Wood Resources International, a ResourceWise company, regularly tracks all critical trends in global wood markets. Current reports out of the Baltic Sea region mark a further dip in softwood imports.

A decrease like this is a key indicator of slowdown within building and other economic activity—a potential cause for concern. But what is the culprit here? And how much of a decline is the area experiencing?

Unpacking the Cause of Trade Decline

Log trade in the Baltic Sea region has declined for two reasons:

- Russia’s invasion of Ukraine

- Investments in forest production capacity in the Baltic States

The two largest log-trading regions in Europe are the Central and Northern regions. In Central Europe, Austria, Czech Republic, and Germany are the major importers. For Northern Europe, Finland and Sweden are the two log-importing countries.

Russia’s Invasion Causing Lingering Effects in Wood Markets

The most significant change in trade flow in Europe over the past few years has been the dramatic decline in log imports to the Nordic countries from Russia. Russia’s invasion of Ukraine in early 2022 and continued aggression has caused a European halt on purchasing their exports.

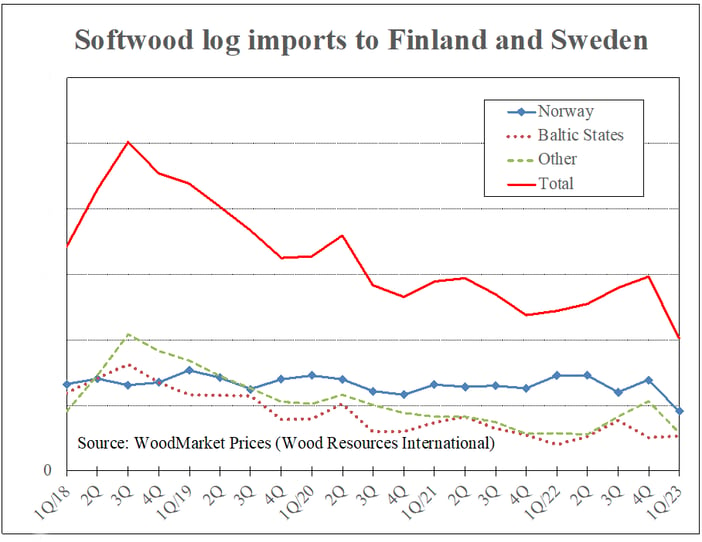

According to Wood Resources International, the total log import volume to Finland and Sweden was cut in half in 2022 compared to the previous decade average. Specific data on total cubic volume of imports and exports is available through ResourceWise’s online platform, WoodMarket Prices.

Other European Export Declines Continue

Besides Russia, we are also seeing a log export decline to the Nordic countries from Estonia, Latvia and Lithuania. Most of the reduction has been in softwood logs, while hardwood log shipments have been relatively stable.

Softwood log trade in the Baltic Sea region has declined steadily for the past five years. In the 3rd quarter of 2018, the total softwood log imports to Finland and Sweden reached a 15-year peak. Since then, prices have trended downward about 40% to where they are in the first quarter of 2023 (see chart).

Over the past year, trade flows to Sweden from neighboring Finland and Norway declined the most. Shipments from Sweden to Finland and from Latvia to Sweden showed slight increases.

Pulplog Prices Raise Due to Smaller Supply

The tighter supply of pulplogs and strong pulp markets have pushed log prices upward over the past year. In the first quarter of 2023, year-over-year import prices for softwood and hardwood pulplog to Finland jumped 93% and 123%, respectively.

Related: European Instability Changes Up Global Lumber Markets

Prices for imported softwood and hardwood pulplogs to Sweden were also up 14% and 111% during the same period. Pulplog import prices to Finland and Sweden were substantially higher than domestic prices in the first quarter of 2023.

Expert Commentary and Data from WoodMarket Prices

Wood Resources International provides all of our commentary, data and insights in one convenient digital platform: WoodMarket Prices.

Our unique indices offer pricing data and market analytics for countries and regions around the world:

- North America: Western and Eastern Canada, US South and PNW

- South America: Brazil and Chile

- Europe: Austria, Czech Republic, Estonia, Finland, Germany, Latvia, Norway, Poland, Sweden

- Asia/Oceania: China, Japan, New Zealand

Subscribers can utilize a variety of tools to help understand markets and develop strategies for precision decision-making. This includes everything from price tracking and trends to trade monitoring and industry developments.

The data and expertise powering WoodMarket Prices benefits your strategy and success potential. Let one of our experts show you how. Get in touch today to learn more.

Håkan Ekström

Håkan Ekström