While some indicators suggest we may be seeing the first signs of a recovery, one very important indicator begs to differ: first quarter GDP contracted at a revised, annualized rate of 5.7 percent. The housing market continues to suffer, a result of rising unemployment (which curbs consumers’ enthusiasm for spending and dampens demand for new home construction) and additional foreclosures (which slow attempts to reduce excess housing inventory). Changes in the types of U.S. securities purchased by foreign investors may indicate higher interest rates in the future. Oil prices are expected to trend higher despite tepid global demand. Hence, we foresee the “ green shoots of economic recovery” suffering repeated frosts until early 1Q2010; after a brief warm-up, the U.S. economy will likely cool off again by 3Q2010.

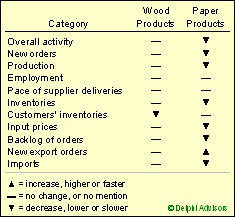

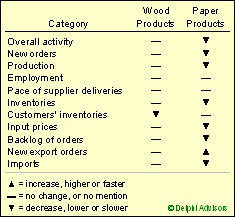

The graph below gives a snapshot of how the wood products and paper industries performed in April 2009, according to the Institute for Supply Management. The wood products industry appears to have leveled off. The paper products industry continues to retreat, overall.

Performance Overview of Wood and Paper Products

Source: Institute for Supply Management, April 2009

Read more about the Forest2Market Economic Outlook.

Suz-Anne Kinney

Suz-Anne Kinney