comes via a recently-published opinion piece written by Frank Stewart, Executive Director of the West Virginia Forestry Association, which has been widely reprinted. Mr. Stewart paints a bleak picture for the hardwood industry in Appalachia, noting that “Retaliatory tariffs from China have been a buzz saw through Appalachian hardwood businesses and the families that own and operate them. The hardwood industry provides an estimated $60 billion economic impact in the 12-state region but that will change this year because of trade with China. Exports make up approximately 50% of the high value hardwood lumber sold and THE top market for species like Red Oak is China.”

Another view of the situation comes via a recently-published opinion piece written by Frank Stewart, Executive Director of the West Virginia Forestry Association, which has been widely reprinted. Mr. Stewart paints a bleak picture for the hardwood industry in Appalachia, noting that “Retaliatory tariffs from China have been a buzz saw through Appalachian hardwood businesses and the families that own and operate them. The hardwood industry provides an estimated $60 billion economic impact in the 12-state region but that will change this year because of trade with China. Exports make up approximately 50% of the high value hardwood lumber sold and THE top market for species like Red Oak is China.”

News out of the Pacific Northwest is equally disappointing, per a recent article in The Daily Astorian covering coastal Oregon. Journalist Edward Stratton notes that the Port of Astoria’s pier revenue is expected to fall off significantly due to reduced log shipments to China. “Port staff projected $1.3 million in pier revenue, down more than 28 percent from this year and part of an estimated $11 million in estimated operational revenues. The majority of the loss in pier revenue comes from the lack of regular log ships that make up the bulk of the Port’s dockage, wharfage and other pier-related money.” Due to the decrease in demand and log shipments to China, Astoria Forest Products has cut its workforce by 40 percent.

Tariffs on US Wood Products

The full Harmonized Tariff Schedule (HTS) of US tariffs on Chinese goods is published by the Office of the United States Trade Representative, which can be viewed here. However, locating an equivalent translated and reliable list via China’s Ministry of Finance is exceedingly difficult, especially as these developments continue to change rapidly.

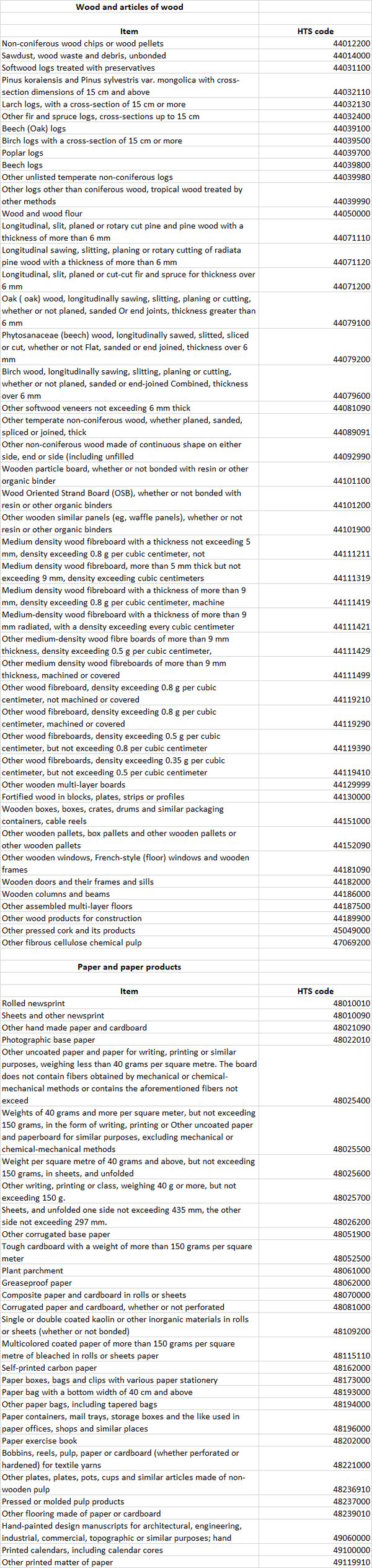

International business news organization Quartz has obtained and published the full list (translated, unofficial) of US products that China is slapping with a 25 percent tariff, which includes a significant number of wood-based products, paper products and wood raw materials.

This list is not comprehensive, however. In addition to other wood-based products included on the 25% list, Quartz notes that “Beijing also added 20% tariffs on 1,078 US products, 10% tariffs on 974 US products, and 5% tariffs on 595 US products,” and some of those products will likely pertain to the forest supply chain.

It’s not yet clear what impacts the new round of tariffs will have on GDP and economic growth—especially as we head into a new election season in the coming months. A National Association for Business Economics' April survey showed that corporate economists predict the US economy will expand over the next year, however the pace of growth will decline.

As CBS reported in April:

- “Only 53 percent now see the economy expanding more than 2 percent this year, down from 67 percent in January's survey.

- Among economists whose companies produce goods, 75 percent said President Trump's tariffs were a negative.

- Fifty-two percent report shortages of skilled labor at their firms, a sign of wage pressure.”

For participants in the global wood fiber supply chain, it’s imperative to remember that the current trade/tariff situation is constantly evolving and will continue to do so in the near term. As outlined above, cautious discretion is the most prudent way to weather the storm.

How has the tariff and trade war with China affected your business?

[1] Exports to China for select industries for Oct. 2017 to Mar. 2018, prior to tariffs and Oct. 2018 to Mar. 2019, after tariffs were implemented