2 min read

Could Paraguay Become a New Frontrunner in the P&P Industry?

Marcello Collares

:

May 26, 2022

Marcello Collares

:

May 26, 2022

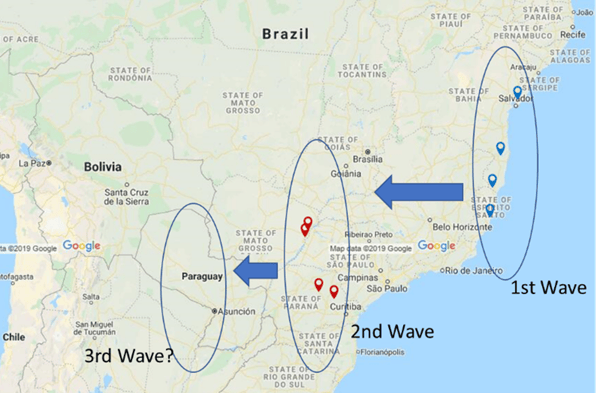

If you look at a map of some of the latest pulp mills being developed in Latin America—highlighted in the image below—there’s an apparent trend occurring: the development and expansion of mills to the west. The first ‘wave’ of mills was built along the Eastern coast of Latin America in Brazilian states such as Espirito Santo and Bahia. Later on, the development of pulp mills expanded towards the Midwest into states such as São Paulo and Mato Grosso do Sul. This trend continues as Paracel’s new bleached eucalyptus kraft mill in Paraguay is about to come to completion, leaving many to wonder if this could give Paraguay a chance to evolve into a frontrunner in Latin America.

Mill Development in Latin America

Paracel’s new mill, which is expected to produce 1.5 million tons of bleached eucalyptus kraft pulp (BEKP) per year, is one of the first major industrial investments in Paraguay and is capable of completely changing the local economy and putting Paraguay on the radar in the global Pulp and Paper industry. But why exactly did Parcel invest $2 billion in building the first large-scale pulp mill in Paraguay? While the expansion of the agriculture frontier could be a factor, it does not explain the major investment alone, as any investment of this scale is the result of a group of conditions and a clear strategy.

For example, the strategic decision to build the mill right along the Paraguay River proves to be extremely advantageous as the combination of the sprawling river, the unvarying year-round climate, and the fact that two-thirds of the roads surrounding the facility are paved creates an optimal solution for transporting products and materials to and from the plant site. These conditions will help prepare Paracel to supply the global market with certified pulp. In addition, precipitation patterns, climatic conditions, and the flat topography and deep soils make the Concepción region in Paraguay an ideal landscape to plant, cultivate and harvest trees throughout the year. But how long can it take to develop enough timberland?

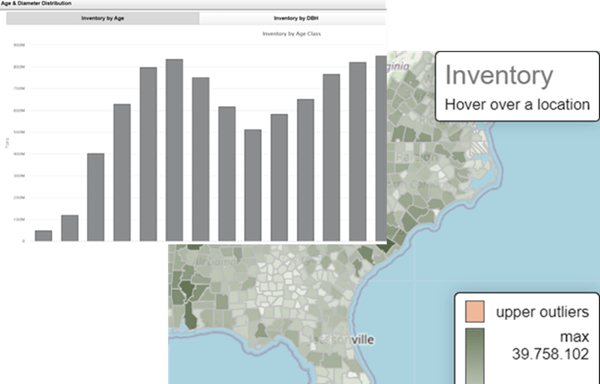

Through ResourceWise’s proprietary technology Timber Supply Analysis 360 (TSA360) for Latin America, we were able to map the forest assets and first determine if there is even enough Eucalyptus in the region to start and maintain operations of a large mill, similar to what is seen in a separate example image below.

Example: Inventory Supply in the US South

Source: TSA360

Source: TSA360

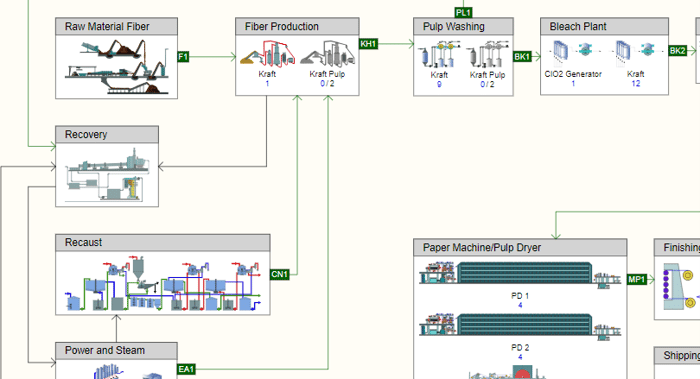

Now for the primary concern: What impact could this new mill have on the global pulp market? While it may be too early to say for certain, we can use FisherSolve’s Virtual Mill module to replicate this mill and consider major assets, energy-mass mill balance, internal flow of energy, etc., which can all be seen in the image below. From this, we can see that the cash cost will be highly competitive and that the mill will have a huge energy surplus in a small, local market.

Virtual Mill Module Example

Source: FisherSolve

Source: FisherSolve

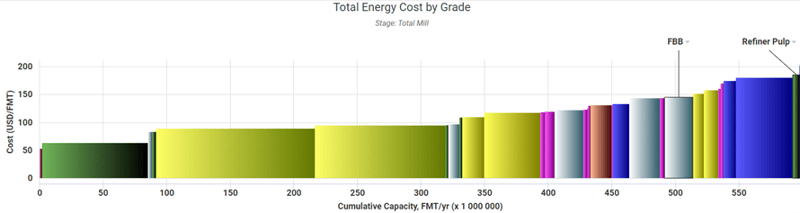

The energy surplus is largely due to the fact that Paraguay is a net electricity exporter. However, Parcel has stated that they will build and operate this mill with the highest standards of global sustainability. So will Paracel integrate its production downstream to a high-intensive energy P&P grade? Or will they find a way to offset their surplus, or even sustainably disperse it?

Source: FisherSolve

Source: FisherSolve

For deeper insight into the possible outcomes and impacts this mill could have, talk with an expert at Fisher International who can help your business formulate an actionable plan with a high degree of accuracy. You can also learn more about how Fisher International’s analytics platform, FisherSolve Next, can provide you with detailed information on every paper and pulp mill in the world for both market and competitive analyses.