3 min read

Could the Downward Swing in Housing Finally Shift Gears?

ResourceWise : February 22, 2023

After dismal housing market reports in December, lots of industry chatter is discussing where the market is heading. We are seeing quite a bit of potential in way of recovery. But the exact path ahead is anything but clear.

Homebuilder Sentiment and Sales

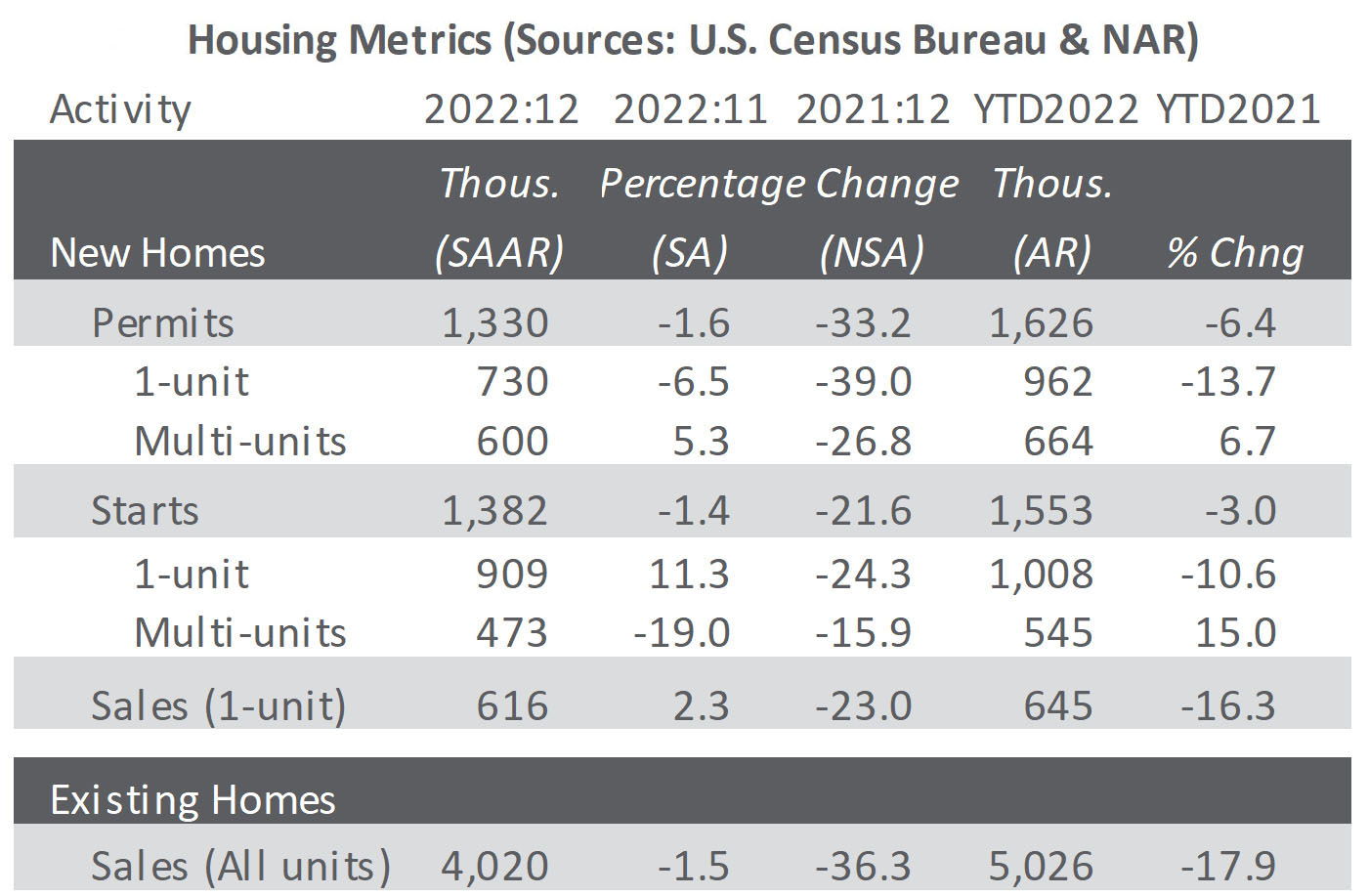

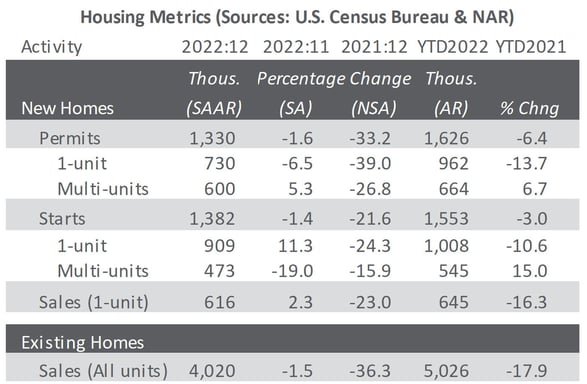

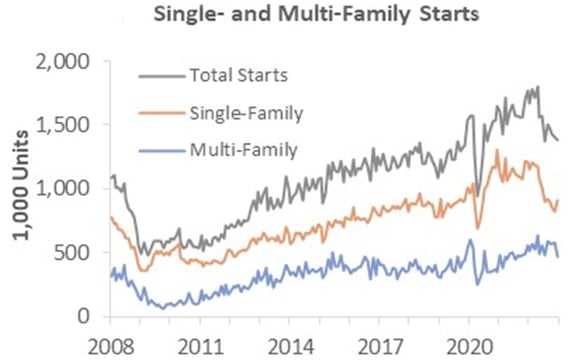

December had the lowest reading of homebuilder sentiment (HMI) since June 2012 outside the pandemic lockdown. Given this dip, further retreats in total starts and permits were not entirely unexpected.

Have we finally bounced off the bottom to find the way upwards? With the HMI potentially on the cusp of an upswing, it is also not surprising that some components of both starts (single-family) and permits (multi-family) exhibited positive month-over-month (MoM) changes.

For 2022 overall, total starts and permits retreated relative to 2021 despite positive showings from the multi-family component.

Home sales were also mixed in December. New homes posted a positive MoM change, but resales remained in the red.

In fact, resales posted a record year-over-year (YoY) drop. These numbers were worse than the worst drop during the Great Recession.

Housing Outlook Remains Optimistic but Unclear

Some of the numbers suggest that we have, in fact, started a shift in gears. However, the outlook for housing—particularly in the short run—is quite murky.

The direction the market is headed depends on how the tug-of-war among competing factors ultimately plays out.

A few examples of market commentary:

Huge Decrease in Gross Orders and Cancellations

One of the largest publicly traded U.S. homebuilders, KB Home reported that its gross orders tumbled by 47% quarter-over-quarter (QoQ) in 4Q2022. Even more startling, KBH experienced a 68% cancellation rate.

According to Reventure Consulting’s Nick Gerli, this exceeds the 47% average rate seen during the 2008 housing crash.

Continued Drying Up of Construction

Economists at the Jefferies Group suggest a fairly clear path for continued economic downturn. As they said it, “Permits are running below starts which is very rare, and suggests construction pipelines are drying up very fast, creating further downslide for activity.”

Better Mortgage Rates as Home Building Incentives

Not everything on this list is bad news for homebuyers. The initial shock of higher rates began to dissipate. In many instances, mortgage rates have been receding since November 2022.

Additionally, a lot of home builders are boosting buyer demand by offering interest rates at 3.0%-4.0%. These numbers are much better than the current 30-year fixed-rate average of almost 7.0% at the time of this post’s publication.

Other builders waiting for mortgage hikes to slow may also provide incentives to boost buyer interest and rekindle construction projects. We have yet to see what sorts of other consumer-centered options builders will devise to convince buyers to get back in the market.

Housing-Price Futures are Rallying

As noted by Goldman Sachs’ Rich Provorotsky, housing-price futures traded on the Chicago Mercantile Exchange (CME) bottomed in November 2022. Since then, they have continued rallying.

Evidence of the rebound is confirmed in a report by real estate firm Redfin: “The number of Redfin customers requesting first tours has improved 17PP from the November trough, and the number of people contacting Redfin agents to start the homebuying process has improved 13PP.”

Forest2Market's Housing Forecast

As these examples show, there is far from a consensus and where and how recovery will trend in the housing market.

On balance we suspect housing starts are nearing their bottom for this cycle. Perhaps 80%-85% of the forecasted decline from 1Q2022’s cycle high is already in the rear-view mirror. The remaining 15%-20% is expected to occur during 1H2023.

We forecast fluctuation of SAARs between -12% and +8% between this year and next year’s levels. 2025 could also see a somewhat reassuring YoY increase as the market further recovers.

Forest2Market: Industry Forecasting for Your Market Edge

How will these housing levels and forecasts affect the lumber market? What will this mean for timber prices and other critical forestry levels?

To answer these questions, you need the best possible data. Forest2Market, a ResourceWise company, provides much more in-depth and specific data insights through our subscription-based forecasting products.

ResourceWise offers detailed market perspectives on everything from our broad Economic Outlook to relevant regional and local timber markets. Our data intelligence platform SilvaStat360 also provides even more economic insight and real-use forestry data.

Contact the ResourceWise team today and learn more about how our data can help your business with strategic decision-making and planning.