3 min read

Evolving Forest Industry Creates Challenges for Lakes States Timberland Owners

Mike Powell : May 11, 2021

The forest products industry has migrated away from the vertical integration model it used until the early 2000’s. While this trend has freed up capital for forest products companies to invest in the future of their businesses and develop new markets, it has also created some challenges within regional timber markets - some of which have been more pronounced in the Lake States.

Regional Ownership & Inventory Challenges

The hardwood resource has traditionally fueled the Lake States forest sector. But as the pulp & paper industry continues to rapidly evolve, regional paper mills are no longer integrated, which means they no longer own the timberlands that once provided a significant portion of their raw material requirements. Initially, these mills sold much of their land to Real Estate Investment Trusts (REIT) and Timber Investment Management Organizations (TIMO), which generally operate with a philosophy of producing income through the sale of both land and timber.

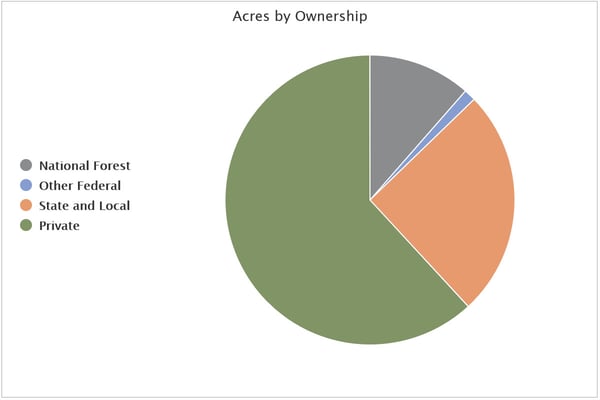

The REIT model has largely been beneficial for regional timber supply and in some cases, Fiber Supply Agreements (FSA) were included with land sales. In many cases, REITs are now selling land to TIMO‘s, many of which operate with a goal of generating long-term investment income; financial gain is realized at the time the land and timber are sold, which could be years or decades. Like the US South, a large percentage (roughly 60%) of Lake States timberlands exists in Non-Industrial Private Forest (NIPF) ownership arrangements, and the percentage of wood contributed to the total supply generally follows this percentage.

While the number of NIPF landowners is significant, the fragmented land base oftentimes results in a larger number of smaller parcels; in Wisconsin alone, the number of NIPFs increased from 230,000 in 1997 to 362,000 in 2020. As the forest ownership dynamic has changed, many FSAs have expired, and much of the available wood supply from previously-owned paper mill land is no longer assured. Less timber is being harvested from TIMOs, as they are structured to allow more valuable timber to mature on the stump before harvesting.

Impact of these Changing Dynamics

Demand patterns also continue to evolve rapidly. The Lake States has a concentration of printing and writing paper mills, and the pandemic has accelerated the decline of this industry sector. Verso mills in Wisconsin Rapids, WI and Duluth, MN were both shuttered in 2020, and many other mills in the area curtailed production in the wake of the lockdowns. This resulted in the permanent removal of over 1.5 million tons of (what had been) stable hardwood demand from the region, and fiber prices have plunged in response.

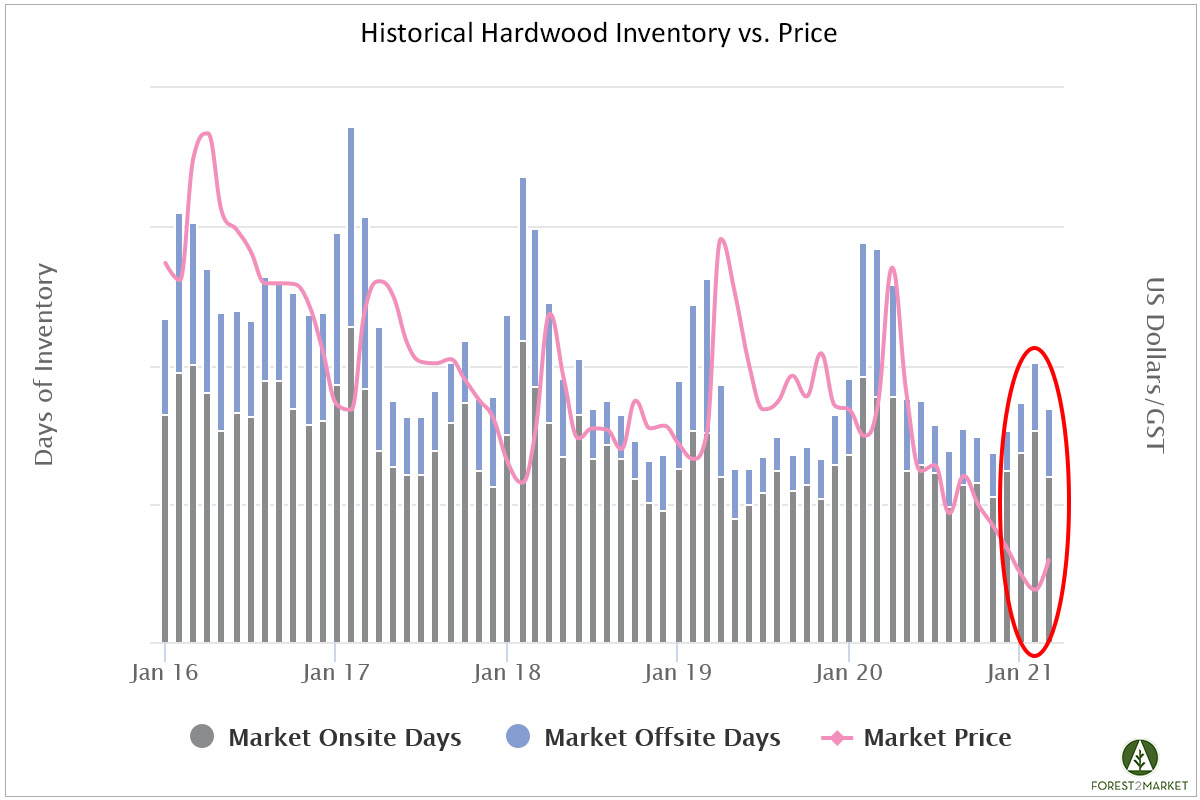

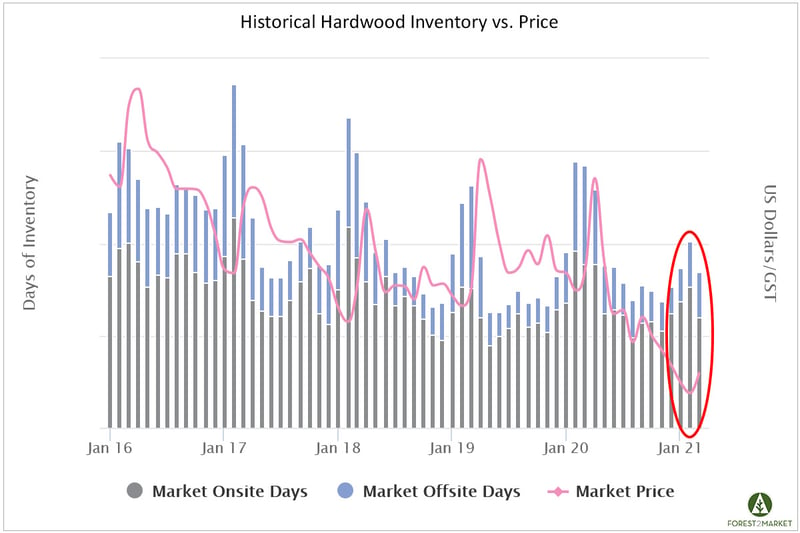

As a result, recent inventory data confirms that regional mills are maintaining lower inventories than in years past – suggesting that there is now more flexibility throughout wood supply systems based on the structural decrease in demand. Lake States hardwood inventory levels for 1Q2021 were 35% below the 5-year average for the same three-month period.

When analyzing days of inventory and price over the last several months, a trend is developing that is similar to what occurred in 2014: We’re now beginning to see a price increase in combination with record low inventory levels, which is a situation procurement teams in the region hope to avoid at all costs.

Landowner Challenges Ahead

With nearly 60% in NIPF timberland ownership arrangements, wood from these lands is critical to the regional supply. However, timber from the existing NIPF structure requires more sales and involves more landowners to generate the same amount of available wood. And with demand plummeting, there are new headwinds facing landowners in the region.

Mutually beneficial landowner assistance programs (LAPs) in the Lake States could ensure that affordable wood supplies remain available while driving economic incentive for NIPF landowners to continue to manage their working forests. This is especially important in the current business climate, as permanent mill shutdowns continue to remove demand for millions of tons of fiber from the regional market. This has driven stumpage prices down and left many NIPF landowners in a tough position.

As the Lake States forest industry continues to evolve, investing in regional landowners will become increasingly important. Benefits include:

- Ensuring that the NIPF ownership class continues to understand the significance of their timberland while providing a valuable wood resource to the market. This leads to increased opportunities to educate new generations of NIPF owners about timberland maintenance, wildlife preservation, and timber harvesting that will keep forestlands forested.

- Increasing the supply of wood fiber from hundreds of thousands of NIPF landowners ensures that a steady supply of fiber is available by stabilizing regional wood flows and improving costs. Land use changes can be an attractive alternative, especially for a fragmented landowner base in a region where the industry is consolidating or disappearing altogether. With such land use conversion, the forest will likely be lost forever.

The entire forest products community seeks the common outcome of maintaining healthy forests that will drive a vibrant forest industry. The Lake States is fortunate to have a diversified wood supply that is supported by robust private landowner groups — all of which are integral to serving the region’s forest industry.