7 min read

COVID-19 Poised to Structurally Alter Tissue & Towel Sector

Bruce Janda

:

January 5, 2021

Bruce Janda

:

January 5, 2021

The COVID-19 pandemic has touched all parts of the global forest supply chain and has brought new visibility into the pulp & paper industry (P&P) in particular. In North America and Europe, the P&P sector has been front-page news since the widespread run on toilet paper that took place from March through June.

Demonstrating the nimble nature of the P&P sector, many mills added shifts and converted machines to meet the surge in demand for household tissue and towel products, and consumers seem to have put a newfound premium on personal hygiene that will likely impact production capacity going forward. Now that the initial hoarding activity seem to be over, we’re able to analyze how recent consumer habits have impacted the tissue and towel industry and look ahead at potential developments that might take shape in the coming months.

Recent History

As frantic consumers well remember, toilet paper became one of the world’s hottest commodities just a few short months ago; however, with a few exceptions, we have largely seen the supply chain stabilize in most regions.

Interestingly, toilet paper is one of those products that has a history of being hoarded when there are rumbling and rumors of a potential shortage. This is especially the case in North America, where consumers have traditionally used about one-third of their tissue away from home because they are at work, shopping, commuting, etc. Toilet tissue is a staple in North America but when state-enforced “lockdowns” took effect in April, it caused a significant change to the existing supply chain.

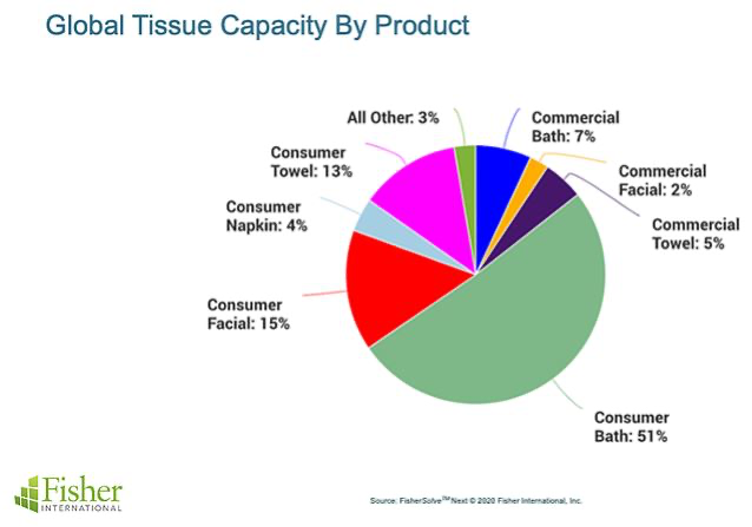

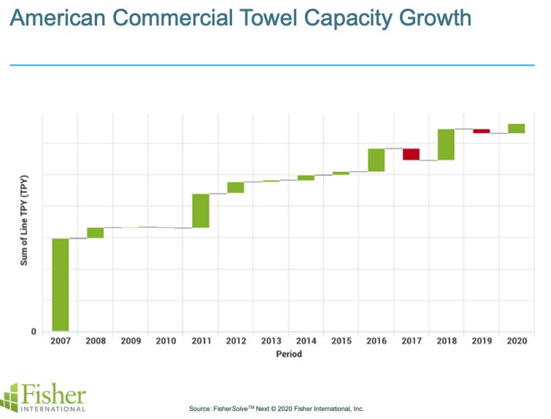

The chart below shows the global tissue product mix for consumer, commercial, and industrial tissue products. Global consumer bath accounts for 51 percent of the total capacity. Commercial bath provides an additional 7 percent capacity to total 58 percent. This is the total bath tissue volume that the supply chain is set to deliver in 2020.

The first big shift came as producers of large, industrial-sized rolls of toilet paper for commercial applications such as hotel chains and office buildings began selling their products to grocers and retail outfits to create more inventory on the shelves. Due to the massive increase in demand during the early stages of the lockdown, we saw more of this trend because the supply gap was so large.

Some commercial bath tissue is produced in familiar consumer formats for away-from-home use, however, and a significant portion of the commercial tissue production is converted in formats that cannot be readily adapted for at-home use. While this resulted in a temporary gap in supply for consumers at home, the issue is mostly behind us at this point.

Trends to Watch

The strong demand for toilet paper to keep the supply chain full drove tissue mills to work extremely hard and at capacity, which has resulted in delaying scheduled maintenance over the last few months. Now that the supply chain is equalizing, producers are able to take care of these issues and pay closer attention to a few developments taking shape in the market.

- Commercial tissue demand in highly affected areas will continue to see more outages. The Tissue Machine production numbers will remain steady or increasing as tissue base sheet paper can be diverted, but the converting machinery devoted to only commercial product formats can be expected to see layoffs. This trend could be moderated partially by increased hand towel consumption in food prep and health care, but it is unlikely to make up for closed schools, offices, and travel facilities.

- North American consumers continue to demand mostly ultra-premium products at home. Roughly 55 percent of at-home tissue use in North America is ultra-premium, which is astronomically higher than it was 15 years ago. In looking at previous recessions, people usually step down to value or economy brands. But during the Great Recession starting in 2008, consumers continued to buy the highest performance tissue available despite the tough economic times. This trend is likely to continue for high-end brands or private labels from club stores.

Since we’re still without a vaccine and are unsure where we are in the virus’s lifecycle, we’re also not sure where the tissue and towel sector will settle. The best estimates are that the effects will continue for another 12 months as vaccines are developed, approved, produced, distributed, and implemented across significant populations. In the interim, a large percentage of the workforce continues to work from home; for instance, Google has instructed its associates to plan on remaining home until July 2021.

These habits will continue to drive strong demand for at-home, ultra-premium tissue products, which will also continue to negatively impact demand for certain formats such as dispenser napkins and hand towels as restaurants, bars, and retail establishments that remained closed or operate at limited capacity.

That said, a newfound emphasis on hygiene in public spaces is poised to drive significant demand for tissue and towel products as we approach flu and cold season and as stay-at-home orders are lifted and we get back to moving about in public.

Post-COVID Focus: Hygiene

The COVID-19 pandemic has brought a new focus on cleanliness and preventing the spread of disease through personal contact and contaminated surfaces—especially in public spaces. Fisher clients in both Europe and North America are asking if we’re going to see some pull back from air dryers that have a reputation for being less hygienic than hand towels.

Tissue makers focused on the commercial or the away-from-home market have long understood that hand washing and drying with a paper towel is an underserved market need. If people followed professional guidelines, there would be a significant increase in paper hand towel demand.

Historically, there are two problems with this simple recommendation: 1) not everyone washes their hands, and 2) those who do rarely take the prescribed time to do so properly.

A 2003 study by the American Society for Microbiology found 83 percent of women washed their hands after using the restroom, but only 74 percent of men did the same. And this isn’t unique to the US, as a British study conducted in highway service station restrooms using electronic sensors to measure compliance found that 65 percent of women and 35 percent of men washed their hands.

There are many reasons why people don’t clean their hands. It’s probably most difficult in a medical setting (where washing is required after each patient interaction) than in food processing, where the work is continuous. Frequent hand washing can irritate skin and cause topical infections. Public restrooms are not always clean, and some consumers simply try to get out as fast as possible without stopping at the sink.

While we don’t know what life in the post-pandemic world will be like, it is reasonable to expect there will be wholesale changes to our routines and behaviors that will be permanent, and an increased focus on cleanliness will be one of them. We are now very aware that soap and water destroy the virus with no need for anti-microbial additives. Hand sanitizer has some efficacy but isn’t a complete solution to removing soiled material or killing other resistant germs like the gastrointestinal norovirus. Manufacturers in the tissue and towel sector now must ask some important questions:

- What if this pandemic results in a sea-change in handwashing compliance and frequency?

- What if patrons in restaurants, hotels, retail establishments, truck stops, etc. all demand better hygiene facilities?

- What if people begin washing their hands after touching public handrails and buttons?

- What if more people head to the washroom after arriving at a destination, or before consuming food or drink on the go?

- Most importantly, if hand washing habits truly change on a global scale, how will we dry our hands?

The two common alternatives for tissue products when it comes to drying one’s hands are cloth towels (typically used at home) and the dreaded air dryer commonly found in public restrooms. Most people start these air dryer units simply give up and walk out while wiping their hands on their pants. So, why do proprietors and building managers install these dryers if no one likes them? It comes down to space utilization. They can avoid storing paper towels and managing wet paper towel waste.

To be fair, electric hand dryers have improved over the last several decades. Several hand dryers have emerged with high-velocity air that can successfully dry hands in about 10 seconds. These dryers suggest using electricity is a benefit because it reduces paper towel consumption, but why is this a benefit and who is it actually benefiting? The coal plant producing the electricity?

Now with hygiene and hand washing at the forefront our daily lives, we understand air dryers create conditions for cross-contamination and defeat the purpose of hand washing. In a report published in the respected Mayo Clinic Proceedings (2012 Aug; 87(8): 791–798.), the authors state that:

“From a hygiene viewpoint, paper towels are superior to electric air dryers. Paper towels should be recommended in locations where hygiene is paramount, such as hospitals and clinics. … Many studies have found friction to be a key component in hand drying for removing contamination. Bacteria were removed from washed hands by the mechanical abrasive action of drying with paper towels. And microbiological testing of the paper towels after use indicated that many bacteria were transferred from the hands to the paper towels.”

How Will Post-Pandemic Towel Production Respond?

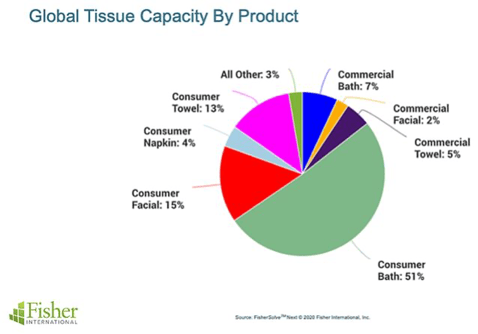

Figure 2 shows the global commercial hand towel production capacity for the top four producing countries. Going into 1Q2020, the United States produced 57 percent of all commercial hand towels. This provides the opportunity to use the US as a test case for modeling potential demand changes after the pandemic passes.

The American hand towel market covers a wide range of quality. Slightly less than a quarter of all towels are still the plain unbleached, brown, wet-creped sheets that have long been the low-price product, and roughly 85 percent of the total volume is made from recovered paper. Almost 25 percent of hand towels used in the United States are produced with TAD or some other form of advanced tissue technology to create improved softness and absorbency. This is a trend that has grown as building owners/managers try to offer upgraded service for clients, and it includes most truck stop chains across the US Interstate Highway System.

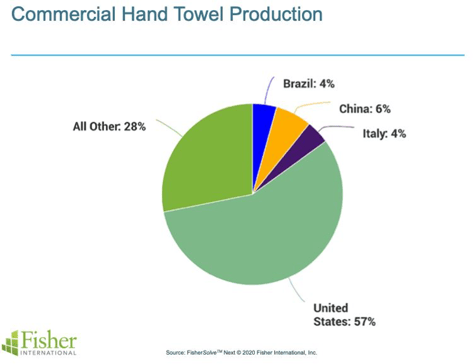

American hand towel capacity grew at a CAGR (compound annual growth rate) of 6.5 percent from 2007-2019. The capacity additions shown in Figure 3 include grade changes, rebuilds, and new machines over that period.

A small consumer behavior change in response to the pandemic could be a step change in demand of 10 percent, requiring two new large tissue machines. If consumers make significant changes in utilization of facilities and toweling in the future, a 30 percent increase in demand (requiring nearly six new tissue machines) is realistic.

This kind of impact on the tissue business would be significant, but American tissue producers have largely remained quiet on the issue in the past, unlike European producers. Based on the sea change in consumer behavior we are facing as a result of the pandemic, maybe this time will be different. Tissue makers should be proud of the role they play in maintaining public health, and they should pay close attention to new opportunities on the horizon as we inch closer to a post-pandemic future.

This article first appeared in the annual 2020 edition of World Pulp & Paper