3 min read

Colonial Pipeline Debacle: A Lesson in Supply Chain Security

Larry Sullivan

:

May 17, 2021

Larry Sullivan

:

May 17, 2021

The many questions being asked in the wake of the Colonial pipeline debacle sure do test the fundamental assumptions of supply chain integrity. Piracy is a form of criminality that goes back millennia and still exists today. But unlike the shipping lanes that were once stalking grounds for the high seas pirates of legend, the modern form has grown to include corporate raiders, internet hackers and all kinds of creative criminals. And, as we’re experiencing now across the East coast, supply chains are still vulnerable to innovative pirates.

The February collapse of The Electric Reliability Council of Texas (ERCOT) infrastructure also presented a similar interruption in energy delivery systems, and the driver of that failure was related to supply chain security as well.

Early in my career in the oil industry, I worked on drilling rigs offshore where I would very carefully observe the “dead man’s” control systems that were set in place for the kind of emergency where all human interfaces failed. Anchor systems with explosive actuators made sure we floated away from a well that was out of control. Due to the inherent risk in this endeavor, these fail safes were an absolute requirement.

Fast forward a few years and supply chain security is still a central feature in the nature of my work. Cybersecurity is a common theme at the Military College of South Carolina where I teach Word Regional Geography, and at Forest2Market we advise industry participants across the world about the importance of supply chain transparency, security, and maintaining integrity in forest markets. Many analysts and investors rely upon the data and analytical insights from Forest2Market, Fisher International and Tecnon OrbiChem to help them preserve supply chain integrity across complex and rapidly evolving systems.

But unlike fossil energy, forest resources remain one of the best collective hedges against a chaotic world due to steady supply volumes, prices, and insurance. Even large insurance companies provide hedges in their portfolios via forest assets. But do these insurance companies protect the 15–20-day world supply chain integrity of oil and gas? No! Who can insure over 1.5 billion barrels of oil and gas every day? Only the sovereign nations can self-insure a resource that large.

Why are forest resources so steady and consistent for biomass supplies, prices, and reliability?

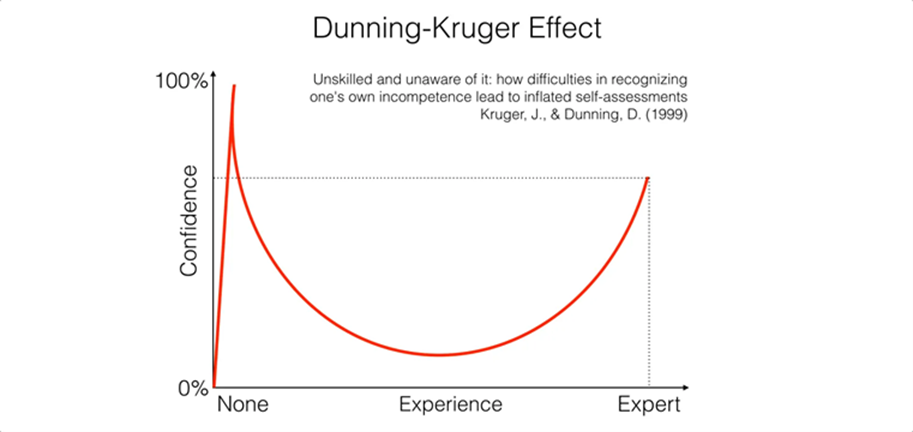

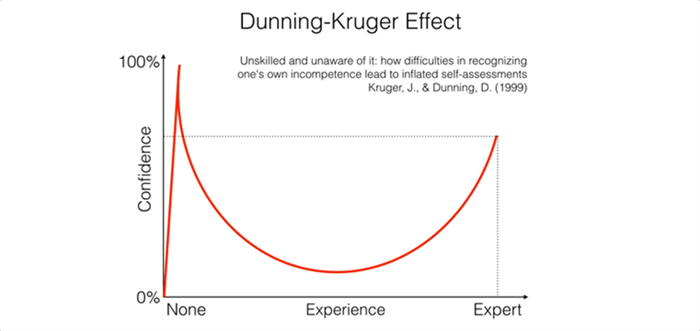

The recent Colonial and ERCOT disasters are case studies in mismanaged supply chains. From the Dunning Kruger Hype Cycles (see below) to Peter Hall’s Great Planning Disasters, the raw material markets of petroleum, minerals, agriculture, and forestry offer many examples of common risk issues.

Image Credit: https://www.jstor.org/stable/10.1525/j.ctt1ppx64

- One of the reasons the corn (maize) ethanol market expanded in the early 2000’s was that nearly 30% of US refinery capacity was shut down after Hurricane Katrina and Congress wanted to broaden the supply of automotive fuels.

- Now, with the Colonial and ERCOT failures, many questions are being asked about infrastructure exposure across the US. More specifically in the case ERCOT, there are increasing questions as to why Texans are so isolated from the Eastern and Western North American power grids.

Unlike oil refining assets, forest resources in North America are spread widely across the landscape and offer basic “savings account” access for fuels, timber, recreation, and investment. Texas has two idled biomass power plants with abundant resources onsite that certainly could have helped remedy the ERCOT collapse. Why weren’t these resources brought online?

Likewise, there was no need for the Colonial pipeline to be so isolated when large scale Distributive Control Systems (DCS) and Enterprise Resource Planning (ERP) software easily defeats attempts at piracy. Redundancy is an inherent quality of DCS and ERP.

Forest resources are so widespread and stable that disasters like wildfire, hurricanes and even urban encroachment seldom set off these types of alarms. Forest supply chains feature safety and long-term access for owners to store and use without the petroleum and electrical supply issues we have faced in recent months.

What lessons can modern industry take from these events? What should our elected leaders do to foster innovation that helps mitigate future risk? Energy portfolio expansion via incentives to use forest resources in the development of biofuels and bioenergy should be expanded. Ultimately, however, the market may progress without much assistance from DC.

The climate/carbon circular economy, Environmental, Social, and Corporate Governance (ESG) policies, waste reductions, etc. are all now part of the corporate “social license to operate.” The pressure behind corporate responsibility is now sidestepping Washington and being applied via the finance sector, which has always had the ability to influence behavior at the corporate level.

Furthermore, global corporations ultimately answer to shareholders, many of which are now part of the Climate Action 100+ organization, which includes large investment houses that have pledged not to invest in fossil energies, but instead invest in renewables. The 450+ members collectively control over $40 trillion in assets, which will create significant influence in the market to drive corporate responsibility around the issues of carbon emissions and climate change.

Innovation in the renewables space is going to continue to increase because the market demands it, not sluggish policy. The broader deployment will be directed, at a minimum, by social license to operate at the corporate level and, hopefully, by policy as an enhancement. Those of us in the sector will continue our advocacy role to educate the public about the benefits of biomaterials products, feedstock and supply chain security, and the development and deployment of bioenergy-based businesses.