1 min read

Despite Low Winter Rainfall, US South Mill Inventories Largely Unchanged

Mike Fiery : June 8, 2017

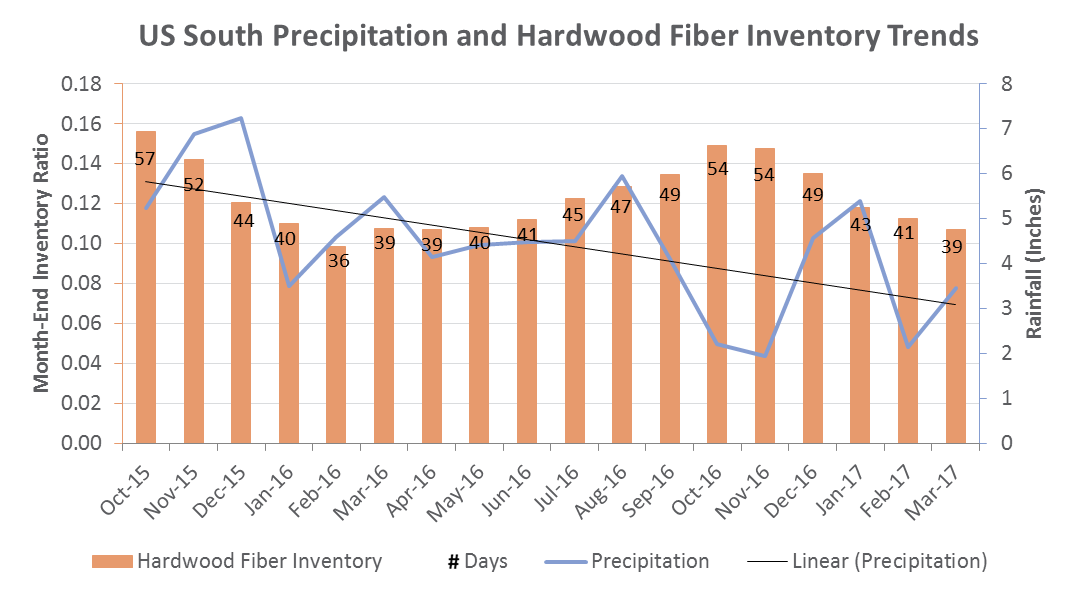

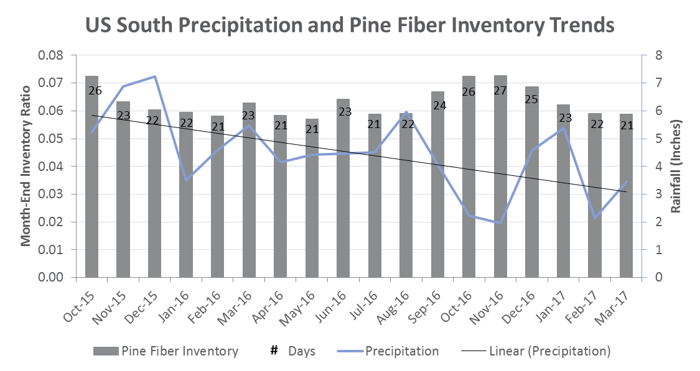

Despite total rainfall (inches) decreasing throughout the US South this past winter, there was no noticeable change in mill inventory levels compared to previous years under much wetter conditions. According to data from the National Oceanic and Atmospheric Administration (NOAA) database, rainfall has declined over the last six months in the US South.

- Average Monthly Rainfall from December 2015 to February 2016: 5.12 inches

- Average Monthly Rainfall from December 2016 to February 2017: 4.03 inches

- Change: -1.09 inches (-21.3 percent)

For southern mills, this period (from December to February) is especially important for effective inventory management, as this is the critical time when supply constraints typically occur. As the cooler temperatures take hold during winter, timber tracts do not dry as quickly as they do during warm months and logging on many of them is not an option. These mills have no way to anticipate how much rainfall to expect in the winter months, so they proactively expand both their onsite and remote log storage yards during the fall to account for this uncertainty.

During the winter months of 2016-17, the expectation based on history would be that inventory levels would have remained higher. In the winter months of 2016-2017, however, Forest2Market’s transaction database showed only a subtle increase in the amount of inventory in both pine and hardwood mills. What this tells us is that mills closely monitor rainfall and adjust their quotas lower when precipitation is lower than usual.

Pine

- Average Pine Mill Inventory Days from December 2015 to February 2016: 22 days

- Average Pine Mill Inventory Days from December 2015 to February 2016: 23 days

- Change: +1 days

Hardwood

- Average Hardwood Mill Inventory Days from December 2015 to February 2016: 40 days

- Average Hardwood Mill Inventory Days from December 2016 to February 2017: 44 days

- Change: +4 days

As this data shows, mills in the US South do a good job of managing their inventory in this season of uncertainty. They are flexible enough to raise quotas in the fall in anticipation of a wet season, but if rainfall is below normal throughout the fall, they quickly adjust quotas to make sure that they don’t end up holding excess inventory by the time spring arrives.