3 min read

Despite Turbulent Start to the Year, Brazil’s Forestry Sector Remains Optimistic

Marcelo Schmid

:

May 15, 2019

Marcelo Schmid

:

May 15, 2019

The recent change in Brazil’s governmental leadership brought a general sense of optimism regarding a number of economic policies, leading many Brazilians to believe that rapid economic development would take place.

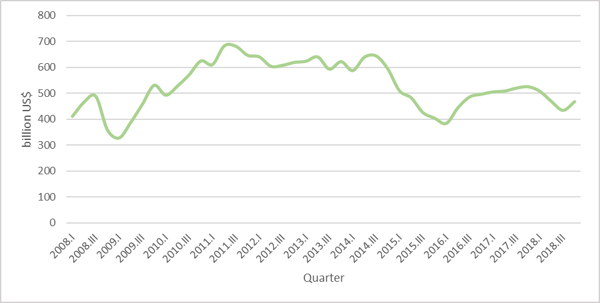

Thus far in 2019, however, development has been slow. According to the Getúlio Vargas Foundation (FGV), consumer confidence fell 1.5 points in April as a result of general disappointment with the pace of economic recovery, as well as a continued sense of uncertainty. Macroeconomic indicators also point to a declining trend in economic growth. Brazilian Gross Domestic Product (GDP) grew steadily from 2016 through early 2017, a period in which the country was not in an economic recession, but this level of growth dropped again in late 2017 before edging back up in 2H2018.

Figure 1. Change in Brazil GDP

Source: IBGE

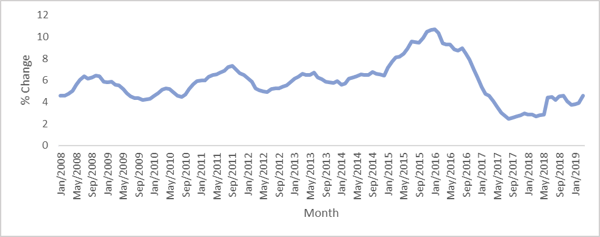

One of the inflation indicators for the country, the Extended Consumer Price Index (IPCA), shows the purchasing power of the average Brazilian consumer. When inflation is high (above 6%), the Central Bank (BC) tends to increase interest rates since, at higher rates, consumers are less likely to spend. On the other hand, when inflation is too low, BC can do the opposite. By reducing interest rates, households tend to consume more, which increases demand and drives prices higher.

With the combination of inflation and higher interest rates, Brazil’s economy is negatively impacted because investment spending significantly slows, which also impacts unemployment. Figure 2 shows the effects of the political and economic crisis in 2015 and 2016 when the IPCA reached very high levels; however, shortly thereafter, the IPCA decreased steadily to a low point of 2.46% at the end of 2017. Recently, this index rose again, reaching 4.58% in March 2019.

Figure 2. Percent Change in Brazil’s Inflation

Source: IBGE

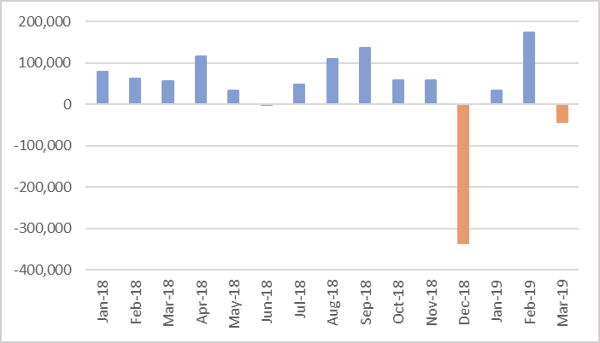

The same trend is observed in the employment data for Brazil. The figure below shows the monthly change of the balance of jobs (job creation vs. layoffs) in Brazil, according to the General Register of Employed and Unemployed (CAGED). December 2018 and March 2019 show a downward trend (layoffs) in the balance of jobs, a direct consequence of the slow rate of growth.

Figure 3. Brazil employment balance

Source: MTE

Expansion of Brazil’s Forest Sector

Despite the slow rate of economic growth in 1Q2019, Brazil’s forest sector remains optimistic. More than 200 people recently attended of the HDom Summit - Meeting of Leaders and Forest Investors, which was held in São Paulo in April. (The technical organization of the event’s first day was carried out by Forest2Market do Brasil). During the event, several companies reaffirmed their interest in investing in Brazil’s forest lands in 2019. In addition to institutional investors and financial institutions, several forest-based companies also reaffirmed their expansion and investment plans in Brazil:

- Klabin

The pulp and paper company recently announced the expansion of its unit located in the municipality of Ortigueira, Paraná. The Puma II project will have an investment of $2.05 billion with start-up scheduled for 2021, when the first kraftliner machine will add a production capacity of 450,000 tons per year. A second machine will start up in 2023 with a production capacity of 470,000 tons per year. The company has been in discussions with investors and financiers to guarantee the expansions. - Bracell

Bahia Specialty Cellulose (BSC) in Camaçari (Bahia) and Lawarcel Celulose in Lençóis Paulista (São Paulo) will operate under the "Bracell" brand. This change was announced in conjunction with the expansion plan named "Star Project." This expansion will increase the production capacity of the pulp mill in the state of São Paulo from 250,000 tons/year to 1.25 million tons/year, with completion scheduled for 2021.

- Suzano

2019 began with the merger between Suzano Papel e Celulose and Fibria Celulose, resulting in a new brand, Suzano. The company became a global leader in the production of eucalyptus, with a production capacity of 11 million tons of pulp and 1.4 million tons of paper per year. The company continues to monitor expansion opportunities in the states of Mato Grosso do Sul and São Paulo. - WestRock

The paper company located in Três Barras, Santa Catarina announced a $345 million investment at the end of 2018 to expand its factory, with completion scheduled for 2021. After this expansion, WestRock will produce 2,000 tons of paper daily, which will require about 8,000 tons of wood. According to company directors, the expansion will not stop there, as WestRock wants to further expand its operations throughout Brazil.