2 min read

Douglas Fir Log Prices Surge in 1Q2018 Amid Tight Supply, Strong Demand

Joel Swanton : April 11, 2018

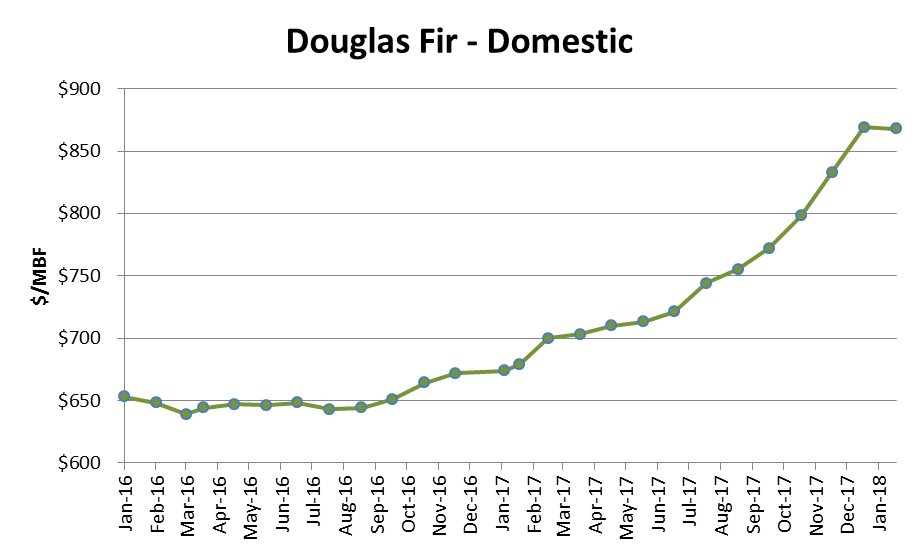

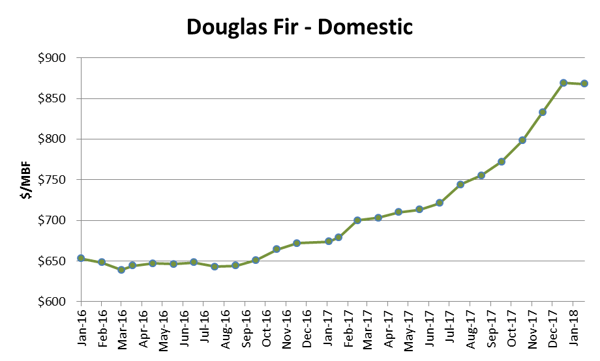

As the spring thaw in the Pacific Northwest (PNW) begins, prices for Douglas fir logs in the region continue into record high territory. Prices in October 2017 crested at $770/MBF, and they have consistently remained above the $800 level since December 2017 when we predicted that high-quality Douglas fir logs in some regions would be closing in on the $850/MBF mark into the new year.

Our prediction was conservative, as it turns out.

Doug fir log prices are at much higher sustained levels than they have been at any time in more than a decade. In February 2018, the weighted average price for delivered domestic logs was $868/MBF. This is $189/MBF higher than February 2017’s price and a huge 170 percent increase over the 10-year low of $322/MBF, which was posted in the wake of the Great Recession in April 2009.

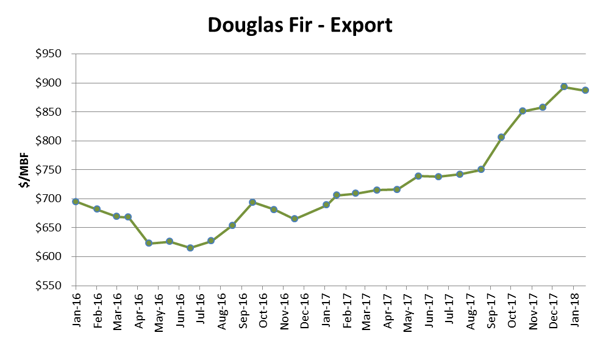

Douglas fir export logs have also remained high during the same period, as strong demand from buyers seeking logs in China and Japan has also driven competition. In February 2018, the weighted average price of Douglas fir export logs was $887/MBF, which is 26 percent higher than the February 2017 price of $706/MBF.

What’s driving prices ever higher?

Lumber prices remain at record levels amid stable housing demand and remodeling activity, the ongoing Canadian lumber dispute, constrained regional supply and increased demand from China and Japan. To demonstrate just how high the current demand for lumber is, Forest2Market’s southern yellow pine (SYP) lumber composite recently hit its highest level since we began compiling the data over eight years ago. After cresting the $450/MBF mark in February, prices spiked to nearly $490/MBF in early March.

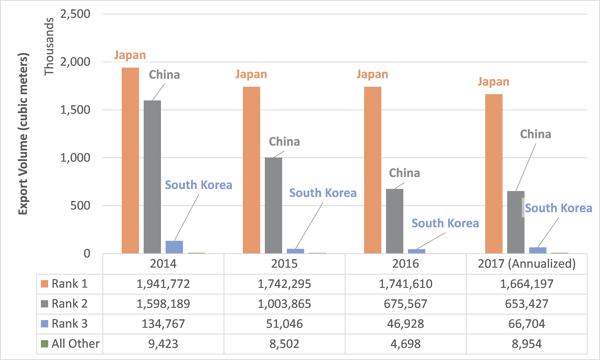

Though volumes tailed off in 2017, Japan continues to be the major importer of Doug Fir logs out of the PNW. However, South Korea has been on pace to purchase more volume over the last year. British Columbia (BC) recently announced its intent to examine and possibly restrict log exports from the province, which may also increase export demand from the PNW.

Regional harvests remain constrained due to the finite supply of timber from the region’s private land base, last year’s devastating fire season and logging accessibility. Consequently, log inventories remain stressed, and demand has exceeded supply in many regions of the PNW.

The strong log market has also put a strain on the region’s pulp mills, as sawmills are aggressively competing with chip mills for small-diameter logs. Southern BC pulp mills have also been struggling with supply, causing some to venture in to the US for access to chips.

The potential increase in log exports to fill the gap left by BC combined with the supply constraints and strong lumber demand are likely to support higher prices throughout 2018.